Summary:

-

Pound sliding lower ahead of MPs’ return

-

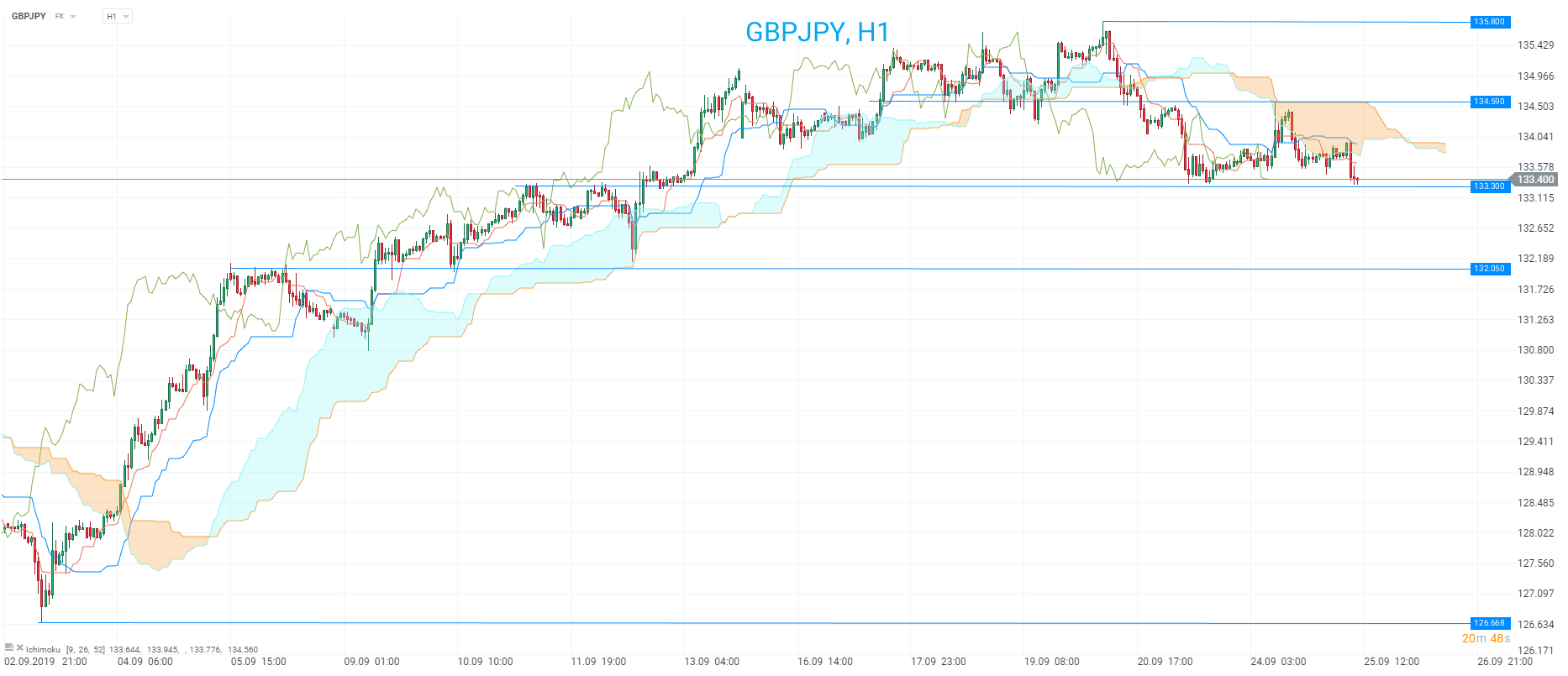

GBPJPY back near prior support

-

Impeachment odds on Trump spike higher

There’s been some selling seen in sterling ahead of the return of MPs, with the pound drifting lower against all its major peers. To put the decline in context they are relatively small with the largest drop seen against the US dollar and Swiss France and only amounting to around half a percent. There’s not really any negative news to support this pullback, with Jeremy Corbyn remaining coy on the timing of his no-confidence motion probably a shrewd move as he is not falling into a possible trap and risking opening the door to a no-deal exit once more.

GBPJPY has pulled back to the prior support level around 133.30. Price is back below the H1 cloud once more. Source: xStation

Rather, the weakness can likely be attributed to a retracement after what has been a strong push higher and perhaps traders are getting just a little bit cautious on the pound as we await the next move from the PM. In the same way that the decision to prorogue effectively sped up the response by the opposition, the return of parliament could move things forward more quickly and with the government’s next move far from certain some paring of the recent gains in the pound is not too surprising.

Trump impeachment odds soar

According to a popular betting website the probability of Trump being impeached have increased dramatically with the odds on Predictit rising as high as $0.62 on the dollar - implying a probability of around 62%. Last night, Nancy Pelosi announced the house would initiate a formal impeachment inquiry against the president, with Trump charged with threatening national security by seeking to enlist Ukraine to dig up dirt on political rival, Democrat Joe Biden. It should be pointed out that while bookmakers odds can provide some insight into the probability of an event, they are also continuously attempting to manage their exposure and therefore it is not unusual for odds to come in sharply if large wagers start to get placed.

Only 3 previous presidents have faced impeachment charges, with Andrew Johnson and Bill Clinton both impeached but later acquitted by the Senate while Rchard Nixon resigned when facing the House impeachment vote. Given that the Republicans currently hold the Senate with 53 seats and a supermajority of 2/3rds or 67 seats are needed to convict the aforementioned odds look extremely short and the base case in our opinion is that this would fail at that hurdle even if it gets that far. That’s not to say the whole process is a futile endeavour however, with the aim clearly to discredit Trump ahead of next year’s election and raise doubts as to his America first approach that he is so keen to trumpet.

At present the market doesn’t seem overly sensitive to the downside for developments on this front, with the sharpest move yesterday actually pop higher in US stocks when Trump announced he would release a manuscript of the phone call that is at the centre of the alleged wrongdoing. However, traders were quick to realise that this would amount to little more than his word of the events and the markets swiftly reverse.

Stocks in the US spiked off their lows when Trump announced that he would release a manuscript that would disprove the allegations. However, the bounce proved short lived. Source: xStation

Stocks in the US spiked off their lows when Trump announced that he would release a manuscript that would disprove the allegations. However, the bounce proved short lived. Source: xStation

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.