The Solana cryptocurrency is losing another week in a row and is already nearly 94% below its price peak in the fall of 2021, when Bank of America reported that the blockchain would become the 'Visa among cryptocurrencies'. In addition, the pressure is created by speculation about a possible desire to sell off by the largest holders of SOL tokens:

Solana was backed by FTX and Sam Bankman-Fried, since the collapse of FTX Solana has lost almost 60% of its valuation. According to estimates, bankrupt Alameda Research held roughly $1.2 billion in Solana - the tokens were its second largest position. This caused a massive sell-off of the cryptocurrency reserve amid fears of a poorly liquid FTX balance sheet and a possible supply of Alameda Research;

Solana's decentralized Raydium protocol was hacked that week to the tune of about $2 million through the use of private keys by hackers who took funds out of the so-called liquidity pool. According to Decrypt, it is still unclear how the hackers came into their possession;

A number of projects affiliated with the NFT industry, among others, are considering migrating from Solana's blockchain (including NFT exchange MagicEden, cryptocurrency wallet Phantom and NFT-related projects DeGods and Y00ts. The DeGods project and Y00ts will power the blockchain of rival cryptocurrency Polygon starting in early 2023. Polygon's Ethereum-operated blockchain has been selected as the target NFT blockchain by Meta Platforms, Disney, Adidas, Nike and Reddit, among others;

In November, NFT sales of DeGods and Y00ts accounted for nearly 70% of all NFT sales on Solana, according to data from the Magic Eden exchange. Their exodus could be a significant blow to the adoption and popularization of SOL-associated projects;

Nevertheless, on the pages of a recent interview with Blockworks, cryptocurrency creators Raj Gokal and Anatoly Yakowenk reported that they are optimistic about the future and compared Solana's temporary problems to similar such events that affected Bitcoin (Mt.Gox in 2014) and Ethereum (the 2016 DAO hack). Both of these events temporarily halted the growth of both cryptocurrencies.

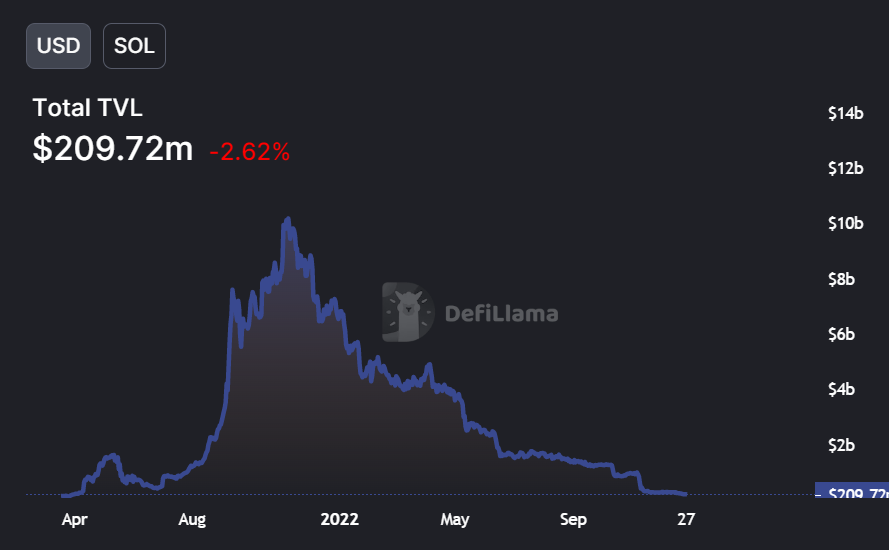

Denominated in U.S. dollars, the value of TVL (Total Value Locked) i.e. investors' funds deposited on Solana's blockchain currently stands at around $209 million versus $10 billion in November 2021. The value denominated in SOL tokens has also declined and approached July 2021 levels. Source: DefiLIama

Solana chart, D1 interval. Solana has lost significantly more than Bitcoin and Ethereum. The price of the cryptocurrency retreated to the levels of February 2021, the SOL TVL deposited on the blockchain at that time, which may be one measure of the blockchain's expansion, was then nearly twice as low as it is now. Source: xStation5

Solana chart, D1 interval. Solana has lost significantly more than Bitcoin and Ethereum. The price of the cryptocurrency retreated to the levels of February 2021, the SOL TVL deposited on the blockchain at that time, which may be one measure of the blockchain's expansion, was then nearly twice as low as it is now. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.