The AI software company C3.ai (AI.US) is one of the biggest beneficiaries of interest in the artificial intelligence. And, as its stock market ticker itself indicates, one of the few companies offering direct exposure to artificial intelligence-based products development. Analysts at DA Davidson described its technology as groundbreaking and compared it to early Microsoft disruptive products. The company has business agreements with technology gignats like Amazon Web Services and Google Cloud, with which it identified more than 350 new business applications in Q4 2022.

The bullish momentum for the company has waned somewhat recently in the face of the AI regulation issues raised in the global debate and the report of the company's shorting fund Kerrisdale Capital, which created the right environment for a dynamic correction. Positive momentum may begin to blow back on the company's stock price again. A general increase in risk appetite, the impending Fed hike cycle, and growing interest in the AI industry could ensure that it attracts new customers and achieves profitability.

What does C3.ai actually do?

The company not only provides its software but also uniquely allows companies to build their own digital products based on AI algorithms. Its flagship product 'Suite' enables estimating the probability of rare events, helps fight fraud, hacking attacks and optimizes supply chains. In addition to Amazon (AWS) and Alphabet (Google Cloud), the company's software customers include such giants as Shell and Baker Hughes, and the U.S. Department of Defense, along with the U.S. Air Force, which only confirms the strength and quality of its products.

Fundamentals

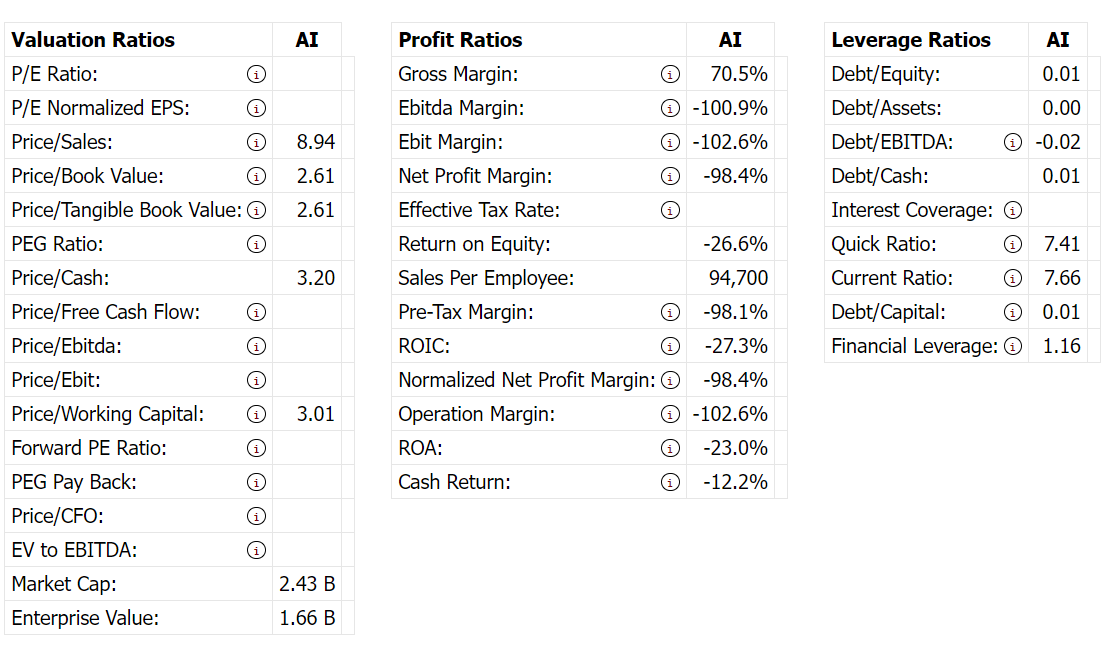

On the fundamental side, a couple of things are thrown up first and foremost. The company is still not profitable and is burning cash. However, its debt is close to zero, its leverage ratio is low, and its 70% Gross Margin means it is able to reinvest 70 cents of every dollar it earns. Its price-to-sales ratio is around 9, its price-to-book-value ratio is 2.7, and the company had 704 employees in 2022 and had not started layoffs. What's more, we can see about 70 new job openings on the company main page, and this year's employee reviews on Glassdoor are mostly very good. Those metrics can indicate that the company is still growing and is a matter of time as will achieve positive cash flows.

Fundamental indicators of the company C3.ai. Source: MarketChameleon

Fundamental indicators of the company C3.ai. Source: MarketChameleon

The most important year ahead?

The company faces a huge challenge because speculative interest and rapid growth will confront its actual business capabilities this year. Analysts will be carefully reviewing financial reports, trying to see how the new trend has translated into financial results. The Q1 report will be released on May 30. The company has issued a relatively conservative estimate, expecting 4 to 5% revenue growth this year which gives plenty of room for growth in case of a positive disappointment. C3.ai's CEO and founder Thomas Sieble indicated that the company has recently seen more interest in products in the business segment. However, the market is particularly keen to see how C3.ai's partnerships with Silicon Valley giants will develop this year.

Low capitalization, higher volatility

The relatively low capitalization means that much less investor interest translates into significant increases (or decreases) in the stock price. Since the beginning of the year, C3.ai shares have risen more than 100%, beating Bitcoin and Wall Street's brightest shining stars this year, Nvidia (up 15%), Microsoft (up 85%) and Meta Platforms (up 30%). The market for companies giving direct exposure to the AI industry is very narrow, and C3.ai is the largest of such companies by market capitalization. This means that anyone who wants such exposure can be interested in the stock - after all, it is not offered by Microsoft or Alphabet (Google), whose involvement in AI ultimately has little impact on revenues and margins. Nor does Nvidia, which could become a leading supplier of high-performance chips for machine learning algorithms, represent a 'pure play' investment in AI. Analysts at DA Davidson have also pointed to an advantage in this regard. However, the condition will be for the company to show that the AI trend has affected new orders and revenues in a real and satisfactory way for the market. The CEO also recently conveyed that the company is gradually moving to a more easily scalable model, where the subprime-based model will no longer be the company's main source of revenue.

Short Squeeze?

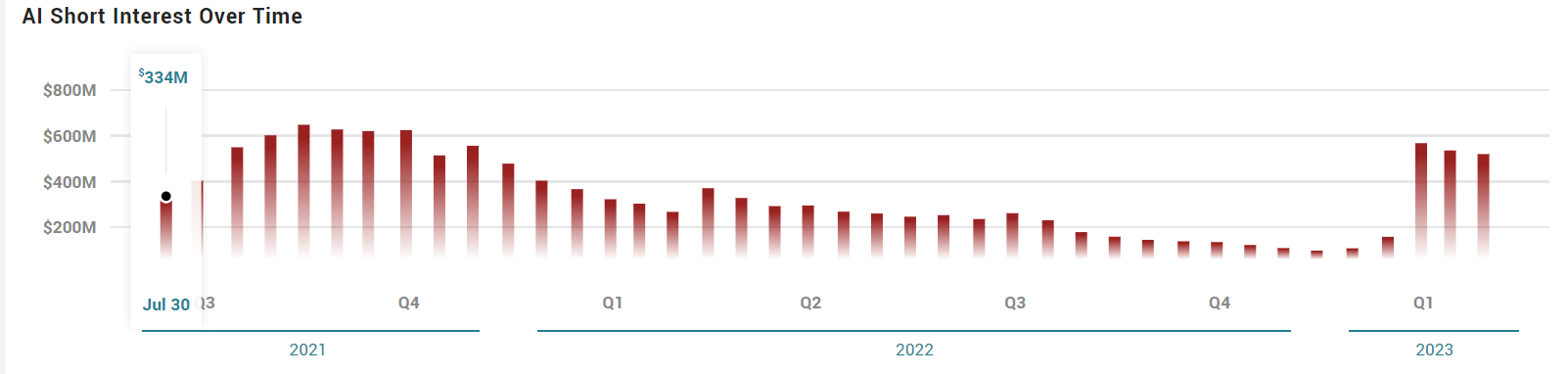

Looking at the amount of short-sold C3.ai (short interest) shares, we can see that the rapid increases in Q1 caused a sudden jump in the amount of shorted shares by speculators. However, the amount of shorted shares has been declining since February. On March 15, 28% of company shares were sold short compared to about 25.5% today. It's still high amount. But the average 'days to cover ratio' near 1.5 shows that a sizable portion of speculators will have to closed their short positions in the coming days and weeks, which may support the bullish scenario of so called short squeeze event. At the same time, it is worth remembering that C3.ai, as a high-risk company, and may be highly dependent on the general sentiment of the market and new technologies.Also informations about wide regulations of AI expantion can weigh on sentiments.

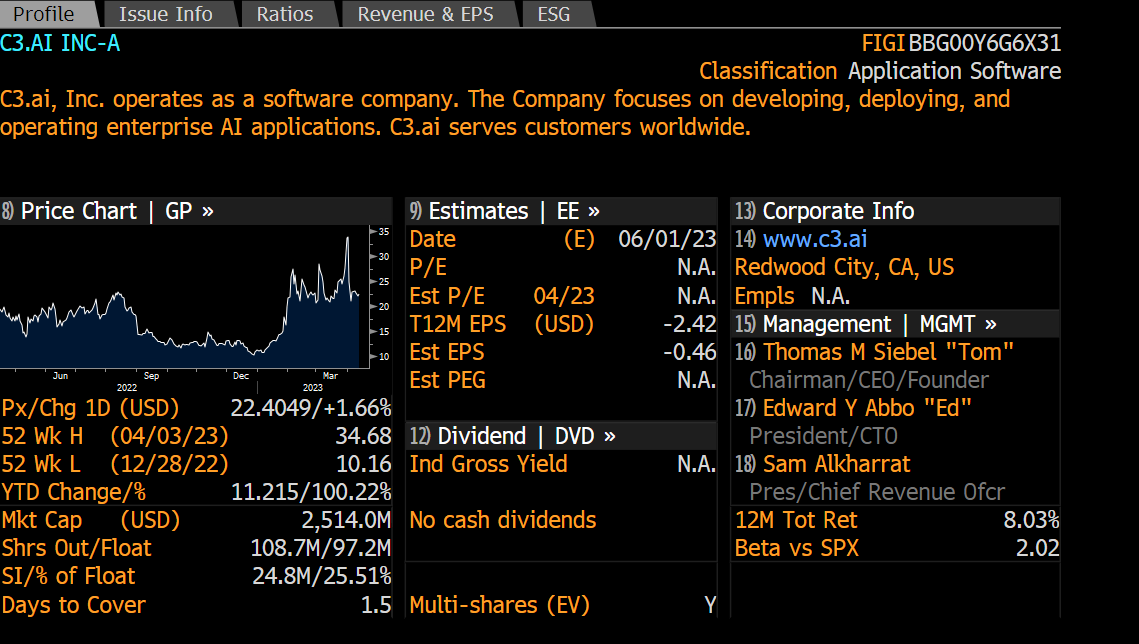

Source: Marketbeat Source: Bloomberg

Source: Bloomberg C3.ai (AI.US) shares, H4 interval. The stock is trading consistently in an uptrend and maintains momentum set by the SMA200 (red line) and the 61.8 Fibonacci retracement of the upward wave, initiated on December 28, 2022. In case of increases, the main resistance level could be the 38.2 Fibo retracement, near $26 per share, and the $29 level, where we see the 23.6 retracement level and previous price reactions. Source: xStation5

C3.ai (AI.US) shares, H4 interval. The stock is trading consistently in an uptrend and maintains momentum set by the SMA200 (red line) and the 61.8 Fibonacci retracement of the upward wave, initiated on December 28, 2022. In case of increases, the main resistance level could be the 38.2 Fibo retracement, near $26 per share, and the $29 level, where we see the 23.6 retracement level and previous price reactions. Source: xStation5

US OPEN: US500 tests record highs as technology sector leads gains

DE40: Regulatory and diplomatic escalations amid holidays

Novo Nordisk - There Were Risks, Now It's Time for Opportunities.

US OPEN: Renewed optimism at the beginning of the week

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.