- The company has been consistently delivering massive revenue growth alongside exceptionally high profitability.

- Expectations are so elevated that even the strongest companies may struggle to meet them.

- What should investors focus on during the earnings call and in the results?

- Technical analysis

- The company has been consistently delivering massive revenue growth alongside exceptionally high profitability.

- Expectations are so elevated that even the strongest companies may struggle to meet them.

- What should investors focus on during the earnings call and in the results?

- Technical analysis

One of the valuation leaders among technology and AI companies will publish its earnings after the close of Monday’s trading session in the U.S. Palantir, a controversial provider of AI-driven data analytics and surveillance solutions for governments and major corporations, is facing another demanding earnings release.

Since its peak, the stock has declined by more than 25%. Despite this, with a market capitalization exceeding $340 billion, its P/E ratio remains above 300. With expectations and valuations stretched to such extremes, even the slightest disappointment could trigger a significant sell-off.

The company has beaten market consensus on both EPS and revenue nine consecutive times, yet this has not always translated into share price gains. This reflects the dynamics that emerge when valuation multiples reach such elevated levels.

For Q4 2025, the market expects EPS of approximately $0.23 and revenue exceeding $1.30 billion. As is typical for Palantir, these expectations are several percentage points higher than in the previous quarter. It will also be crucial for the company to deliver on its commitment to 61% year-over-year revenue growth.

The company faces as many opportunities as risks. Supporting the valuation are strong customer retention metrics and a balanced mix between commercial and government contracts.

At the same time, even a minor slowdown in growth within one of the key segments, by just 1–2%, could prove devastating for the valuation. Trust among U.S. allies in software originating from Silicon Valley is also weakening, which could affect the pace of product adoption outside the United States.

Forward guidance and management commentary will be just as important as the financial metrics themselves. Any statements suggesting a deceleration in growth could trigger a sharp market reaction. Conversely, sentiment could quickly shift in the opposite direction.

Growth forecasts significantly exceeding current assumptions, acceleration in deployment cycles, or a jump in the value of the order backlog could help the company regain its previous valuation highs. Particular attention will also be paid to new initiatives linked to the armed forces, such as the ongoing software development program for the U.S. Navy.

The company continues to demonstrate growth at a scale and consistency rarely seen in financial market history. Regardless of one’s opinion about the firm, it is one of the few companies on Wall Street that fully understands AI, its strategic applications, and executes its strategy with remarkable discipline.

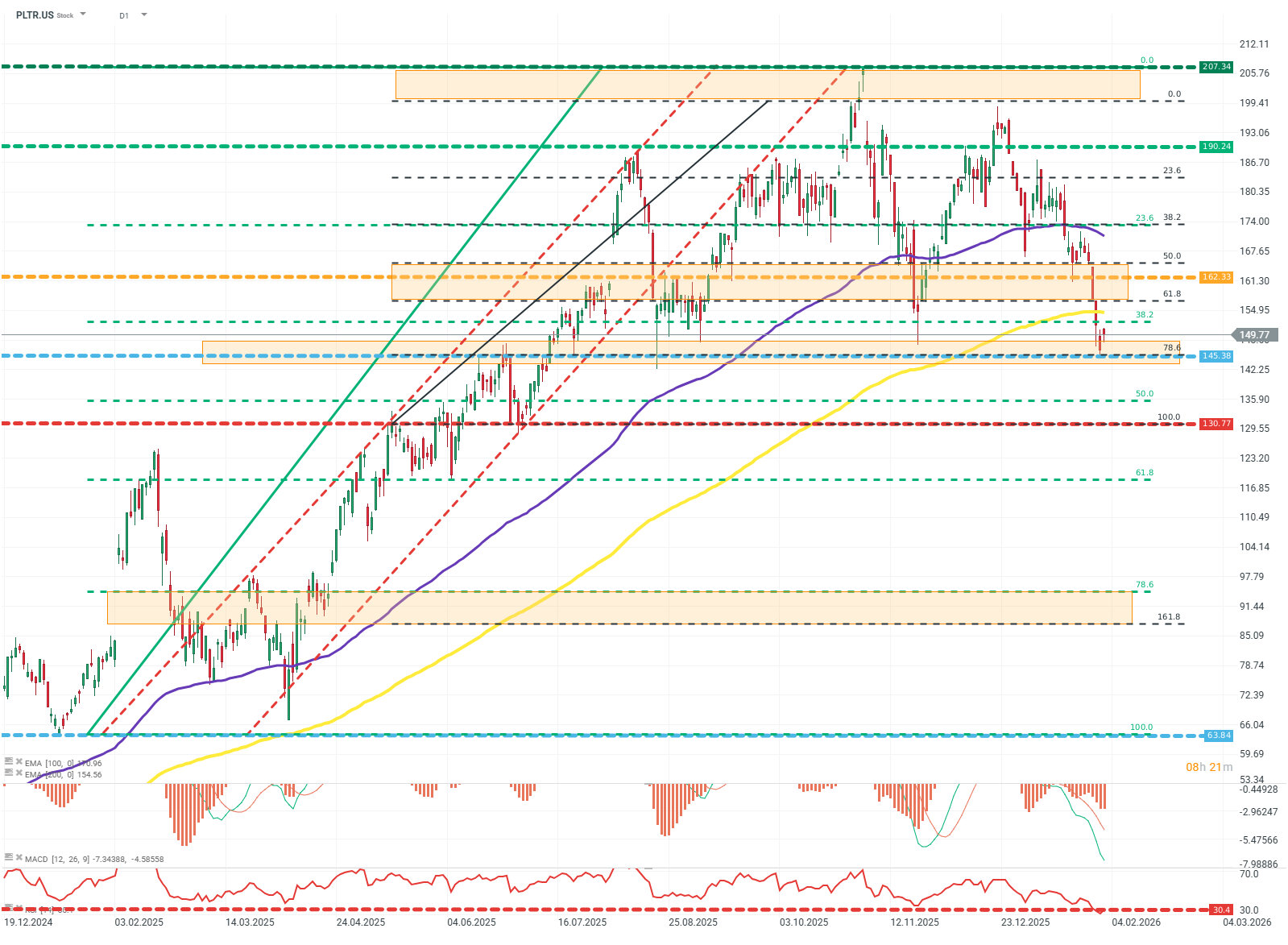

PLTR.US (D1)

The stock is currently trading within a key support zone around $145. The momentum of the EMA averages continues to support the uptrend, while RSI indicates extreme overbought conditions. MACD remains on the negative side. The next major support level is near $100.

Source: xStation5.

Michael Burry and Palantir: A well-known analyst levels serious accusations

Palo Alto earnings: Is security cheap now?

Daily summary: The market looks for direction, oil and metals under pressure

IBM Goes Against the Tide: Three Times More Entry-Level Employees

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.