Market uncertainty vs. economists' consensus

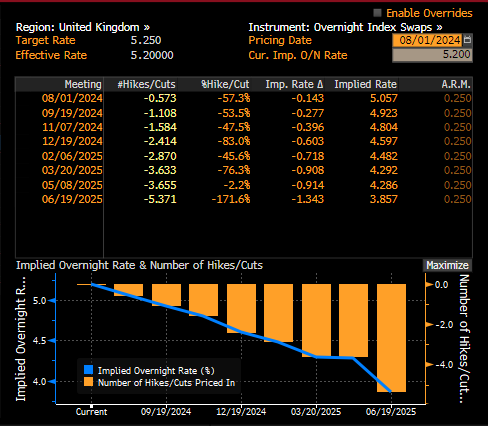

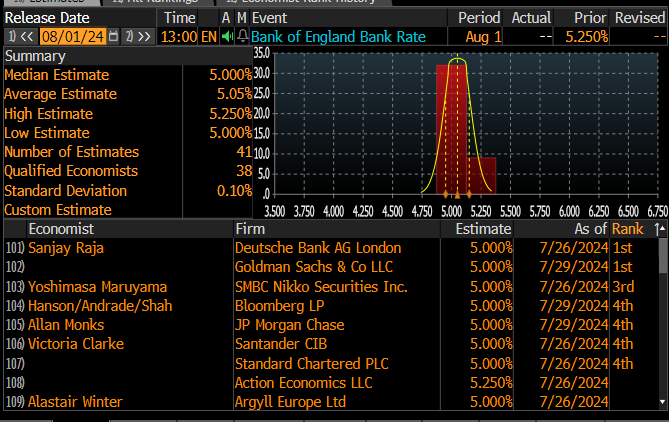

Expectations for the BoJ and the Fed were rather clear and the decisions fell more or less in the expected direction. In the case of the Bank of England's decision, the situation is no longer so clear-cut. The market is pointing to a little more than 50% probability for today's cut, while the Bloomberg consensus gives a definite certainty for a cut. Approx. 30 economists are pointing to a cut, while less than 10 are giving a chance for interest rates to remain in place. Nevertheless, the pound remains under selling pressure, suggesting that the market is also tilting toward a likely cut.

The market is pricing in just over a 50% probability for a cut. Source: Bloomberg Finance LP

Economists are mostly in agreement and expect a cut today. Source: Bloomberg Finance LP

Does the UK need lower interest rates?

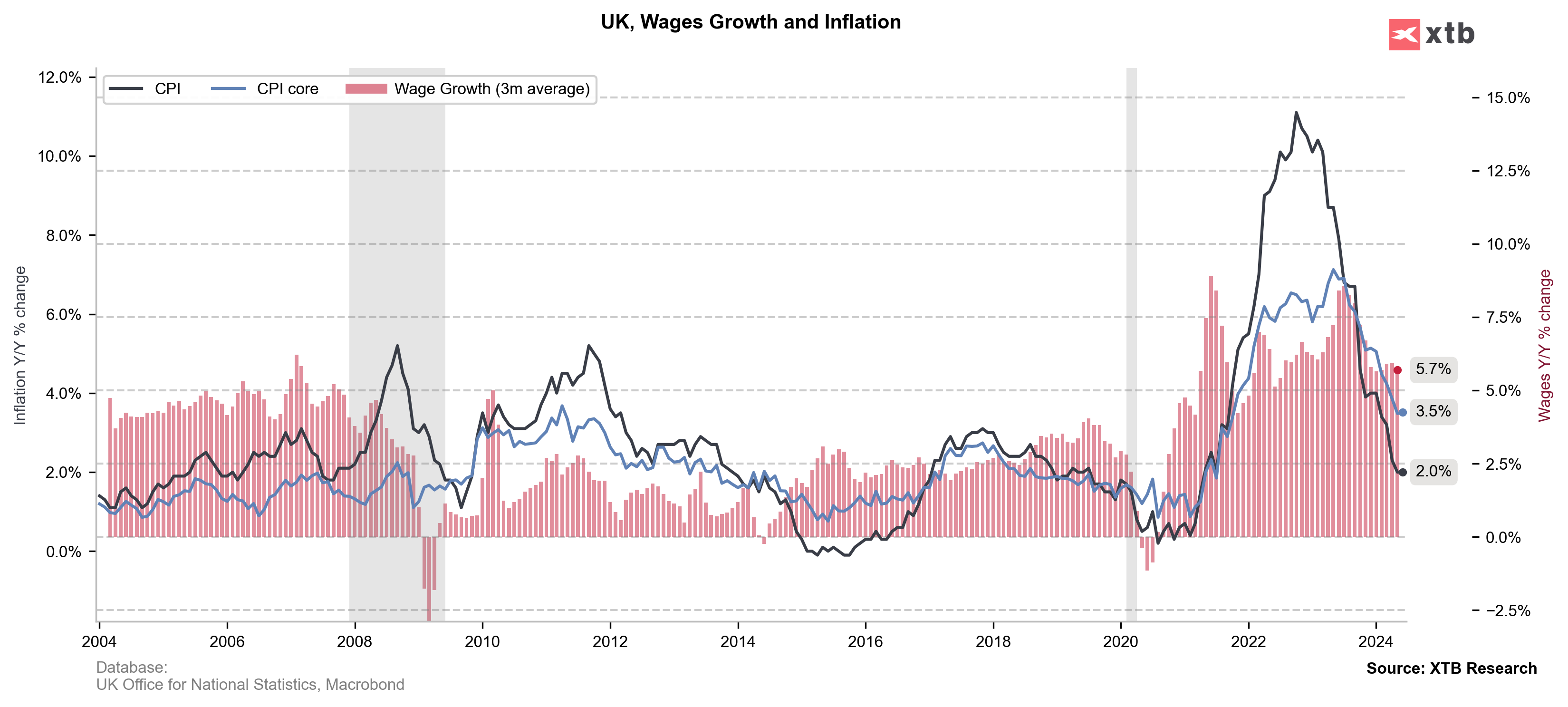

UK inflation fell to 2.0% for June, but will almost certainly rebound for July, due to underlying factors. Although core inflation is falling sharply, it remains at 3.5%. We saw such a high level only in 2011, and before that in the early 1990s. If monthly inflation does not rise faster than 0.2% by the end of this year, the CPI will remain around 2.5%. The reason for concern, however, is wages, whose growth rate has remained close to 6% for many months, which could have an impact on limiting the decline in core inflation in the second half of this year.

Inflation remains low, but costs from the labor market could pose a threat. Source: Bloomberg Finance LP, XTB

Inflation remains low, but costs from the labor market could pose a threat. Source: Bloomberg Finance LP, XTB

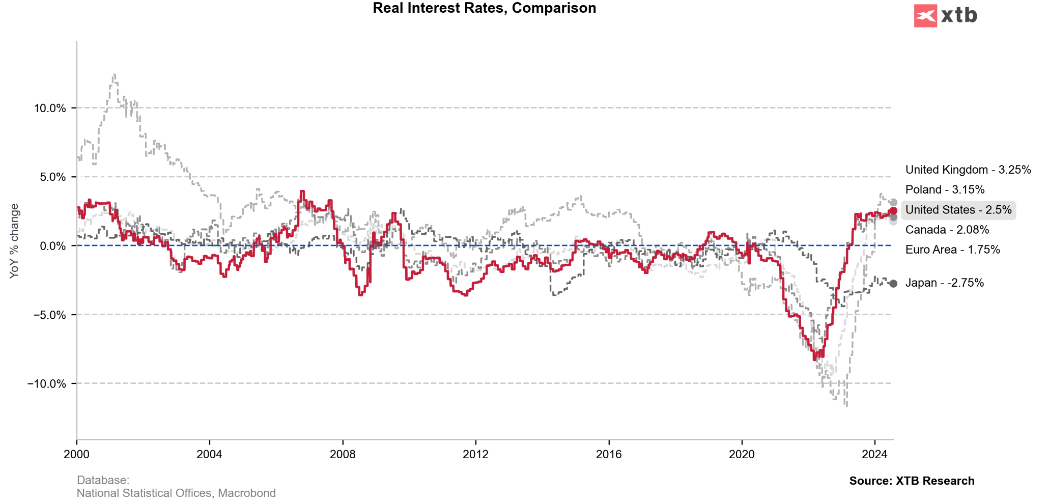

The economy was doing very poorly through 2022 and 2023, but we are now seeing a recovery. We only know the data for Q1, which doesn't look impressive either: 0.3% y/y and 0.7% k/k. However, it is worth noting that the current real interest rate in the UK is the highest among the key economies. WHAT's more, Bailey himself, during recent speeches, suggested that the BoE will start cutting interest rates in the coming months, and they may be larger than the market expects. It is worth revisiting at this point the expectations outlined at the beginning of the article: a full cut is not priced in until September, while 2.4 cuts are priced in by the end of this year - that's less than the US!

Real interest rates in key economies around the world. Source: Macrobond, XTB

Pound vulnerable to declines?

The market suggests that the decision on cuts will be made by a 5:4 ratio. More votes for a cut may suggest that the market should set its sights on a more dovish approach by the central bank. However, if the cut today does not take place, the pound could potentially return to gains for a while, but there are several factors that speak to its possible sizable overvaluation:

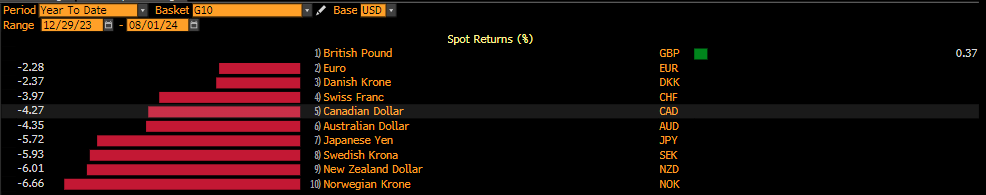

- The pound is the only currency in the G10 that has gained against the dollar this year

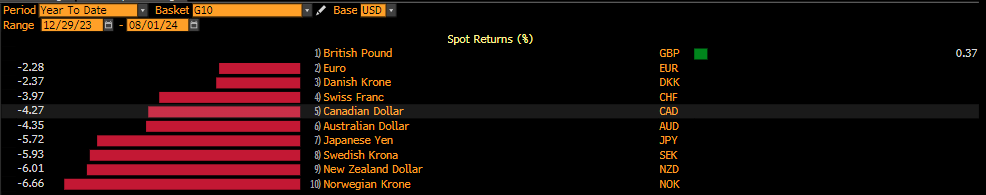

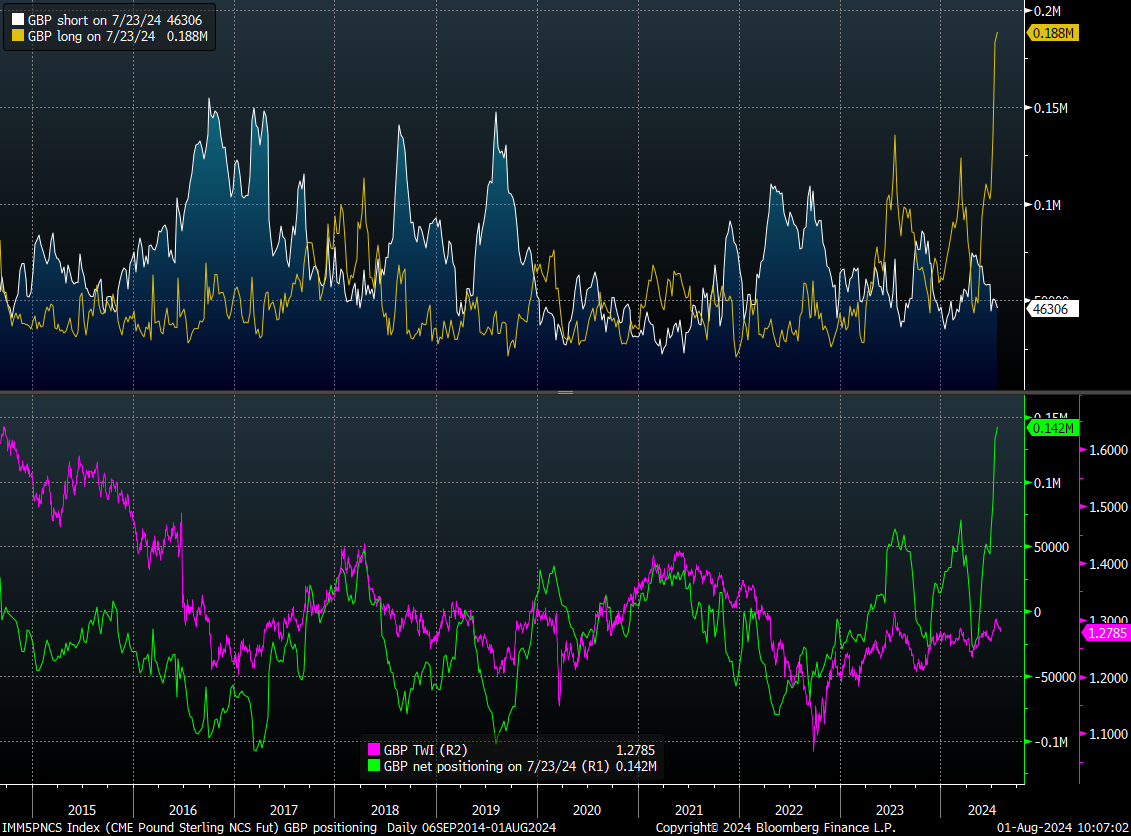

- The pound is being aggressively bought by hedge funds around the world. We haven't seen such a strong gain in such a short period of time in years, which in turn raises the risk of quick liquidation of long positions

- The pound has gained excessively in relation to the change in the spread between UK and US bond yields. The spread suggests that the pound's position should be much lower

The pound is the only currency in the G10 that has gained against the dollar since the beginning of this year. Source: Bloomberg Finance LP, XTB

Long positions on the pound are a play on the positive impact of the UK election on the pound and the possible maintenance of interest rates by the BoE. Extreme positive positioning with a possible dovish BoE, however, poses a lot of risk to the pound. Source: Bloomberg Finance LP, XTB

A look at GBPUSD

The GBPUSD pair clearly gained in the first half of July, realizing a potential inverted head-and-shoulders scenario. However, we are currently seeing the pair return to the vicinity of the neckline. The last defense for the bulls is the upward trend line. It is worth noting that seasonality points to declines in the near term. Last year from July to October we saw a massive downward wave on the GBPUSD pair. If there is a reduction of longs on the pair, the situation could repeat itself. On the other hand, if the bank does not cut rates and indicates that cuts may be delayed, then a return of the pair above the 1.30 level is possible.

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.