Peloton (PTON.US) stock plunged over 25.0% before the opening bell after the exercise equipment and media company reported a wider-than-expected quarterly loss and slowing sales volume followed by weak sales guidance for Q4 due to softening demand;

- Company recorded a Q3 loss of $2.27 per share, down from a loss of 3 cents per share over the same period last year and well above analysts’ estimates of 83 cents per share loss.

- Revenues plunged 23.5% from last year to $964.3 million, below Wall Street estimates of $973 million;

- Similar to other pandemic winners, the company is grappling with weakening demand. Peloton market value fell to $4.69 billion from nearly $50 billion during the pandemic;

- For the current quarter, the equipment maker expects revenues in the region of $675 million to $700 million and approximately 3 million Connected Fitness subscribers.

- Peloton will increase price of its connected fitness programs for the first time since 2014, while reducing costs of bikes and treadmills as company want more people to be able to afford their training equipment;

- The company plans to cut 2,800 workers, more than a fifth of its workforce, and has confirmed the decommissioning of the $ 400 million facility it planned to build in Ohio;

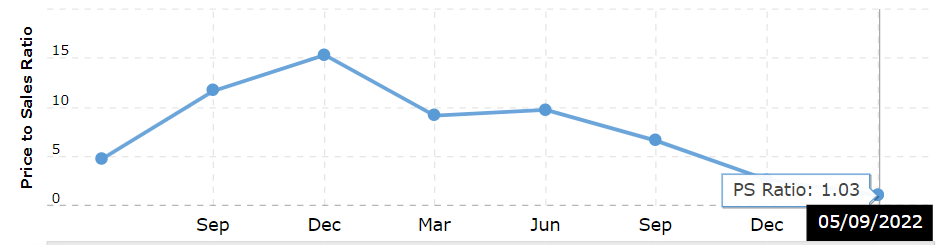

The price-to-sales ratio (P/S) fell sharply from pandemic highs. Source: Macrotrends

The price-to-sales ratio (P/S) fell sharply from pandemic highs. Source: Macrotrends

Peloton (PTON.US) stock fell sharply in premarket to new all-time low around $11.50. Source xStation5

Peloton (PTON.US) stock fell sharply in premarket to new all-time low around $11.50. Source xStation5

Gaming companies with huge discounts 🚨 Will Project Genie end the traditional era of gaming ❓

Lockheed Martin earnings: The peak of global tensions and valuations

Market wrap: European indices outperform US stocks ahead of the opening bell on Wall Street 📉

Apple’s Record Quarter: iPhone, Services, and ‘Invisible’ AI. Is a Return to the Throne Imminent?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.