Marathon of central bank decisions scheduled for this week is coming to a close. Investors were offered rate decisions from the Swiss National Bank and Bank of England among others today. Both banks delivered rate hikes in-line with expectations of economists but those failed to provide a lift for CHF or GBP. Were the decisions dovish? Or is the market simply unimpressed following the Fed decision yesterday? Take a look at our commentary to both decisions.

Bank of England hikes by 50 bp but decision was not unanimous

The Bank of England delivered a 50 basis point rate hike today, a move that was in-line with economists' expectations. Market priced in a 70% chance of 75 basis point rate hike so from this point of view, decision can be seen as dovish. One thing that deserves attention is a split among MPC members. Out of nine MPC members, five voted for a 50 bp move while three (Haskel, Mann and Ramsden) voted for a 75 bp rate move. One MPC member voted for a 25 bp move and it was Swati Dhingra, for whom it was the first meeting since becoming an MPC member. Apart from a rate hike, MPC also voted to begin active bond sales, starting from October 3, 2022. Such a move was already hinted at back in August but there were some concerns that it may be delayed amid the newly announced fiscal package.

Speaking of a new UK fiscal package, Bank of England said that the energy price guarantee will lower inflation by 5 percentage points in 2023 but will add to a medium-term inflation pressure. However, BoE said that a full assessment of new fiscal measures will come in November.

Inflation forecasts were more optimistic than in August. BoE now sees inflation peaking slightly below 11% in October, down from 13.3% forecasted for October in August. Inflation will, however, remain above 10% in the coming months. Growth forecast were less optimistic. GDP forecast for Q3 2022 was lowered from +0.4% to -0.1% and BoE noted that the UK economy may have fallen into technical recession in Q2 and Q3 2022. Back in August, BoE said it expects the UK economy to enter recession in Q4 2022.

Judging by the reaction, the market took the decision as dovish. It should not come as a surprise given an above-50 bp market pricing prior to the announcement. Weaker growth forecasts also played its part. As current inflation is mostly supply-side inflation, rate hikes will do little to cool it. Also hiking rates when inflation is driven by supply and the economy is in recession is rather a poor combo… unless BoE thinks that inflation became entrenched already.

GBPUSD was regaining some ground ahead of BoE rate decision today, thanks to USD weakening. However, the Bank of England disappointed, triggering a pullback on the pair. As a result, an attempt to break above the 1.1350 resistance zone failed and the pair pulled back below the 50-hour moving average (green line). Source: xStation5

GBPUSD was regaining some ground ahead of BoE rate decision today, thanks to USD weakening. However, the Bank of England disappointed, triggering a pullback on the pair. As a result, an attempt to break above the 1.1350 resistance zone failed and the pair pulled back below the 50-hour moving average (green line). Source: xStation5

Switzerland exits negative interest rates era

The second bank to raise interest rates today was the SNB. For the past few weeks, the CHF has been one of the stronger currencies in the market, so we are seeing the typical realization of gains after the decision. Here we have a classic example of the old saying "buy the rumors, sell the facts."

The SNB already surprised in June with its decision to hike, pointing to clearly high inflation. Moreover, it seems that the SNB may decide to intervene with currencies to strengthen the franc in order to further whip up inflation.

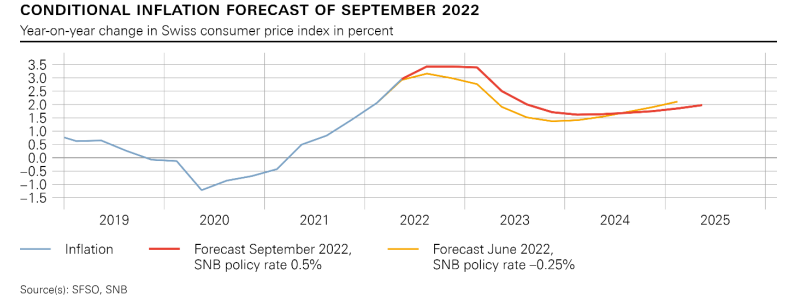

Nevertheless, today's downward movement is mainly related to the fact that the market saw the chances of a 100 basis point move, and the SNB only met the market consensus. However, it seems that by raising inflation expectations strongly, the SNB is sending a signal that further hikes are very likely (3.0% this year vs. 2.8% in the previous forecast for this year, and 2.4% in 2023 vs. the previous forecast of 1.9%).

Source: Swiss National Bank

Source: Swiss National Bank

Of course, it's hard to match the Federal Reserve's hawkish announcements, but it seems that today in the case of the franc we may only see profit-taking.

The swiss franc weakened against the euro after the SNB decision. The EURCHF pair is testing today the limit set by the 50-day exponential moving average (blue curve). D1 interval. Source: xStation 5

Economic calendar: US CPI Inflation the Most Important Report of the Week 🔎

Market wrap (09.03.2026)

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.