- The Baltic Dry Index soared to 5-week highs and has risen more than 80% in the past 7 days

- The increases were fueled by iron ore shipments to China, which are opening up the economy after several years of 'covidzero' languor

- Dry freight spot rates for all major commercial vessels saw improvement

- Capesize bulk carriers benefited the most, with a set of average rates on five key shipping routes rising 135% to $5271

Stocks of ocean freight companies are extending their gains in response to improved sentiment. These companies are cyclical and remain heavily dependent on global economic conditions and global trade volumes. The key risks continue to be the prospect of a looming economic recession and geopolitical issues with deglobalization in the background, which could dampen sentiment and put downward pressure on maritime trade volumes.

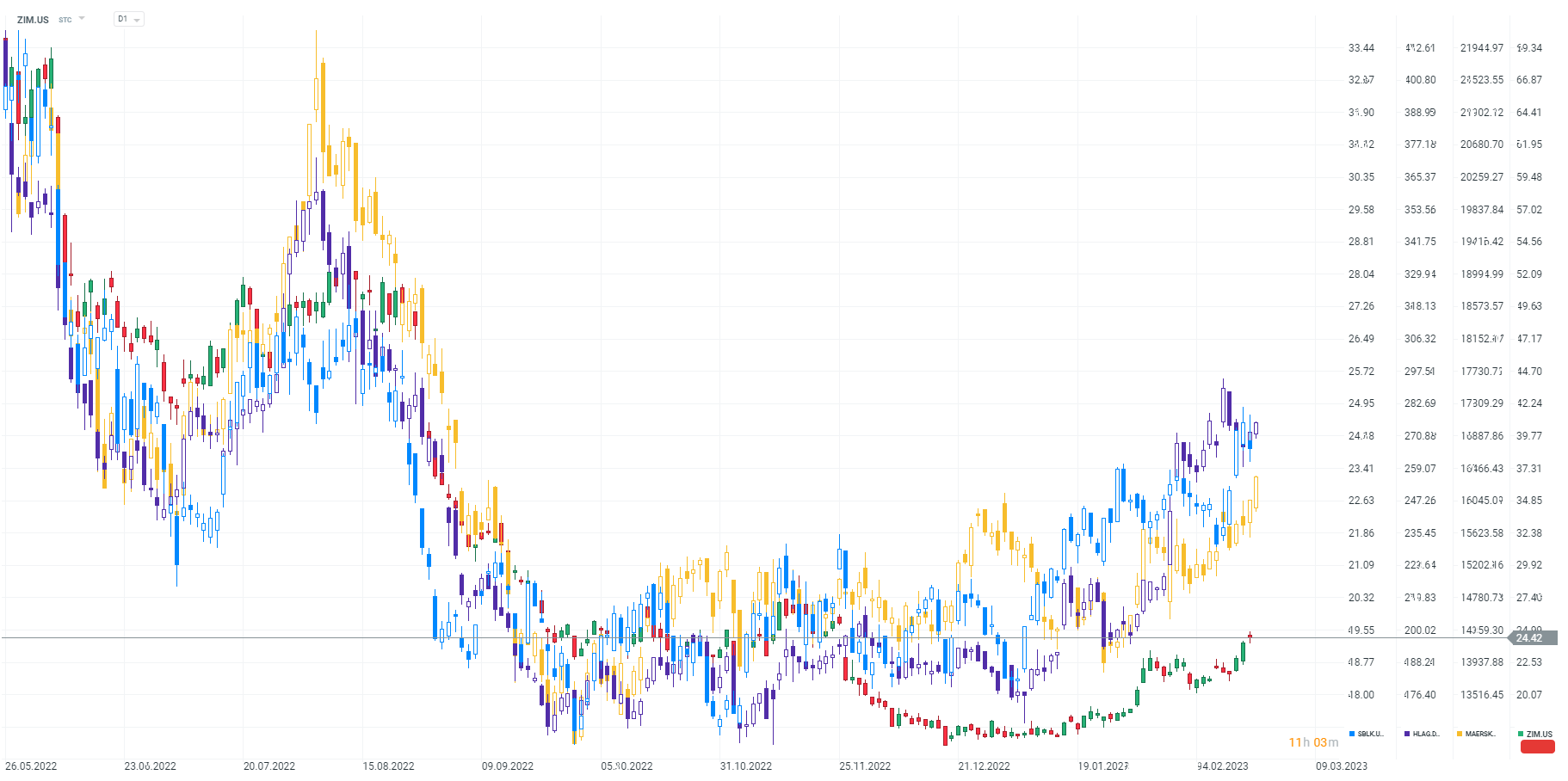

Recent gains include the shares of ZIM Integrated Shipping (ZIM.US), Maersk (MAERSKA.DK),German giant Hapag-Lloyd (HLAG.DE) and Greece's Star Bulk Carriers (SBLK.US), which has a branch in Singapore and a fleet geared mainly to transport dry commodities such as iron. Most of these companies have been under tremendous selling pressure until recently with freight companies losing the hardest as they put in place an aggressive business model in 2020 to reap as much profit as possible from global supply problems with high consumption of goods.

The BDI index tracking freight prices for dry and dry bulk commodities on the world's 20 largest trade routes rebounded from around 500 points, not far from historical lows. Source: Bloomberg

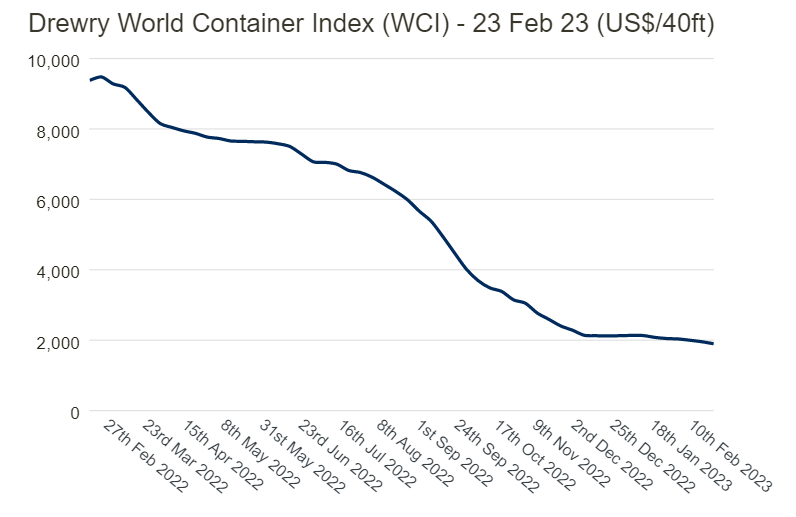

The average freight price of a standard 40-foot container continues to fall. As recently as February 2022 it was nearly $10,000, today it is around $2,000. For the moment, the index for containers has not rebounded on par with the index for bulk goods - mainly raw materials. Source: Drewry

Average rates for the transport of ordinary containers on the 8 largest sea lanes, unlike rates for the transport of dry commodities are still under pressure, making a more sustained rebound in the companies' shares still in question. Source: Drwery  Shares of ocean freight companies are trading up and climbing to new year lows after record lows in the fall of 2022. Most of the companies have healthy fundamental valuation ratios and are one of the cornerstones of global economic exchange by which they can be seen as interesting, for long-term investors. Source: xStation5

Shares of ocean freight companies are trading up and climbing to new year lows after record lows in the fall of 2022. Most of the companies have healthy fundamental valuation ratios and are one of the cornerstones of global economic exchange by which they can be seen as interesting, for long-term investors. Source: xStation5

Kongsberg Gruppen after earnings: The company catches up with the sector

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨

Morning wrap: Tech sector sell-off (06.02.2026)

Amazon shares tumble 10% as investors recoil at the price of AI dominance

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.