The Reserve Bank of Australia is scheduled to announce its next monetary policy decision tomorrow at 5:30 am BST. Economists polled by Bloomberg expect the Australian central bank to deliver a 25 basis point rate hike this week, following a pause at the meeting at the beginning of July. However, weaker CPI print for Q2 2023 puts this hike into question.

RBA expected to hike one more time

The Reserve Bank of Australia has increased interest rates by a cumulative 400 basis points in 15 months, which is the fastest pace of tightening in RBA's history. Bank delivered a 25 bp rate hike back at the beginning of June, putting the cash rate at 4.10%, and then decided to keep rates unchanged at a meeting at the beginning of July.

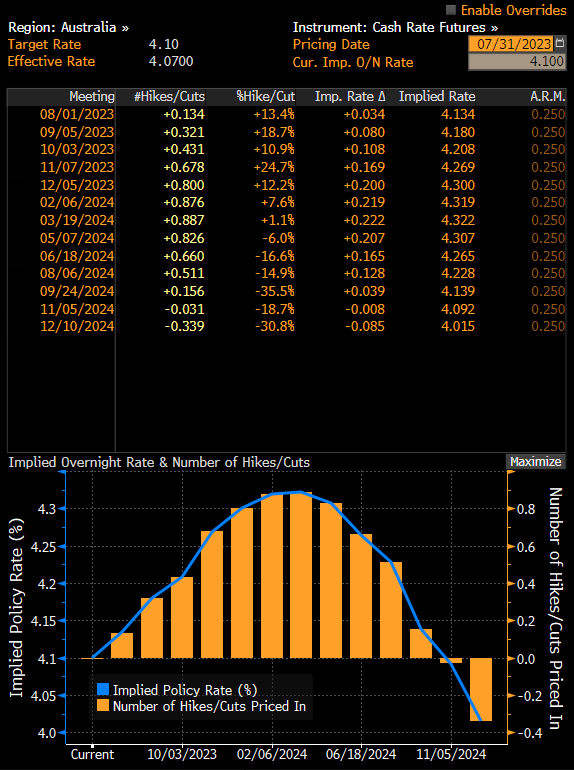

Expectations among economists are for RBA to resume hiking and decide on a 25 bp rate hike, that will put the main interest rate at 4.35% - the highest level since November 2011! However, it looks like it may be the final hike in the cycle with money markets seeing a rate peak around 4.35%. However, it should be noted that money markets do not fully price in a rate hike at a meeting tomorrow and a peak is priced in for Q4 2023/Q1 2024.

Source: Bloomberg

Inflation slows, labor market remains strong

Data that was released since the last meeting has been mixed from monetary policy's viewpoint. Australian CPI inflation slowed from 7.0% YoY in Q1 2023 to 6.0% YoY in YoY. This was below the market's forecast of 6.2% and below the RBA's forecast of 6.3% YoY. Meanwhile, jobs data for June came in strong with the unemployment rate staying unchanged at 3.5% (exp. 3.6%) and almost 40k full-time jobs being added. This was another strong jobs report from Australia in a row after May data showed an almost 76k total increase in employment, driven by 61.7k full-time jobs.

While inflation is dropping faster than expected, it is still significantly above target and combined with other solid data from the Australian economy, it makes a 25 basis point rate hike tomorrow highly likely. Question is what guidance will RBA give to investors. Will it hint that the rate hike cycle is still live and another move could be expected later into the second half of the year? Or will it hint that given the extent of the already delivered tightening, a pause would be reasonable in order to assess impact.

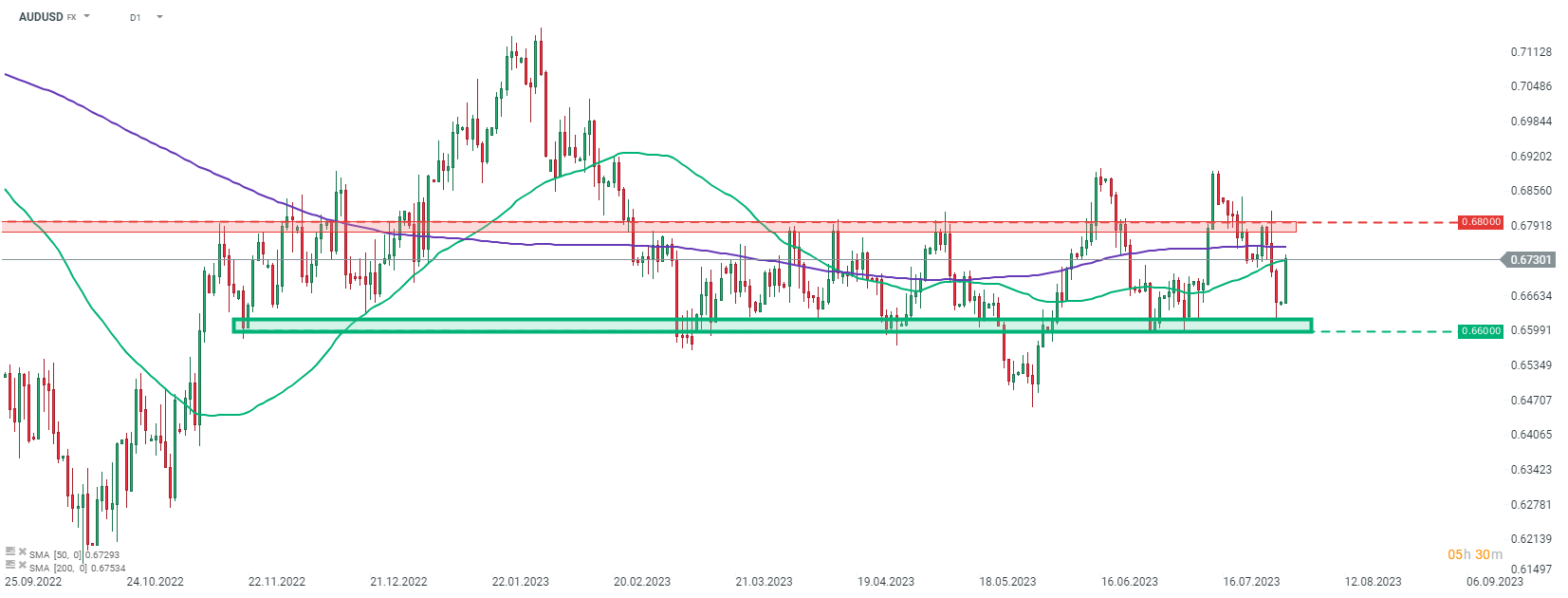

A look at AUDUSD

Taking a look at AUDUSD chart at D1 interval, we can see that the pair has been trading in a sideways move for the past half a year. A recent pullback was halted at the support zone ranging above the 0.6600 mark, which serves as the lower limit of the trading range. A strong recovery move can be observed this week with the pair climbing to and testing the 50-session moving average in the 0.6730 area (green line).

A dovish message from RBA like for example no hike or a move smaller than 25 basis points would likely see AUD lose some ground. Also the currency may experience some weakness if RBA delivers a hike but strongly hints that this was the final move. Nevertheless, such a clear forward guidance is unlikely to be offered and instead, some rather vague comments on data-dependency and need to assess impact of the already delivered tightening seem more likely. However, a 25 bp rate hike and no changes in the statement that would signal that cycle is over, could see a hawkish reaction on AUD. Still, the balance of risks for AUD seem to be tilted to the downside ahead of the meeting with RBA having it much harder to deliver a hawkish surprise than dovish surprise.

AUDUSD at D1 interval. Source: xStation5

AUDUSD at D1 interval. Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.