Apple (AAPL.US) shares have recently come under pressure after analysts at several Wall Street funds saw a threat to the company's further expansion. On Tuesday, Barclays and today Piper Sandler decided to change their rating from 'overweight' to 'neutral', lowering their target price by $15, to $205 per share. The giant's shares are losing 1% before the open. Will Apple be a company highly sensitive to a possible 'recession'?

Piper Sandler has doubts in Apple 2024 momentum

- In an analyst report, Piper Sandler cited a weaker smartphone demand globally, a fairly high stock valuation and macro uncertainty weighing on sentiment in 2024. This shows that potentially weakening macro data from the U.S. or other economies could cause more concern around the valuation of the shares of the largest U.S. listed company;

- In particular, Piper Sandler expects the first half of the year to be challenging for consumers in many countries, making the semiconductor and smartphone industries vulnerable to uncertain new trends. In the case of Apple, the report highlighted the risk of accumulated large inventories entering the new year. This could put pressure on margins and earnings per share if product sales are lower;

- Analysts pointed out that Apple's growth rate has likely already reached a record high for unit sales. Also, the deteriorating macro environment in China could have a significant impact on Apple's smartphone business, in the Asian market;

- Also in the broader context is Apple's strategic Taiwan, where elections will be held this year. The company has the largest factories in mainland China, and rising tensions between Beijing and Washington may indicate risks to the manufacturing chain. Chinese diplomats have indicated that the new year will be a year for Taiwan to choose between 'war and peace' which has somewhat raised concerns around a possible escalation.

Apple will report Q4 2023 results on February 1, 2024.

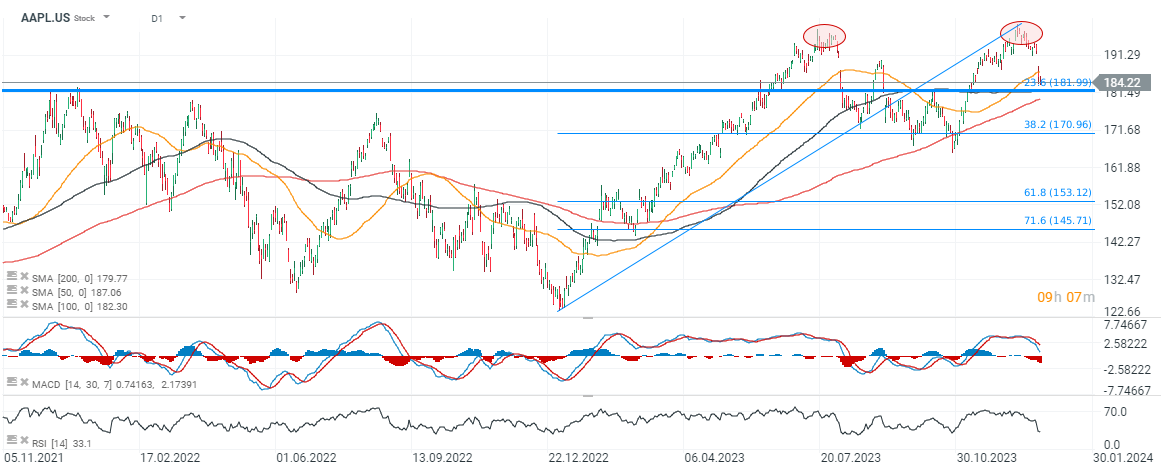

Apple shares (AAPL.US, D1)

Looking at the chart of Apple shares, we see a bearish double peak formation above $200 per share, previous price reactions, the 23.6 Fibonacci retracement and the dynamics of the SMA200 moving average as well as the extent of the previous correction in the uptrend suggest that the stock may seek to test the $170 level. On the other hand, the RSI indicator at 33 points suggests an oversold condition.

Source: xStation5

Micron Bets Billions on AI. Here’s What’s Driving the New Semiconductor Supercycle! 📈

Will the defense sector keep European stock markets afloat❓

Nvidia and China: Huge Money and Growth Potential!📈

Euphoria in U.S. defense stocks 🗽 An additional $500B for Department of War?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.