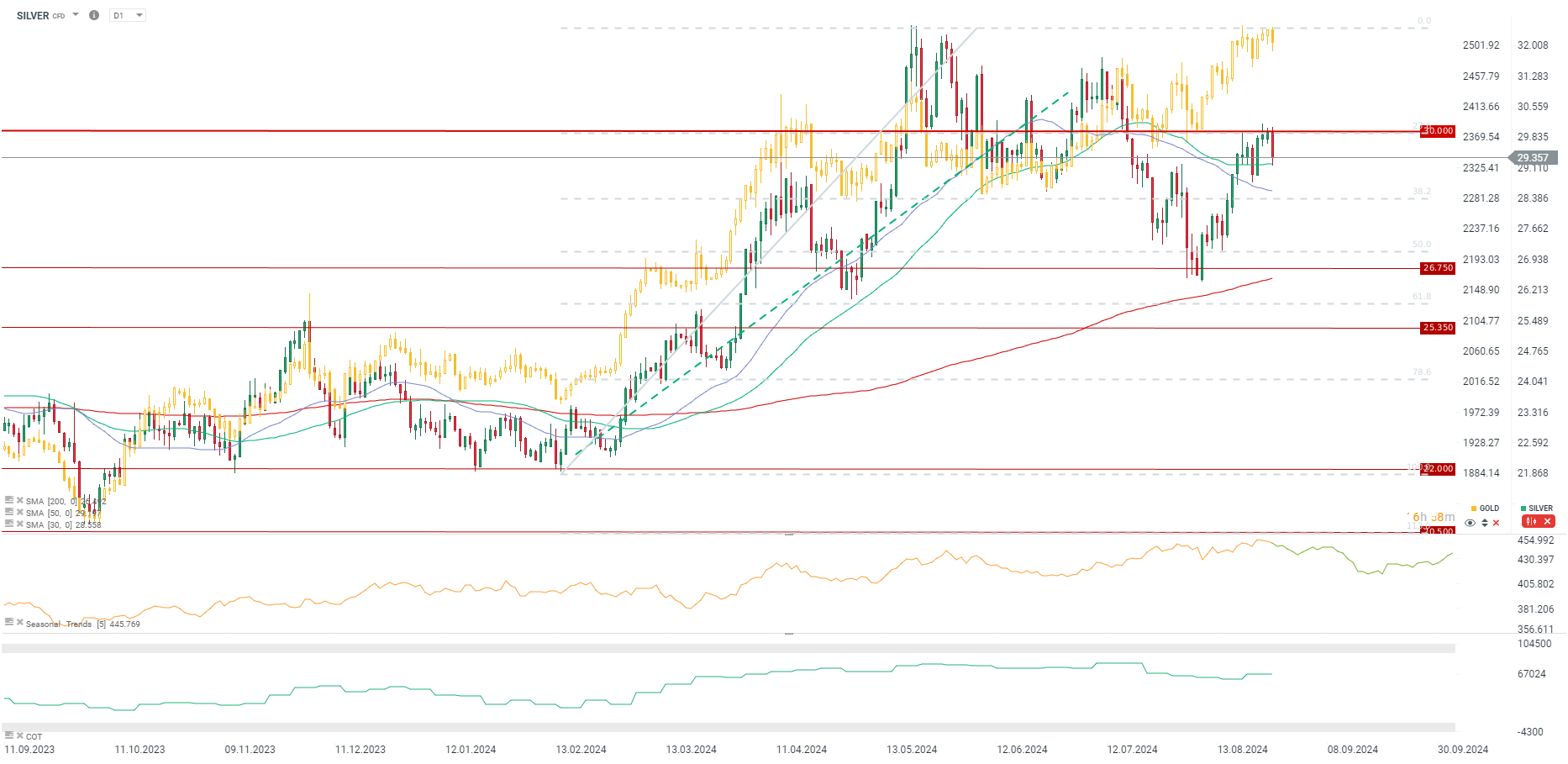

Today, we are observing a strong pullback in the silver market after the metal reached its highest levels in a month earlier this week, briefly surpassing the $30 per ounce mark. Silver is retreating by 2% today, with gold prices also down by 0.7%. Market chatter suggests portfolio rebalancing ahead of the month's end, just before investors return from their summer holidays. Historically, September has been one of the weaker months for both gold and silver. Additionally, the U.S. dollar is stronger today, gaining more than 0.5% against the European currency. The dollar's strength is due to uncertainty surrounding the number of interest rate cuts by the Federal Reserve. The market is expecting as much as a 100 basis point cut and is still giving about a 35% chance of a double cut in September. It is also worth noting that after today's trading session, Nvidia's earnings will be released, which could influence movements in the bond market and, consequently, the dollar. On Friday, we will receive the U.S. PCE inflation data.

Silver is responding positively to the 30-period moving average. Slightly below, around 28.5, is the 50-period moving average. Source: xStation5

The gold-to-silver ratio has once again retreated from the 88-90 range. Nevertheless, such a high ratio suggests that silver is undervalued relative to gold. On the other hand, during a bear market in precious metals, silver typically loses more value than gold, so during a correction, we cannot rule out a return of the ratio to the 88-90 range. However, this year we have seen the ratio around the 72-73 level. The 20-year static average indicates a level of 69-70 as the equilibrium point. Source: Bloomberg Finance LP, XTB

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.