-

Silver tumbles nearly 5%, dropping below the $50 level for its largest single-day loss since April.

-

The correction follows a surge of retail FOMO, often seen as a contrarian signal by seasoned investors.

-

Key factors include easing US political risk, renewed US-China trade optimism, and a technical breach of the accelerated uptrend line.

-

Silver tumbles nearly 5%, dropping below the $50 level for its largest single-day loss since April.

-

The correction follows a surge of retail FOMO, often seen as a contrarian signal by seasoned investors.

-

Key factors include easing US political risk, renewed US-China trade optimism, and a technical breach of the accelerated uptrend line.

The correction follows a period where images of queues outside physical bullion shops circulated globally, suggesting a surge of FOMO (Fear of Missing Out) among retail clients previously unfamiliar with precious metals. The entry of the least experienced investors into a market is frequently considered a contrarian signal.

While the market's underlying fundamentals remain robust, pullbacks are a regular feature, especially when several catalysts align:

- US Political Risk Eases: News emerged yesterday of a potential deal between Republicans and Democrats this week, paving the way for the US government to resume operations. This development potentially removes a layer of geopolitical risk from the market.

- Trade Optimism: Donald Trump has declared that a trade agreement with China will be "magnificent," and he plans to meet with Xi Jinping at the APEC summit later this month.

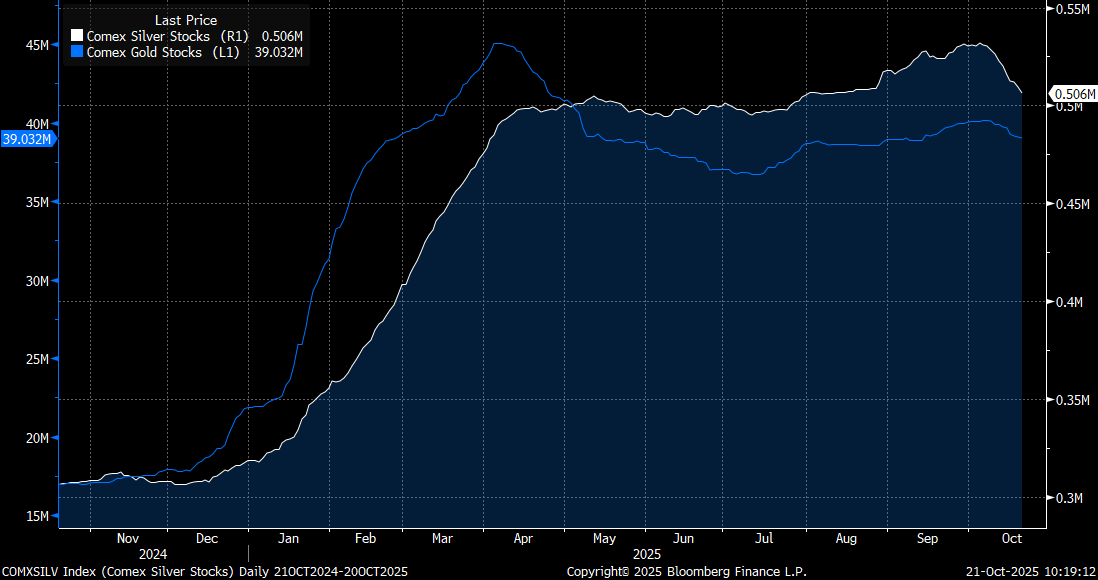

- COMEX Inventory Shift: Silver inventories at COMEX have begun to decline, a trend that could signal the metal's return to London.

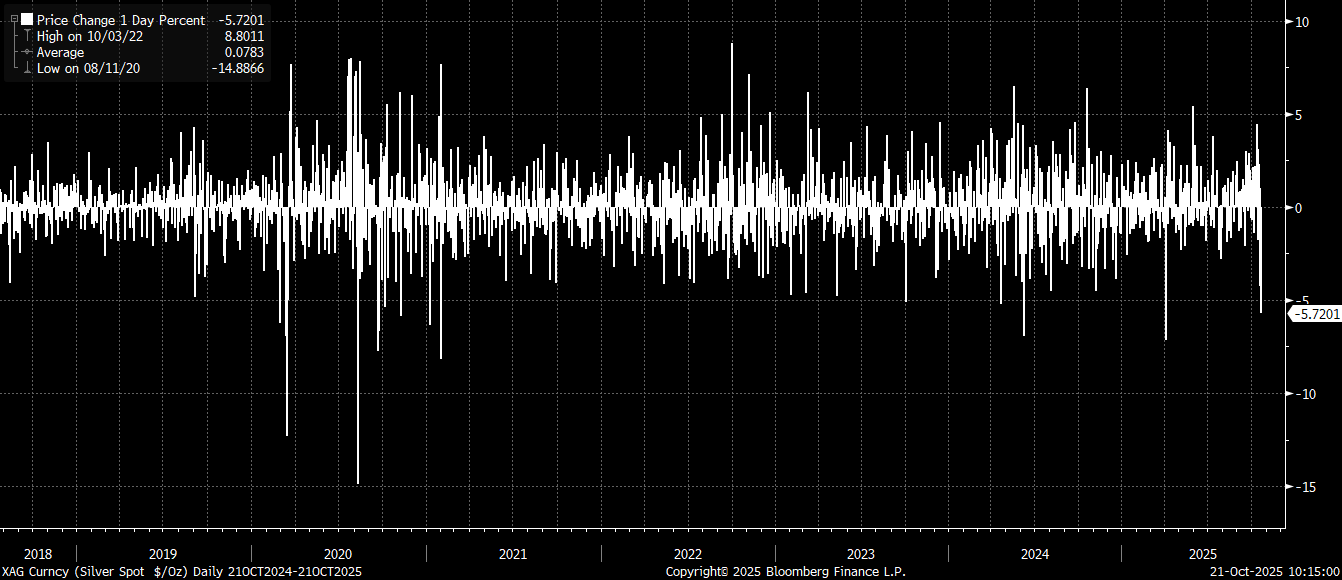

Silver is recording its largest daily decline since April. Historically, movements of this magnitude have been exceedingly rare. Source: Bloomberg Finance LP

The drop in COMEX silver inventories could signify a normalization of the situation on the exchange and the return of some metal to London. Source: Bloomberg Finance LP

Technical Snapshot

The price is retreating significantly today, falling not only below $50 per ounce but also breaching the 2011 peaks. Furthermore, the accelerated upward trend line, initiated in the second half of September, is being broken. Should this correction extend beyond a one-off profit-taking event, the next key support level will be around $47 per ounce, coinciding with the 30-day moving average.

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.