Deterioration in sentiment on the markets is clearly visible today. Risk-off moods can be seen all across the globe. There is no clear reason behind the flight for safety but among factors that may have contributed are:

- Weak data from China. Chinese trade data for July was weak with exports and imports dropping more than expected. This hints at a weaker demand for Chinese goods but also weaker demand within China as well

- Italian banks dragging peers lower. Italian banks are slumping today after the Italian Senate approved a 40% windfall tax on 2023 banks' profits. However, declines were not limited to Italian shares only and banks from other European countries trade lower today

- Moody's downgrading US banks. Moody's ratings agency downgraded 10 small- and mid-sized US banks, put some other banks under review (including Bank of New York Mellon and US Bancorp) and put 11 banks on negative outlook. Agency noted that mild recession is on the horizon in early-2024 and banks' asset quality is likely to deteriorate further after recent banking sector issues

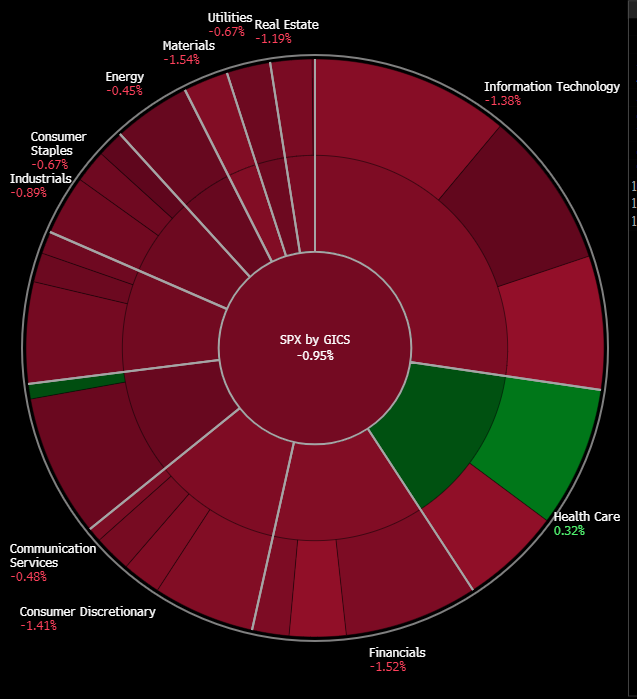

Financials are one of the worst performing group of stocks in US today. Source: Bloomberg Finance LP

An important point to note is that deterioration in moods can be seen across different asset classes:

- Equities, oil and industrial metals are dropping

- Commodity currencies (AUD, CAD, NZD) and EM currencies (ZAR, MXN, PLN) are pulling back

- Safe haven currencies (USD, CHF and JPY) are on the rise

- Yields are plunging as investors flee to bonds. 10-year US yield is down 7 basis points, German yields drop 13 basis points

Precious metals are dropping today, pressured by a rise in the USD. However, while silver drops 1.5% and platinum plunges 2.5%, gold trades 'only' 0.5% lower showing that there may also be some safe-haven inflows into this market. Cryptocurrencies seem to be the only class that bucks the 'risk-off' trend as gains can be seen almost all across the digital assets market.

US100

US100 plunged below the lower limit of a recent short-term trading range and is continuing to move lower. The textbook range of a breakout signals the possibility of a drop to 15,130 pts area. However, a key support zone to watch can be found slightly lower at 15,050 pts. Source: xStation5

US100 plunged below the lower limit of a recent short-term trading range and is continuing to move lower. The textbook range of a breakout signals the possibility of a drop to 15,130 pts area. However, a key support zone to watch can be found slightly lower at 15,050 pts. Source: xStation5

EURUSD

EURUSD failed to break back above the 1.1025 resistance zone, marked with previous local highs and 50-sesion moving average (green line). The pair is diving today as USD gains on safe have flows. Should we see a break below the recent local lows in the 1.0920 area, the next target for the bears will be 1.0875 support zone. Source: xStation5

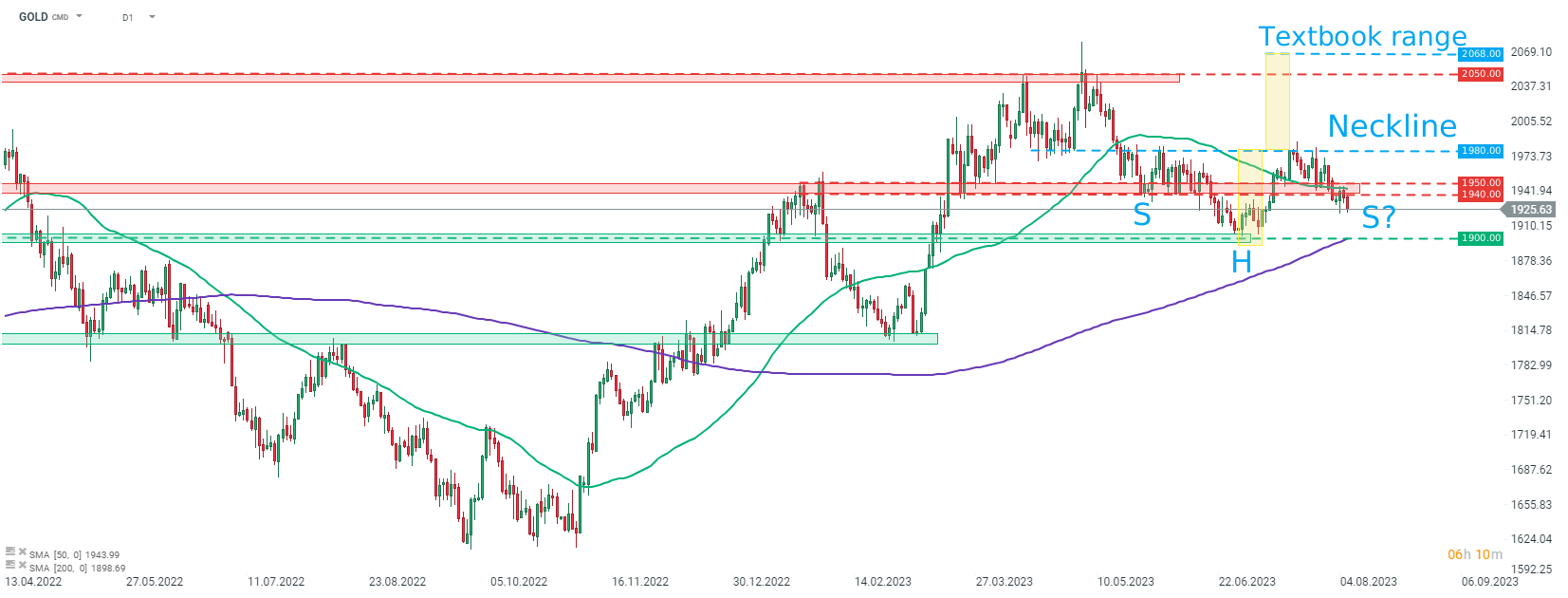

GOLD

Gold is plunging below the $1,940-1,950 price zone today, likely invalidating a potential inverse head and shoulders pattern on D1 chart. If declines are not stopped there, the $1,900 support zone, marked with previous price reactions and 200-session moving average (purple line) may be in danger. On the other hand, should bulls manage to regain control and recover from losses, the aforementioned inverse head and shoulders pattern may still materialize. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.