Remy Cointreau (RCO.FR) stock jumped over 11% during today's session after the French drinks group announced that earnings doubled in the first half of the year thanks to strong demand for its premium cognac in China, the United States and Europe, price effects and good cost control. The group recorded operating profit of 212.9 million euros ($238.5 million) in the six months to Sept. 30, twice that of the same period last year. Net profit came to EUR134 million, more than doubling on the year.

Eric Vallat, Remy Cointreau’s CEO, commented: “It has been an amazing semester for Rémy Cointreau, reflecting our market share gains and the solid progress made on our strategic priorities. These results will reinforce our ability to become the worldwide leader in exceptional spirits".

As a result of the strong first half performance, the company raised its full-year outlook and now expects "very strong" organic growth in current operating profit in the 2021/22 financial year. It had previously targeted "strong" growth. However Remy warned, that second-half earnings will be affected by higher spending on marketing and communication and by inventory management in the year’s final quarter. The company did not provide any specific earnings forecasts for the full year.

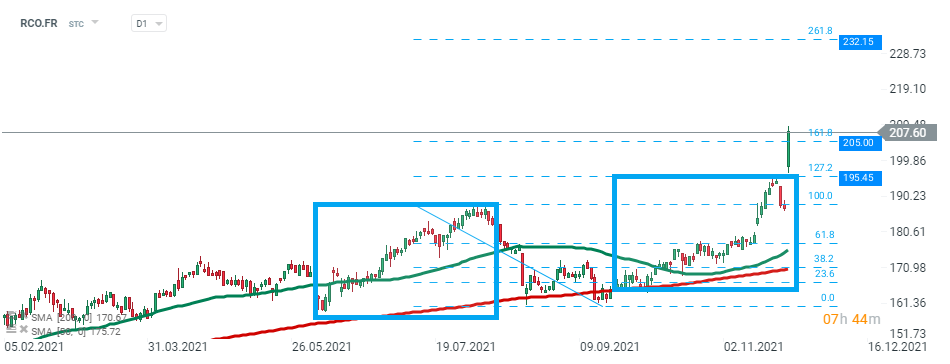

Remy Cointreau (RCO.FR) stock launched today's session sharply higher, tested support at €195.45 and then skyrocketed to new all-time high at €205.00. If current sentiment prevails, upward move may accelerate towards €232.15 which coincides with 261.8% external Fibonacci retracement of the last downward wave. Source: xStation5

Daily summary: Wall Street and precious metals try to rebound 📈Microsoft down 12%

Apple shares down ahead of the earnings 📉Will iPhone support the company?

US Open🚨US100 slides almost 2% amid 11% Microsoft shares crash📉

Caterpillar gains after Q4 earnings 📈AI support industrials?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.