Summary:

-

Talk of new parliamentary session not starting till Oct 14th

-

Would reduce chances to prevent no-deal Brexit

-

GBP falling lower across the board

There’s been some selling seen in the pound after a couple of recent developments on the Brexit front with an acrimonious outcome looking more likely by the day. First off, reports that Parliament could be suspended in the coming days hit the wires with rumours swirling around Westminster that a privy council are set to head to Balmoral to meet the Queen and make the request. Shortly afterwards, speculation grew further when additional reports suggested this means that Boris Johnson is planning on beginning a new session of parliament some 5 weeks later than previously thought, with a fresh Queen’s speech on or around 14th October.

This seems like a pre-emptive strike from Boris against those seeking to block a no-deal Brexit and once more it seems that the opposition are in danger of fluffing a big opportunity to have an impact. If the government is successful in this then a no-deal Brexit wouldn’t be taken off the table until the 11th hour at the earliest and this keeps a significant downside risk to the pound in play. It is also worth pointing out that this reduces the chances of getting a deal passed through parliament with the timescale for any bill to pass greatly reduced.

Having said that, as far as the markets are concerned there’s a fair bit of bad news already “baked-in” to the pound and it is telling that after the knee jerk move lower in recent trade, the selling we’ve seen is far from panic stations - so far anyway. The currency has been increasingly sensitive to any developments on this front in recent sessions and this doesn’t look likely to end anytime soon with traders and algorithms both very keen to jump on the back of the latest headlines.

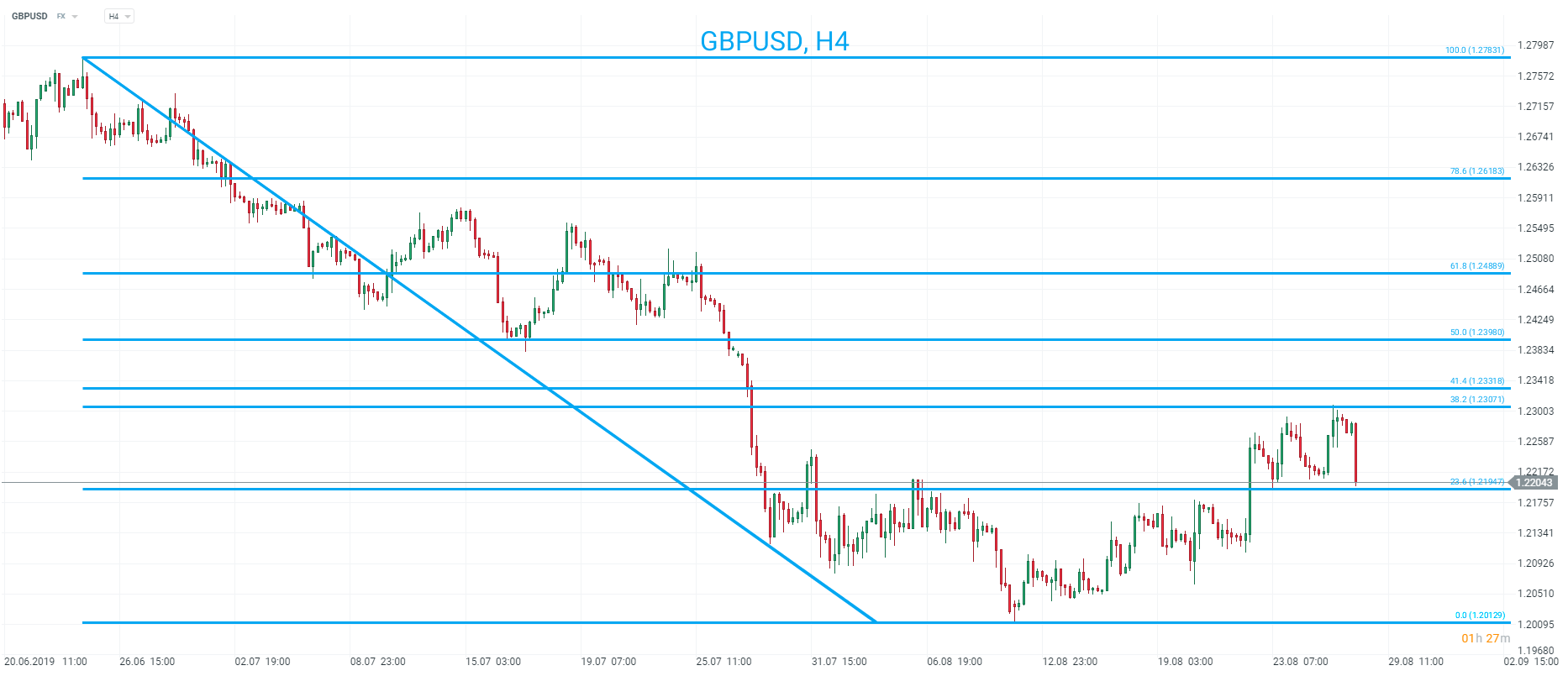

The pound had recovered a fair chunk of the declines seen since the June high, with price hitting the 38.2% fib at 1.2307 yesterday. However, the market is coming under pressure on these latest headlines and has fallen back near the 23.6% fib at 1.2195. Source: xStation

The pound had recovered a fair chunk of the declines seen since the June high, with price hitting the 38.2% fib at 1.2307 yesterday. However, the market is coming under pressure on these latest headlines and has fallen back near the 23.6% fib at 1.2195. Source: xStation

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.