Shipping stocks, such as Israel ZIM Integrated Shipping (ZIM.US), German Hapag-Lloyd (HLAG.DE) and Danish AP Moeller-Maersk (MAERSKA.DK) are falling today by 17%, 6% and 5% respectively as Wall Street reacted to digested ceasefire talks in Gaza and potentially disrupting impact of Hurricane Beryl in the Gulf of Mexico. ZIM is losing today the most due to the highest operational leverage and transatlantic spot freight costs exposure.

- Egypt and Quatar help US to mediate between Gaza and Israel, to end the 9-month conflict. If it succeeds, a peace can put the pressure on freight rates due to falling number of Houthi attacks in the Red Sea.

- Maersk drops today despite that the company raised the 2024 profitability outlook citing strong demand and Red Sea crisis twice this year, citing "continued strong container market demand" and disruptions caused by an ongoing crisis in the crucial Red Sea region.

- According to Maersk commentaries, still strong demand and geopolitic could pressure freight rates higher in the second half of the year. Also, ZIM Board expected rising freight rates to continue in H2 2024. However, in the successful Gaza ceasefire scenario, lower tensions may lead to pull back in freight rates.

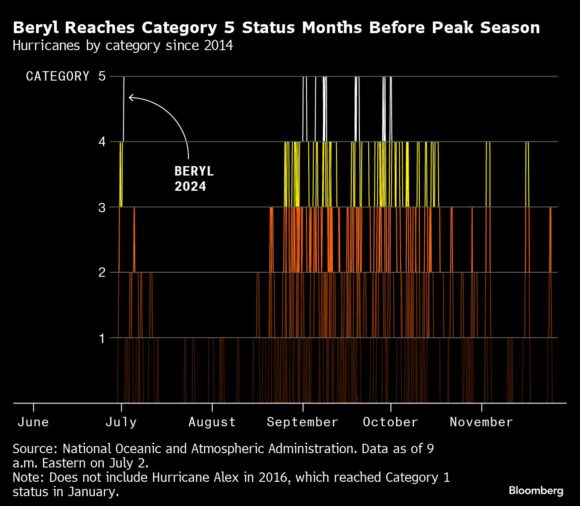

Also, Hurricane Beryl (Category 5) made landfall in Texas today, with a number of ports in the region closing in preparation. Some companies may see operational pressure because of that. Source: NOAA, Bloomberg Finance L.P

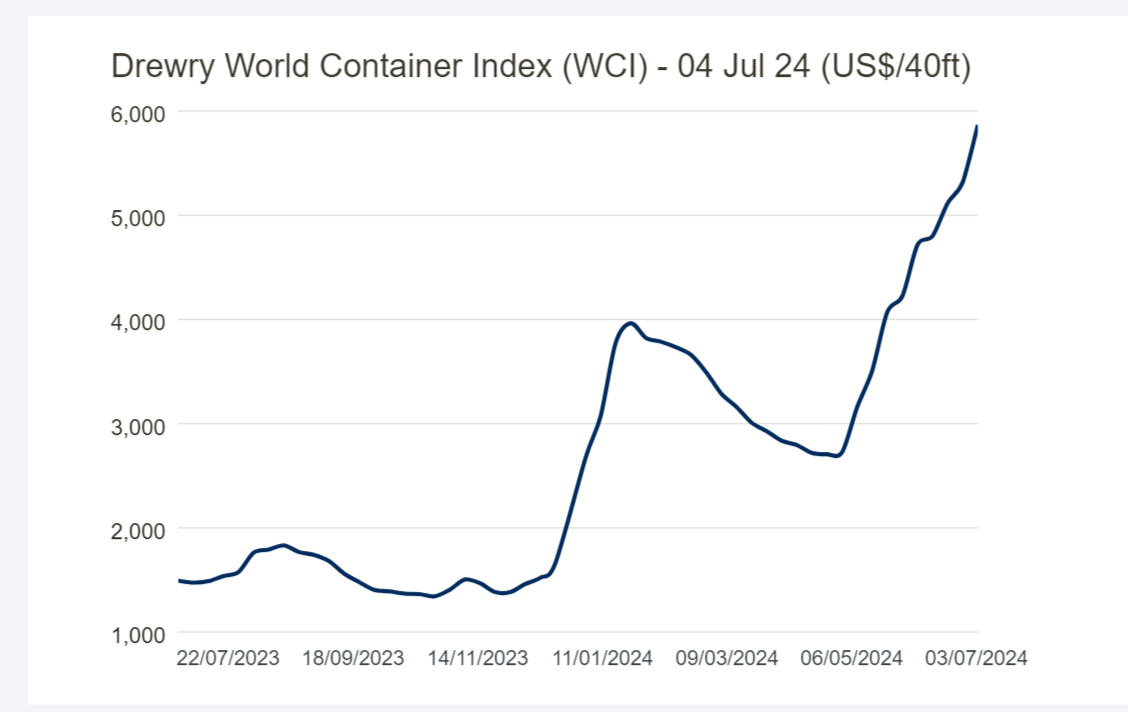

Freight rates for 40ft container are soaring and almost doubled since May 2024. Source: Drewry

Freight rates for 40ft container are soaring and almost doubled since May 2024. Source: Drewry

ZIM (ZIM.US, D1 interval)

Shares of ZIM are testing SMA50 today, with double-top technical pattern. If SMA50 support fails, the first important zone is $17 per share and $13 where we can see 61.8 Fibonacci retracement of the rising wave since the fall of 2023.

Source: xStation5

Source: xStation5

Nvidia expands into software AI sector? Wired reports on NemoClaw

Market Wrap: Energy Stocks Retreat as Hopes for End to Iran War Grow 🌍 (10.03.2026)

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.