Summary:

- Australian Treasury signals the RBA could start buying bank bonds to take downward pressure off their profitability

- The RBA could also offer cheap funding to banks

- These measures are intended to help banks as they struggle to pass on subsequent rates cuts to customers

Australian Treasury warned that rate cuts delivered by the Reserve Bank of Australia are squeezing bank profit margins and that it why the central bank may soon have to resort to some measures intended to help banks deal with such downward pressure. What could be the most interesting point here is the fact that according to Josh Frydenberg, the head of Treasury, the central bank could initially start buying bank bonds and residential-mortgage backed securities (RMBS) to lower borrowing costs for households and businesses. This notion differs substantially from the RBA’s message that government bonds should be bought first. Also, other central banks like the Fed or the ECB focused largely on this part of bond markets. Frydenberg says that such a possibility could be needed in the case of reaching by the RBA a zero lower bound and if the government does not loosen the purse strings. In its report the Treasury also warned of risks arising from extremely low rates such as “excessive growth in asset prices, including house prices” and difficulty unwinding the measures, according to AFR.

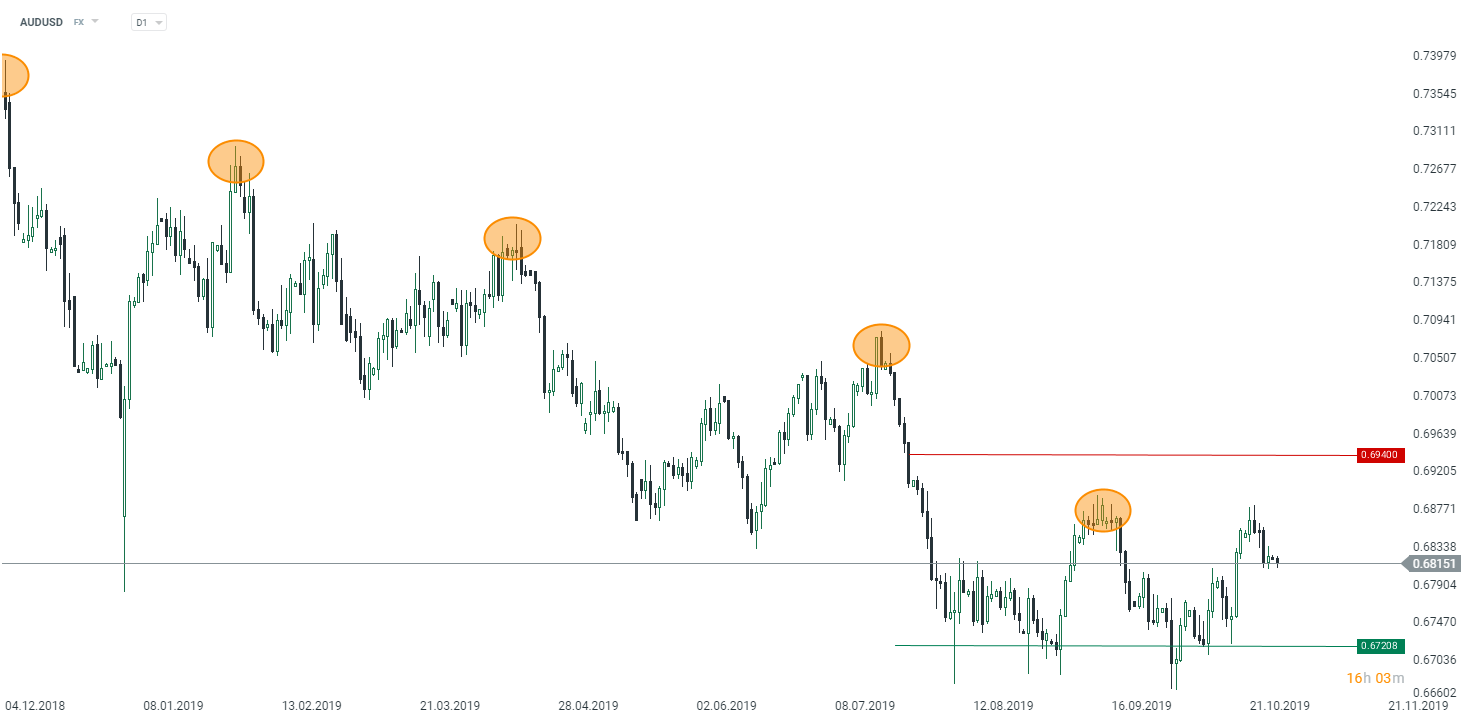

The Aussie dollar remains again under selling pressure as the new week kicks off. Source: xStation5

The Aussie dollar remains again under selling pressure as the new week kicks off. Source: xStation5

Three Markets to Watch Next Week (16.01.2026)

Chart of the day: USD/JPY under pressure from BoJ and Japanese policy (January 16, 2026)

Morning wrap (16.01.2026)

📉EURUSD loses 0.3%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.