Summary:

-

Lots of Brexit noise but lack of clarity

-

GBP little changed from a week ago

-

BP shares gain as Dudley announces date to stand down

Once again the week has been dominated by Brexit-related headlines as PM Boris Johnson has made his move and unveiled his latest plan to reach a new deal with the EU. It’s widely believed that the latest proposals won’t fly as a final solution, but it is no doubt encouraging that they have at least been received and not dismissed out of hand. The latest reports suggest the PM has a week to revise the deal and it looks like Boris will now have to turn to plan B.

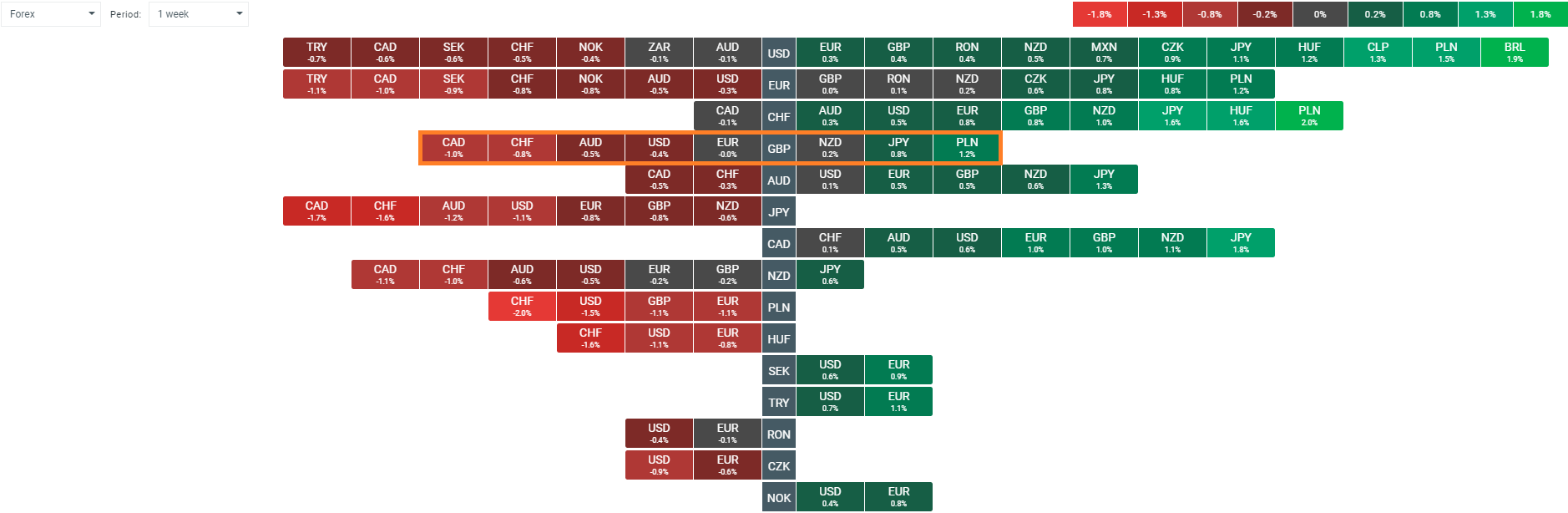

The pound is mixed on the week with many traders still awaiting further clarity on the Brexit situation before committing to any long-term positions. Source: xStation

Quite what this is remains unknown but given the initial reaction amongst MPs perhaps the shrewdest move could be to try and bring his latest deal before parliament for a vote. It is far from a given that it would receive the requisite backing to pass, but it should get far closer than May’s attempts with her deal and reports that as many as 30 Labour MPs are willing to support it suggest it could just sneak through. Were it to pass, or even come close, that would back the EU into a corner, with the bloc perhaps having made a rod for its own back by previously claiming that for progress to be made the UK needs to bring a deal that could command parliamentary approval. This would then ramp up the pressure on the bloc to at least cede some ground in negotiations even if they wouldn't accept it in its current guise.

There is a possible path here to a new deal that could be both accepted by parliament and the EU, but on balance in our view the probability of this playing out remains less than 50%. The base case remains that the current impasse isn’t broken and the focus would then turn to how far the PM is willing to push the limits of legality in order to avoid a further extension to the 31st October deadline.

Another CEO steps down as Dudley resigns

If Brexit has been at the forefront of political news this week, the corporate landscape has been dominated by a series of high-profile CEOs amongst UK blue-chips announcing that they will be stepping down. The latest is Bob Dudley, the boss of BP, who is going out on his own terms after what has been a successful tenure at the helm. Similar to David Lewis at Tesco, Dudley took control at a time of crisis - in his case following the Deepwater Horizon disaster and leaves with oil major back in a position of growth. This news has been a long time coming with Dudley repeatedly saying he would retire around his 65th birthday and the market has responded mildly positively to the news that he will vacate the post in February and be replaced by Bernard Looney with the stock higher by around 0.75% at the time of writing.

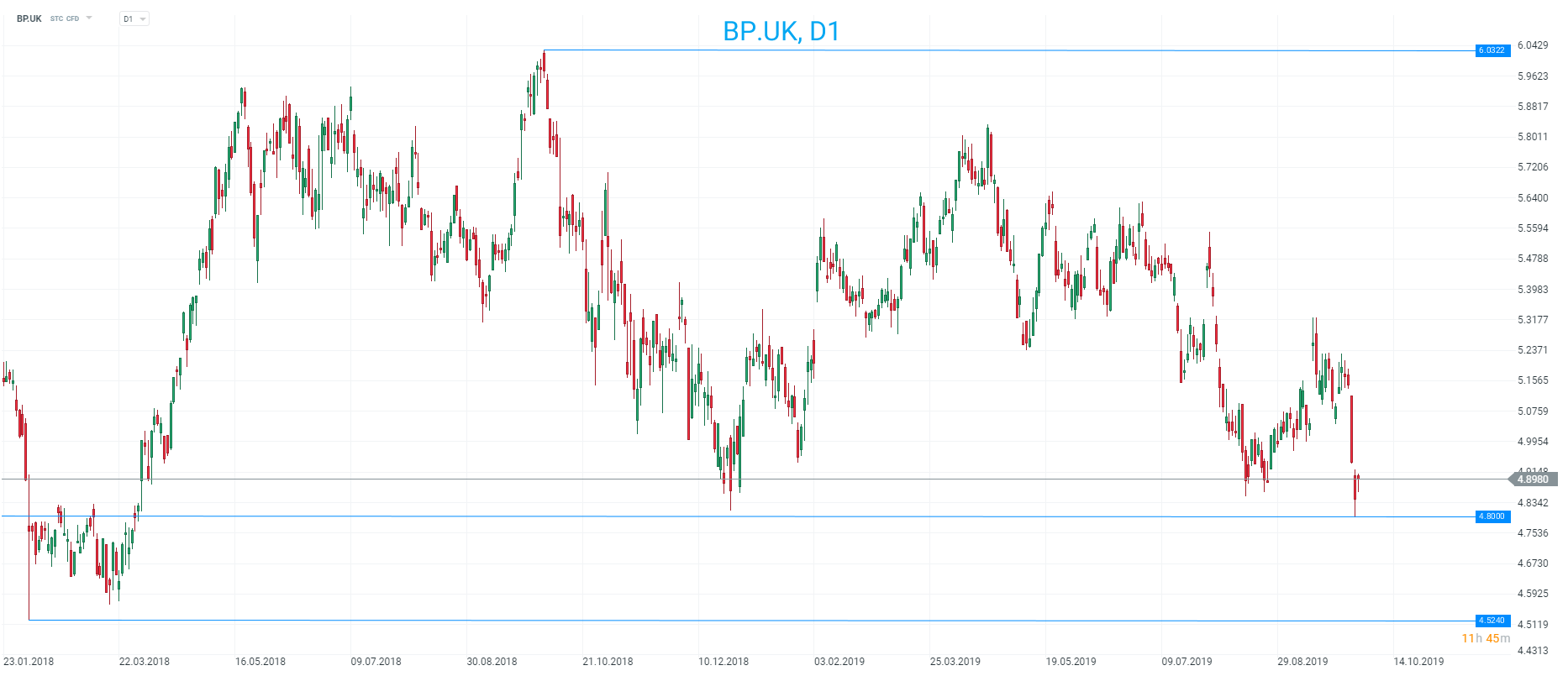

Shares in BP have moved a little higher today as the news broke but the market remains not far from its lowest level in 18 months around 4.80. The stock has gained 23% since Dudley took control in 2010 - not including substantial dividend payments during that time too. Source: xStation

Shares in BP have moved a little higher today as the news broke but the market remains not far from its lowest level in 18 months around 4.80. The stock has gained 23% since Dudley took control in 2010 - not including substantial dividend payments during that time too. Source: xStation

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.