-

50 bps Risk Rises: Significant GDP contraction boosts probability for a 50 bps RBNZ rate cut, though 25 bps is still the official consensus.

-

Dovish Outlook: Expect a strongly dovish statement to signal that rates are heading below 2.5% next year.

-

NZD Under Pressure: The Kiwi is vulnerable to further declines against the USD, especially with a surprise large cut or dovish guidance.

-

50 bps Risk Rises: Significant GDP contraction boosts probability for a 50 bps RBNZ rate cut, though 25 bps is still the official consensus.

-

Dovish Outlook: Expect a strongly dovish statement to signal that rates are heading below 2.5% next year.

-

NZD Under Pressure: The Kiwi is vulnerable to further declines against the USD, especially with a surprise large cut or dovish guidance.

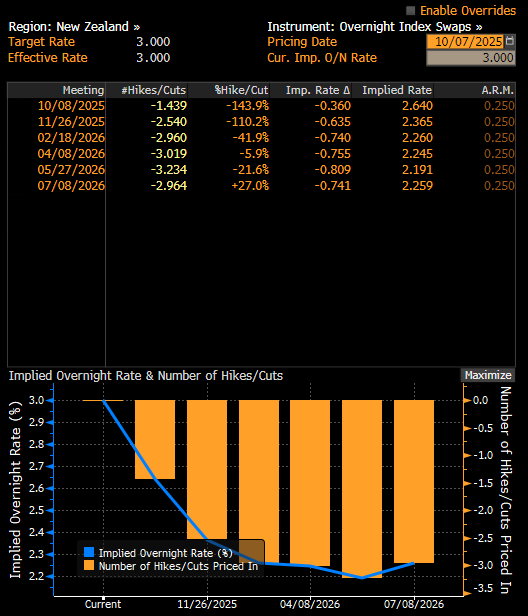

The Reserve Bank of New Zealand (RBNZ) is set to announce its official cash rate (OCR) decision tomorrow at 02:00 AM (BST). Ahead of the announcement, market expectations are heavily tilted toward further monetary policy easing. While the majority of analysts forecast a 25 basis point (bps) rate cut, chances are rising for a more decisive 50 bps move, fuelled by significantly disappointing GDP figures and weakness in the labour market.

It is worth noting that the RBNZ has previously enacted 50 bps cuts multiple times (twice in 2024 and once earlier this year). The previous reduction in August was 25 bps, suggesting the central bank may favour a similar step this time.

Expectations Ahead of the Decision

-

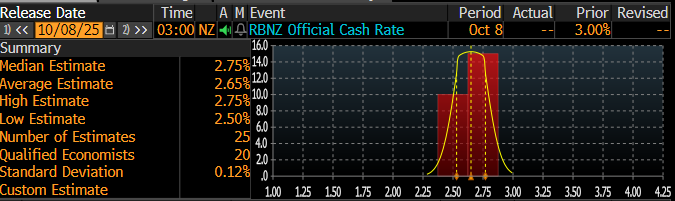

The market consensus forecasts a 25 bps cut to the OCR, bringing it to 2.75%, consistent with the RBNZ’s previous guidance and its own August model projections.

-

Simultaneously, the risk of a deeper 50 bps cut to 2.5% has clearly increased, reflected both in comments from some economists and in market pricing, where the probability of such a move is assessed at approximately 50%.

-

The latest disappointing data, including a 0.9% quarter-on-quarter contraction in GDP (three times weaker than the central bank’s own forecast), and a deteriorating labour market are increasing pressure for bolder action. As most key New Zealand data is published quarterly, the central bank must rely heavily on its internal forecasts.

-

Personnel changes within the RBNZ—the departure of the most hawkish Monetary Policy Committee (MPC) member and the addition of a new, potentially more dovish individual—may also favour greater easing. The governorship of the central bank is also due to change in December.

Market-implied probability suggests up to a 50% chance of a 50 basis point cut. Source: Bloomberg Finance LP

Consensus points to a 25 basis point cut, but a significant number of economists are advocating for a 50 basis point reduction. Source: Bloomberg Finance LP

Macroeconomic Context

-

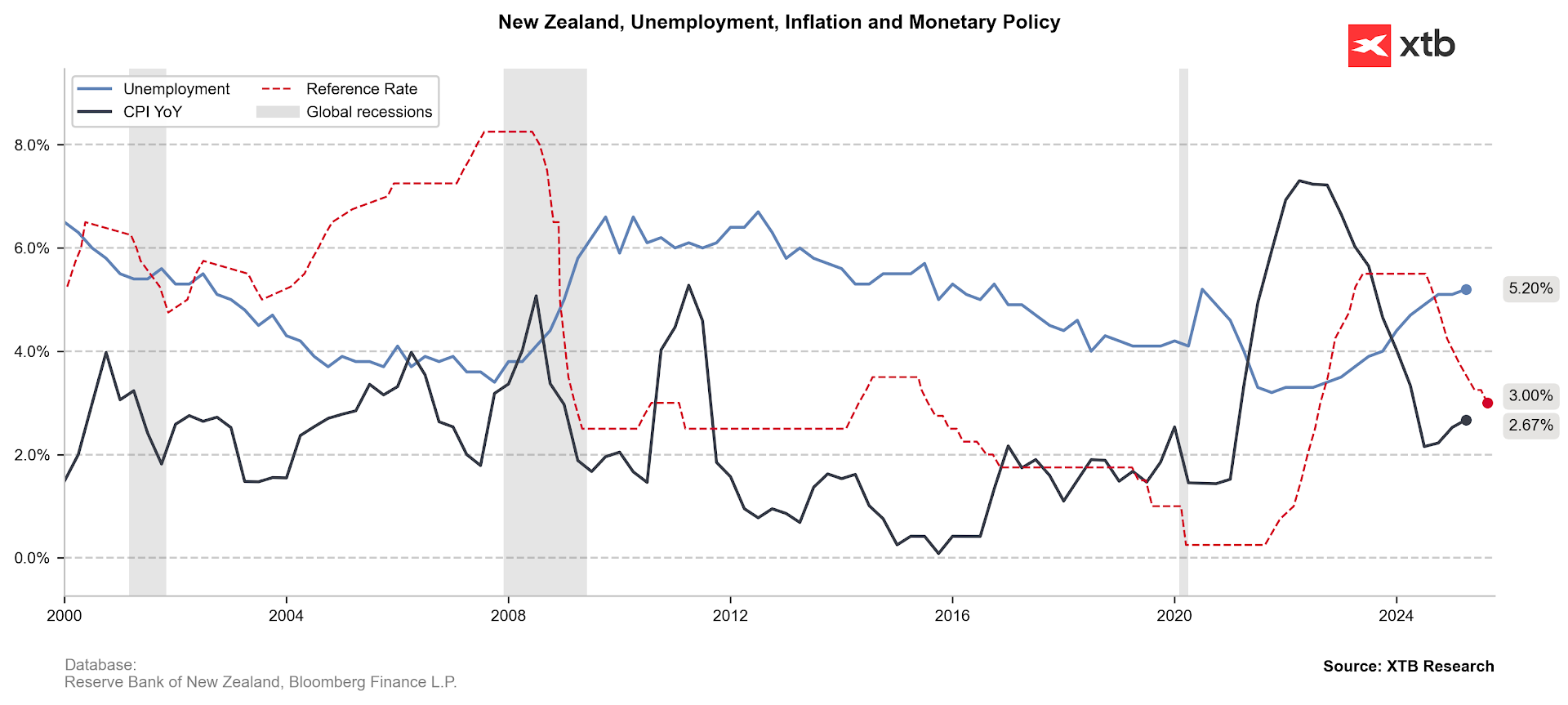

The labour market remains a source of risk: monthly employment indicators are consistently being revised downwards, and unemployment has risen to 5.2%, with forecasts suggesting values as high as 5.5% by 2026.

-

Hours worked and weekly wages remain lower than in 2023 and 2024, indicating a fairly deep slowdown in economic activity.

-

While inflation is expected to have accelerated in Q3, it is projected to fall back closer to the RBNZ’s 2% target midpoint in 2026.

The labour market poses an increasing risk, although we are simultaneously observing an inflation rebound. Source: Bloomberg Finance LP, XTB

Forward Outlook

-

The decision and subsequent communication are expected to be dovish: even if the bank opts for a smaller cut, the message should be clear that there remains room for further reductions (including at the next meeting in November). Indications suggest that interest rates could fall below 2.5% next year.

-

A policy of rapidly moving below the "neutral" rate level (2.9%) may be necessary to stimulate economic activity ahead of the crucial Christmas and summer period in New Zealand.

What to Expect for the Kiwi (NZD)

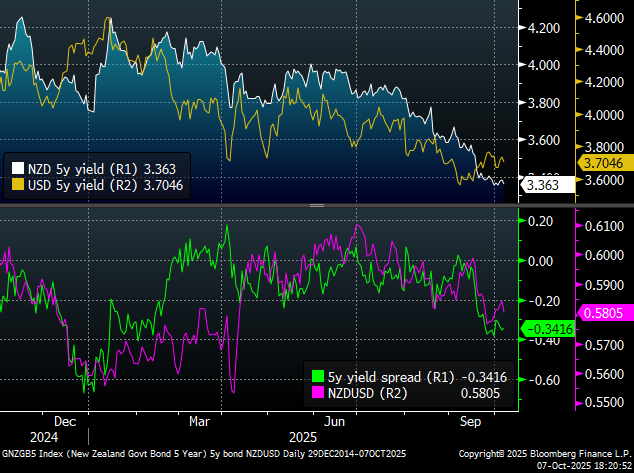

The New Zealand Dollar (NZD) is broadly weak. Against the US Dollar (USD), only the Canadian Dollar has gained less this year than the NZD. The NZD/USD pair is currently testing the 50.0 Fibonacci retracement of the last major upward wave. All signs indicate that continued declines should follow in the event of a surprise larger cut or a dovish statement. Nevertheless, if the lows from September 29th are not breached soon, the existing downtrend sequence may be jeopardized. The two-year yield spread suggests that the pair should decline in the near term.

Source: xStation5

Source: Bloomberg Finance LP

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.