Silver (SILVER) is trading nearly 2% higher today ahead of tomorrow’s Federal Reserve decision. The market expects a 25 bp rate cut and is increasingly positioning for a more aggressive policy shift in 2026, when Kevin Hassett is expected to become the new Fed Chair — likely implementing a monetary policy framework aligned with the views of Donald Trump and close members of his administration, including Scott Bessent.

Although USD index futures (USDIDX) have been edging higher over the past few sessions, silver continues to see strong upward pressure. After each of the last two corrections, demand returned rapidly — first after the drop to $45/oz, and then after the pullback to $48/oz. The market is now moving toward the psychologically important $60/oz zone, even though ETFs cut 4.76 million troy ounces of silver from their holdings in the last session, reducing this year’s net purchases to 127.6 million ounces — the largest one-day decrease since October 24. Positive forecasts from industry giant Heraeus are also supporting sentiment.

Key Takeaways from Heraeus’ 2026 Outlook

-

Heraeus expects gold to reach $5,000/oz in 2026, with the rally resuming after a consolidation phase driven by central bank buying, falling real interest rates, and concerns over U.S. fiscal dominance.

-

Silver is expected to trade in the $43–62/oz range, though weakening demand in PV, jewelry, and silverware markets means the metal will depend heavily on investment inflows.

-

Central bank purchases remain a critical pillar of support for gold, and the dedollarization trend continues. Many central banks plan to increase their gold reserves while reducing U.S. dollar exposure.

-

Investment demand remains strong: sales of bars and coins continue to rise, and ETF holdings increased 18% in 2025, though still below the 2020 peak — leaving room for additional buying.

-

Heraeus warns that U.S. fiscal dominance — higher government spending and political pressure to keep rates low — may keep real interest rates negative, which historically supports gold prices.

-

A potential U.S. recession in 2026 remains a downside risk, especially for PGMs, as labor-market indicators weaken and the yield curve’s uninversion signals a deteriorating economic outlook.

-

Demand for platinum, palladium, and rhodium may decline further as combustion-engine vehicle sales shrink, while ruthenium remains supported by HDD demand linked to data-center expansion.

-

The sharp silver rally in 2025 was driven by tight liquidity and strong ETF/retail buying, rather than industrial demand, suggesting the market may need time to stabilize.

-

Photovoltaic sector demand for silver is expected to decline in 2026 for the first time in years, as thrifting accelerates and installation growth in China slows sharply.

-

High prices continue to suppress global demand for silver jewelry and silverware, especially in India, which accounts for the majority of demand in these categories.

-

Silver recycling is likely to increase in 2026 as higher prices incentivize recovery, while mine supply should rise modestly alongside increased production of gold, copper, and zinc.

-

For silver, investment flows remain the primary directional driver — inflows can boost prices, but they have been volatile, and high coin premiums may limit retail activity.

-

Heraeus emphasizes that silver remains a higher-beta version of gold — meaning that if the gold rally returns, silver is likely to follow with significantly higher volatility.

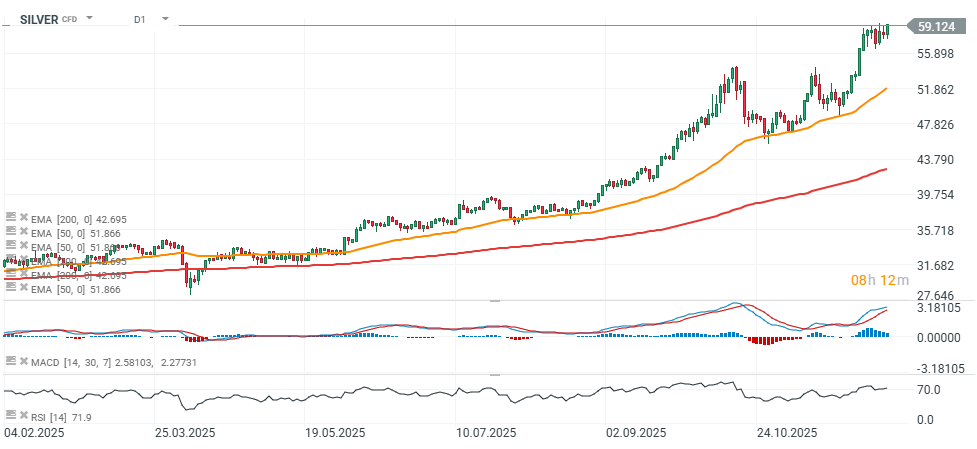

SILVER (D1 interval)

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.