Coronavirus outbreak in China is the key theme for financial markets these days. While it spreads fear across China, market reaction has been limited so far partly because it’s so hard to estimate the consequences. In this analysis we point out at evidence worth tracking as well as the key markets to watch.

A long wait for the data

The most obvious source of information should come from the Chinese government that releases statistics on sales, output and international trade. There are two problems with this. First, markets always were a bit cautious with the Chinese data that looks incredibly smooth. In this particular case the caution might be even greater. Second, the initial impact will be captured in reports for February that will be released between 29 February (the first PMI) and 16 March (output, sales). This is a long wait and investors want to know now.

China is now a much bigger economy than during the SARS outbreak and the initial transport statistics are worrisome. Source: XTB Research

That means they are left with anecdotal evidence and that’s a lot of it. First of all, we’ve heard about closures from many multinational companies like Apple, General Motors, Ikea, Starbucks, McDonald’s or Toyota. 18 Chinese steelmakers from 4 key provinces decided to curb output by 30%. Macau gambling centers were asked to close for at least 2 weeks. Many universities will delay the start of the semester until at least March. The Japanese shopping malls reported a 5-15% y/y sales decline during the Lunar New Year. There’s a lot of evidence, but it’s very hard to generalize it. Perhaps the most striking are the Lunar New Year travel statistics reported by the Transport Ministry. Initial estimates saw railway transport down by around 40% but for the whole 10-day holiday period it deteriorated to -67% y/y and air transport was down by 57%.

Two parameters to track

While there is a lot of evidence flowing from China everyday, the challenge is to put it all together. This is clear in first estimates for the GDP impact that vary from 0.6 to 1.1 percentage points. In our view, investors should focus on two things: infection numbers and production outages. The first assumption that we take is that a spread beyond China will be limited and other economies will not be paralyzed by transport and production limitations. If that assumption fails, the consequences could be dire. If it holds, it will be about returning to normal in China. Watching the number of infections seems to have a lot of sense - if the increase in infection slows down (so far it has not) it will be a sign that the virus could be contained. Production outages are very dangerous for the Chinese economy but also for trading partners. Korean Hyundai already announced a stoppage due to parts’ shortages. Korean economy, while not big, plays an important role in the Asian value added chain. So far the Hubei province faces a stoppage until 14 February while other provinces are supposed to return to work on 9 February. Extension of stoppages would have a meaningful impact and investors should track such information closely.

A shortage of supplies could be very painful for Vietnam and South Korea and trigger a domino effect on the global economy. Source: XTB Research

A shortage of supplies could be very painful for Vietnam and South Korea and trigger a domino effect on the global economy. Source: XTB Research

Markets to watch

The economic impact of the virus will have a global impact and it will affect most of the market in more or less direct way. However, these 4 markets are especially worth watching. All 4 have already seen major sell-off and they’ll likely move sharply depending on the direction of the parameters we discussed above:

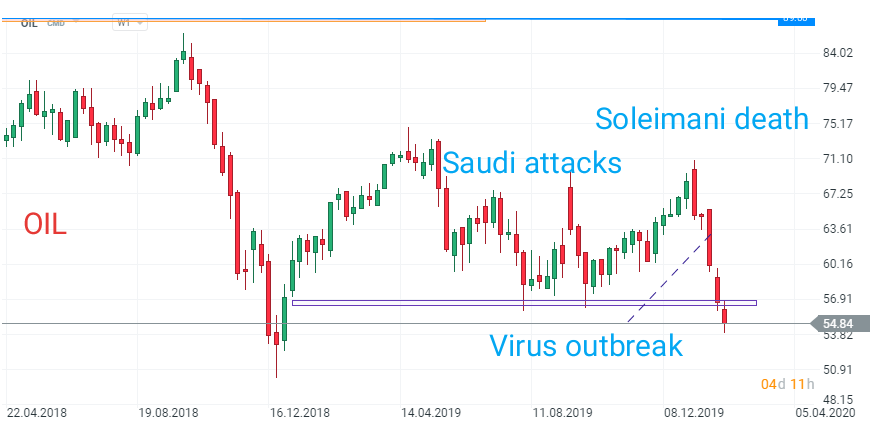

OIL, OIL.WTI - oil prices tumbled heavily as the oil market is very sensitive to changes in balance. China is by far the biggest net oil importer, responsible for more than 20% of global imports. Demand is set to decline on lower business activity and collapse of tourism. This might force the OPEC to consider additional supply cuts.

Copper - the Chinese residential market already looked challenging and if the economy suffers a setback, construction activity can decline and lower demand for copper. China was responsible for around 50% (!) of global demand for copper in 2019 so if this translates into a full-blown economic crisis, prices are set to crater.

CHNComp - profits of the Chinese companies declined by 6.3% y/y in December even before the virus broke out. The index is the most direct exposure to the Chinese economy. Key level to watch in this case is 9800.

KOSP200 - the Korean economy can be badly affected by manufacturing stoppages in China. The Korean market was rebounding nicely as the semiconductor sector started to recover but now this outlook has suddenly darkened. 273 is the key support to watch.

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.