Shares of dental and veterinary company Patterson (PDCO.US) are trading on a rally today as the company beat analysts' forecasts and reported a net growth rate on revenue growth, indicating that it has improved business margins despite a challenging environment in the US. The market expected a y/y decline in earnings per share, this one surprised with a 20% increase.

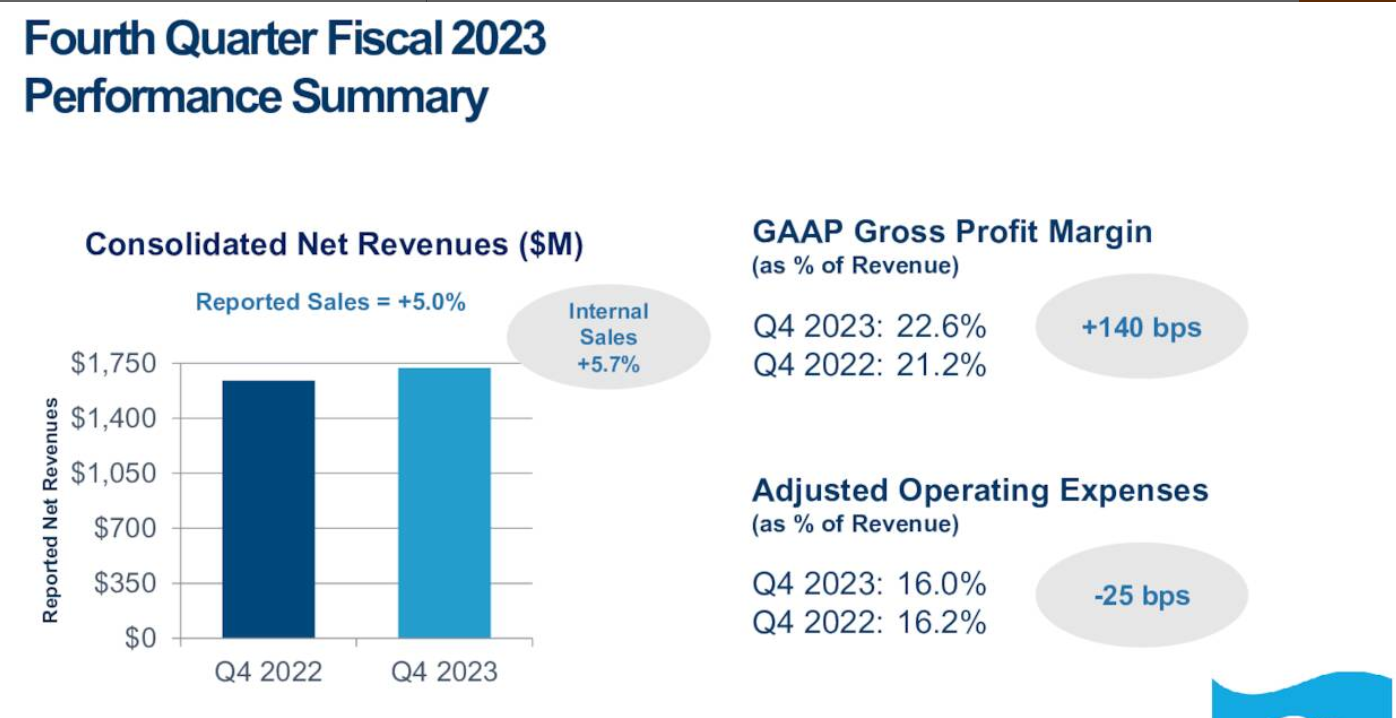

Revenue: $1.72 billion vs. $1.71 billion forecast, $61 million above consensus ($1.64 billion a year ago)

Earnings per share: $0.84 vs. SD 0.70 forecasts ($0.71 a year ago)

The company said it repurchased 1.5 million shares during the fourth quarter of fiscal 2023 and decided to pay $0.26 in quarterly dividends to shareholders (over $25 million). At the same time, the company's free cash flow fell from $194 million to $180 million.

The company's operating expenses fell, margins and consolidated net income increased. Source: Patterson Earnings Report

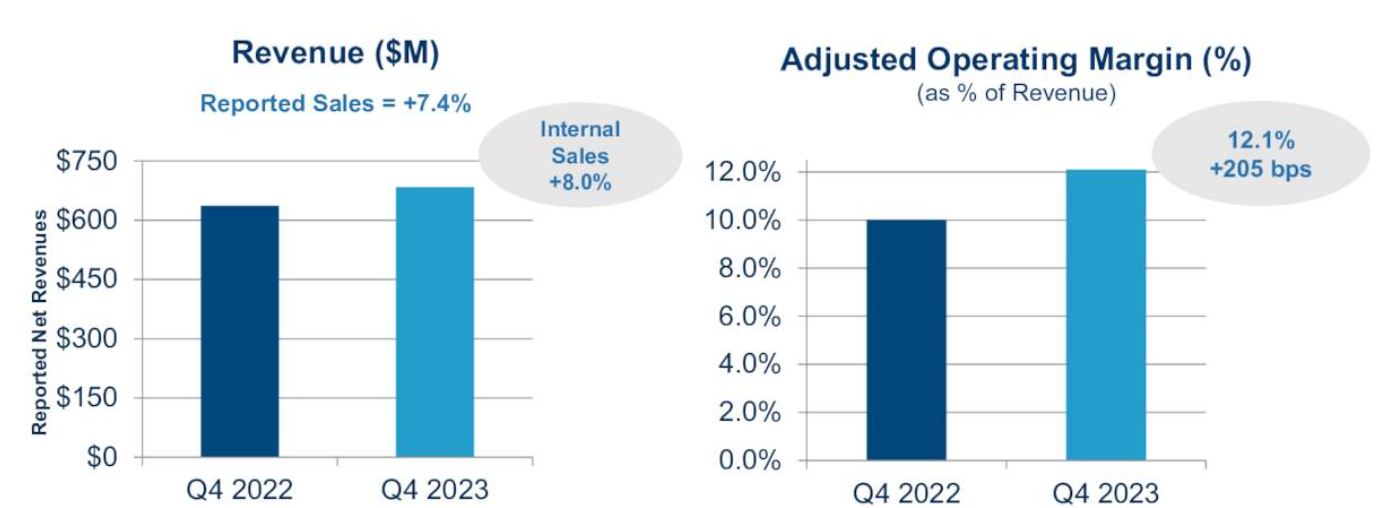

International sales rose 8% y/y with 12.1% operating margins (up more than 2% y/y). Source: Patterson Earnings Report

Patterson (PDCO.US) shares rose today above long-term resistances near the SMA100 and SMA200 (red and black lines). A retest of $38 per share, the local highs of 2021, may become possible.Source: xStation5

Nvidia expands into software AI sector? Wired reports on NemoClaw

Market Wrap: Energy Stocks Retreat as Hopes for End to Iran War Grow 🌍 (10.03.2026)

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.