Summary:

-

Boris to try and call election on Monday

-

EU27 agree in principle to Brexit extension

-

GBP drifts lower on the week; FTSE gains

News that Boris Johnson will make a 3rd attempt to call a general election at the start of next week caused a flurry of activity in the pound, but after the initial knee jerk reaction there has been little lasting impact due to the belief that there’s a good chance this could fail once more. The PM has earmarked December 12th as a possible date for the vote, which means time is very much of the essence in calling a ballot. Due to the fixed term parliament act, he would require a 2/3rds majority to succeed and despite claims from the opposition that they want an election it seems that they will likely not support it and therefore the current impasse could drag on and on.

In trying to force some movement on this front Johnson has stated that he would freeze his Brexit legislation and turn Westminster into a zombie parliament if MPs reject his attempt. The PM also claimed that if an election is approved then he would bring his withdrawal agreement back to parliament and give MPs essentially another week after the October 31st deadline to approve the legislation. Both of these are unlikely to sway many politicians and it appears that the current Brexit quandary is unlikely to be ended anytime soon.

Similar to his decision to prorogue parliament the PM is clearly trying to force the whole process along but it seems that he may well be frustrated again. It’s been a negative week for the pound with sterling sliding lower against all its major peers, but the declines seem more a case of a natural pullback after a strong advance rather than an inflexion point lower for the currency.

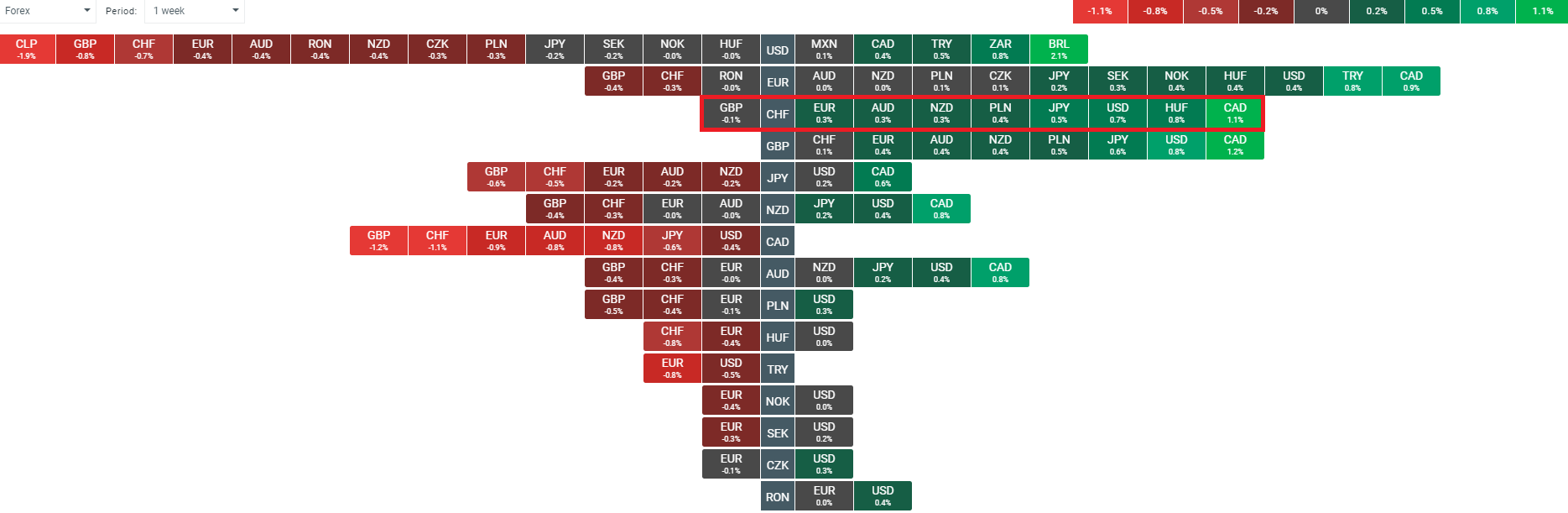

The pound is losing ground on the week after a strong run higher of late. The largest declines can be seen against the Canadian dollar which has performed well after Monday’s election outcome. Source: xStation

FTSE rises back to 7300 handle

While the FTSE 100 is trading lower on the day, it’s shaping up to be a positive week for the benchmark with the dip in the pound providing a boost to the index. For much of the month leading UK stocks have lagged behind their European and US counterparts, largely due to the strong appreciation in the pound which imparts downward pressure on those stocks which generate revenues in non-GBP terms.

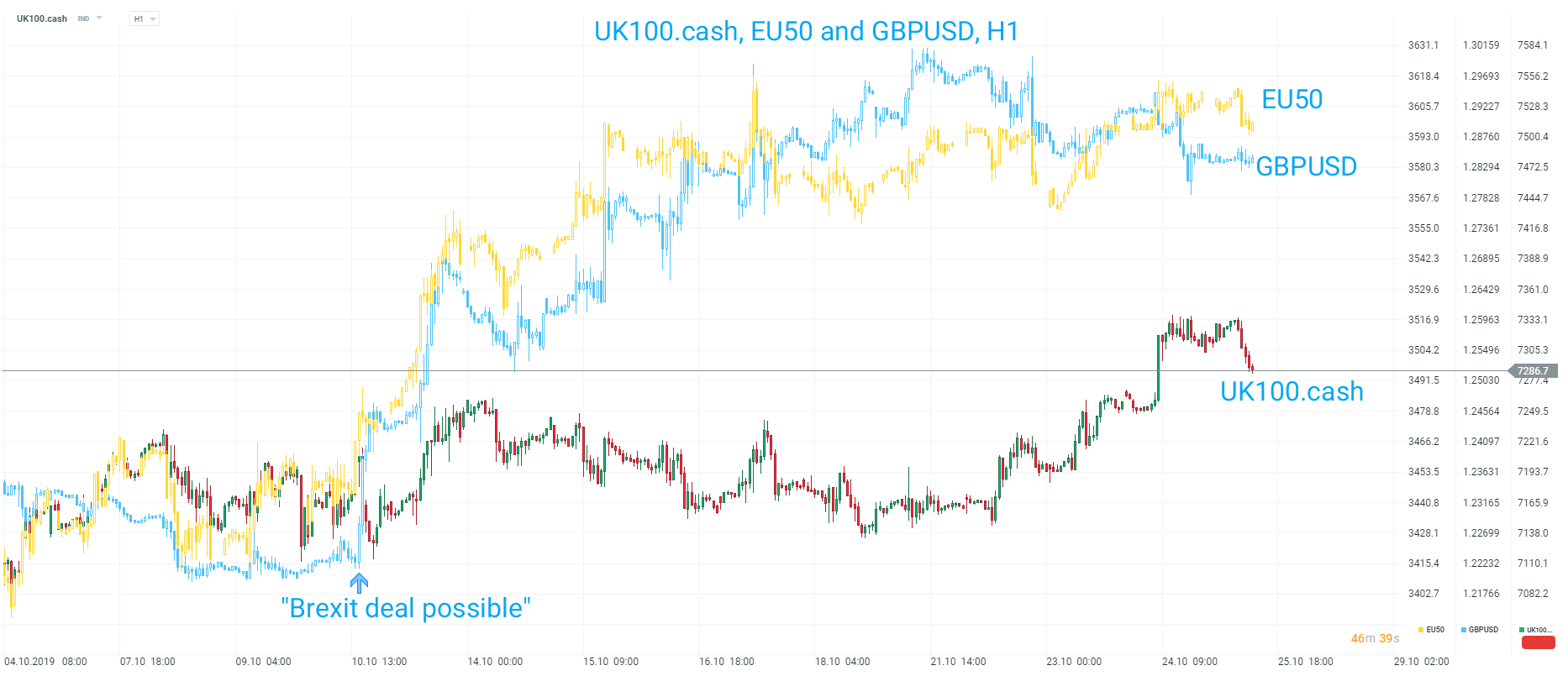

Since the pound began to rally on comments from Irish Taoiseach Varadkar that a Brexit deal was possible there’s been a notable divergence open up between Eurostoxx and the FTSE - with the former outstripping the latter in its move higher. Source: xStation

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.