U.S. natural gas futures (NATGAS) are climbing 4% today, led by a sharp rally in the front-month January contract, which surged into expiration while later-dated contracts also climbed. The key bullish driver is a near-term colder weather outlook for the North and West, with forecasts pointing to a stronger cold push from December 31 into early January, supporting expectations for higher heating demand.

-

Another major tailwind remains exceptionally strong LNG demand, as U.S. export flows to global markets are running at record or near-record levels, helping absorb domestic supply.

-

These supportive factors are partly offset by solid U.S. production, which continues to provide a meaningful supply cushion, limiting how far prices can run.

-

The latest EIA storage report added fuel to the rally: for the week ending December 19, U.S. inventories posted a 166 Bcf withdrawal, bringing total storage down to 3,413 Bcf.

-

That drawdown pushed U.S. inventories slightly below the five-year average for the first time since April, signaling that the market is moving from comfortable supply conditions toward a tighter balance.

-

Storage is now estimated at 24 Bcf below the 2020–2024 seasonal norm, after being 32 Bcf above average just one week earlier — a notable swing that traders quickly priced in.

-

The withdrawal was close to expectations, coming in just under the Wall Street Journal analyst consensus of 169 Bcf, reinforcing confidence that cold-driven demand is beginning to show up.

-

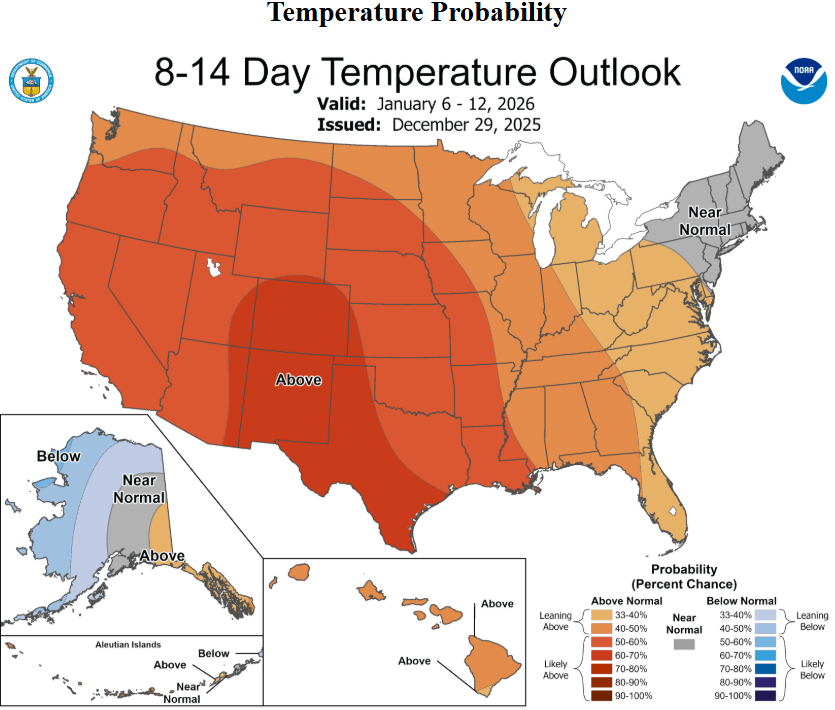

However, the rebound may be tested in the beginning of January, as Climate Prediction Center according to NOAA data signals warmer temperatures across the United States since 6 to 12 January 2026.

Source: NOAA, CPC

Natural gas futures climbs almost 4% today, rising to the highest level since 17 December. If the price will fall from todays level, test of $3.80 may be immitend. On the other side, if the price will continue to rise above EMA50 (orange line), fundamentals may support the trend even in January - especially if 6 - 12 January NOAA weather forecasts will change.

Source: xStation5

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.