Summary:

-

Brexit back at the forefront of GBP traders' minds

-

Headline risk remains high going forward

-

FTSE set for another weekly gain

The news flow this week has been dominated by Brexit, with the latest developments filling many column inches as Boris Johnson appears to have played his hand ahead of the return of MPs from their summer recess next week. The decision by the PM to prorogue parliament caused plenty of controversy and clearly toed the line as far as flouting the constitution goes, but in effect all it has done is shorten the timeline for those looking to prevent a no-deal Brexit. Intricate legalities surrounding the decision will be scrutinized in a forensic manner with Scottish courts scheduled to have a substantive hearing on the issue on Tuesday, but in all likelihood this won’t change the current state of play.

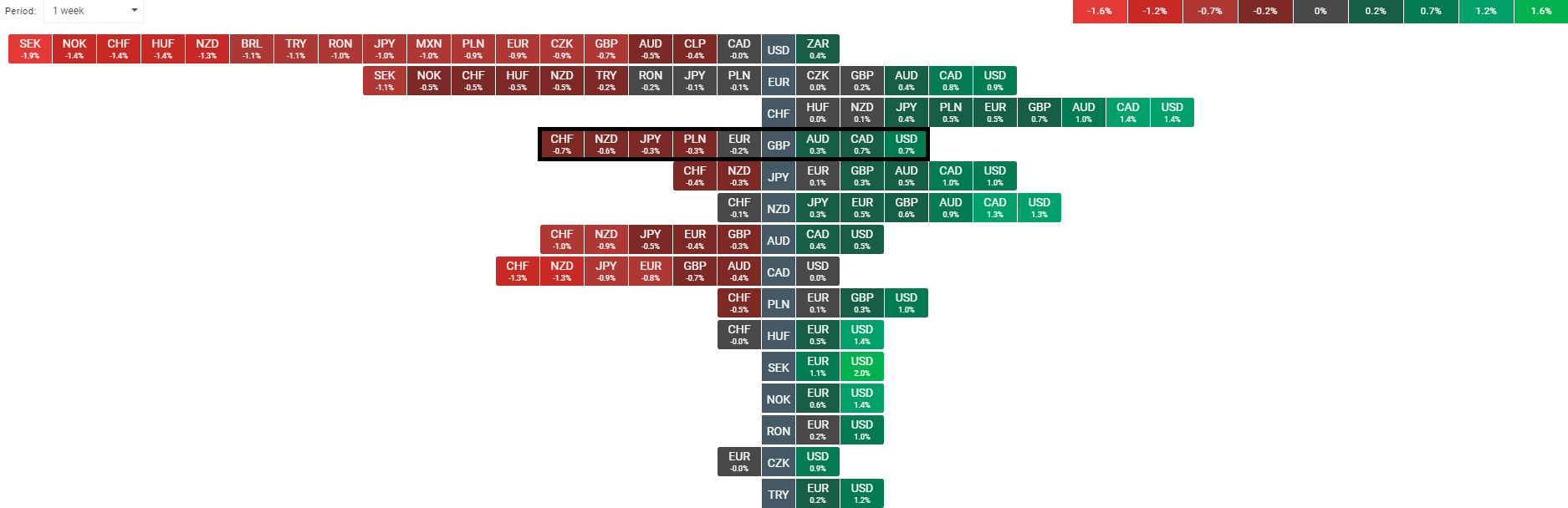

Despite all the headlines, the pound is actually little changed on the week on the whole, falling lower against the US. Source: xStation

Heightened volatility can be expected in the pound in the coming weeks with the currency set to remain highly sensitive to headline risk, with the focus being on the strategy chosen by the opposition in an attempt to take no-deal off the table. Predicting the next political move is inherently risky - as we’ve seen time and again with Brexit - but if pushed to make a forecast, the most likely outcome remains a “new” deal passing through parliament before October 31st, which in reality would look a lot like the current Withdrawal Agreement with a few twists, including most importantly, a rephrasing of the “backstop”.

Speculative positioning in the pound remains pretty extreme on the short side and there’s unsurprisingly been a clear increase in the appetite for protection to downside risks in the options’ market in recent weeks. Having said that, the risks to the pound moving lower are well-versed and widely publicised and given this, there is some logical support behind taking a contrarian position and looking for a recovery in the coming weeks.

FTSE set for 2nd consecutive weekly gain

Following a testing few weeks for UK blue-chips, the FTSE is on course to post a 2nd weekly gain in a row, boosted by a marked improvement in global risk sentiment. After last Friday’s rout and further negative news over the weekend, stock benchmarks began the week on the back foot, but since then there’s been a steady improvement and the FTSE 100 is working on a 3rd consecutive day of gains. How markets react to news can often reveal an underlying strength or weakness and the way investors have bought into what could be described as wishful reports of US and China de-escalating their trade war, while seemingly disregarding last week’s additional tariffs is clearly a boon for stock market bulls. The summer months are typically volatile with clear trends often lacking, but as we now move into September equities appear well placed to resume their year-to-date gains despite the mounting concerns from not only trade tensions but also inverted yield curves and slowing economies. For how long this is sustainable remains to be seen but for now it seems that the bulls have wrestled back control of the tape.

UK stocks are trading higher for the 3rd day in a row. The FTSE continues to oscillate around the 200 day SMA with support seen around 7000 and resistance 7300. Source: xStation

UK stocks are trading higher for the 3rd day in a row. The FTSE continues to oscillate around the 200 day SMA with support seen around 7000 and resistance 7300. Source: xStation

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Strong Service ISM Reading as activity expanded most since 2022

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.