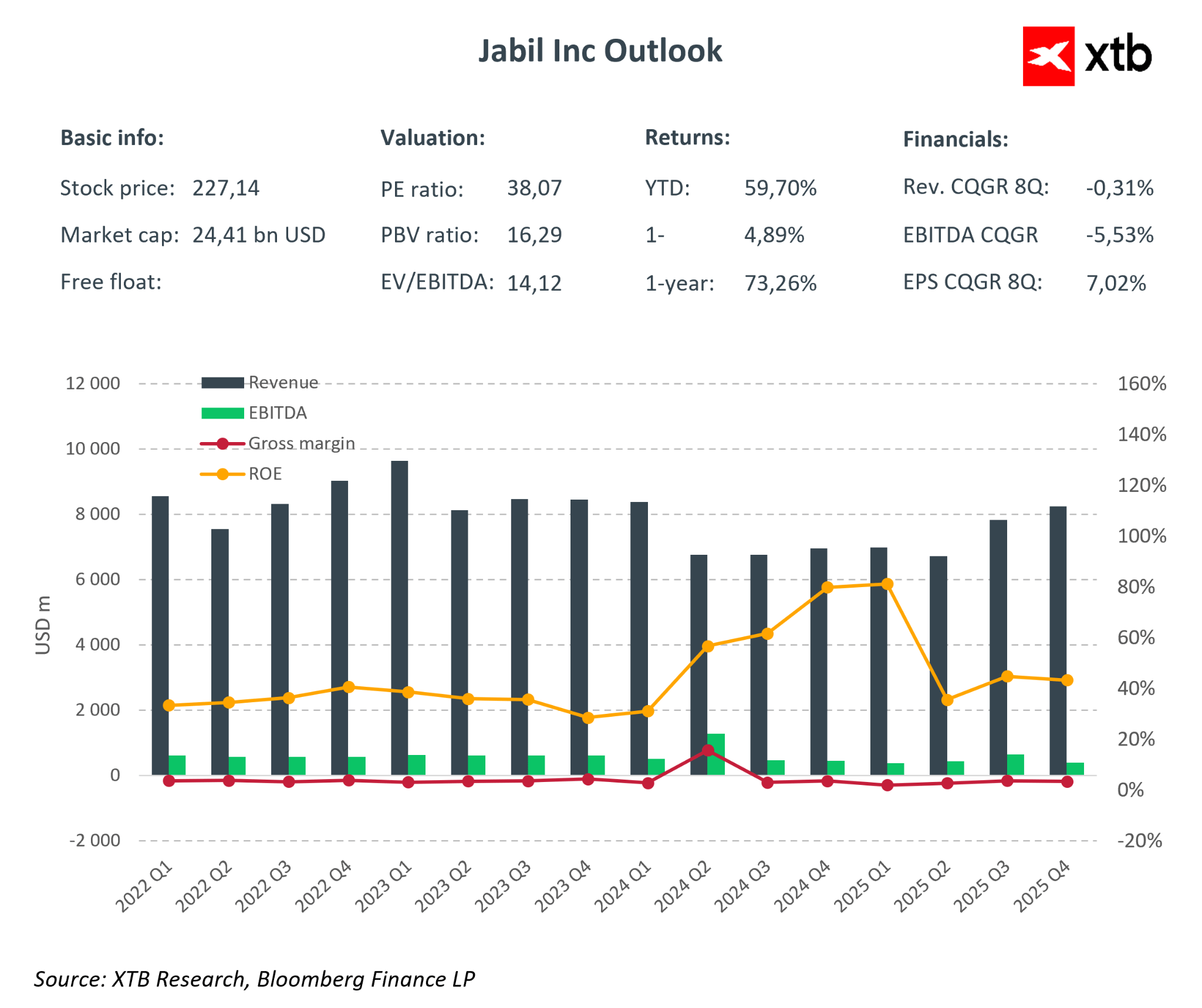

Imagine a company that does not design chips like Nvidia and does not build clouds like AWS, yet plays a key role in the technology boom. Jabil Inc. assembles AI servers, prints iPhone casings, and manufactures electronics for Tesla. Since the beginning of 2025, the company’s stock has risen by 59%, while a valuation of just 14x EV/EBITDA suggests that Wall Street still underestimates Jabil’s role in the explosion of data centers. Jabil does not make headlines, but it is a quiet architect of global tech. Apple, Cisco, HP, and major hyperscalers all rely on Jabil’s factories in 30 countries. In the era of AI and electric vehicles, where demand for GPU servers and automotive electronics grows by 30 percent annually, the company is entering a phase of solid acceleration. Will this invisible player outperform the S&P 500 and become the next favorite of investment funds? Let’s look at the numbers and the equity story that may change the perception of the technology supply chain.

Company Profile

Jabil Inc. is a U.S.-based company specializing in contract electronics manufacturing. The company provides end-to-end services including design, manufacturing, and logistics, supporting its clients at every stage of the product lifecycle. Operating globally, Jabil serves many leading technology firms, delivering components and finished solutions across industries such as IT, automotive, healthcare, and consumer electronics. Growing demand for advanced technologies such as artificial intelligence, electric vehicles, and 5G infrastructure drives the company’s development. Jabil leverages outsourcing trends to help clients optimize production and bring innovations to market faster. Its flexibility, broad range of services, and global presence allow Jabil to maintain a strong industry position and meet the dynamic needs of customers worldwide.

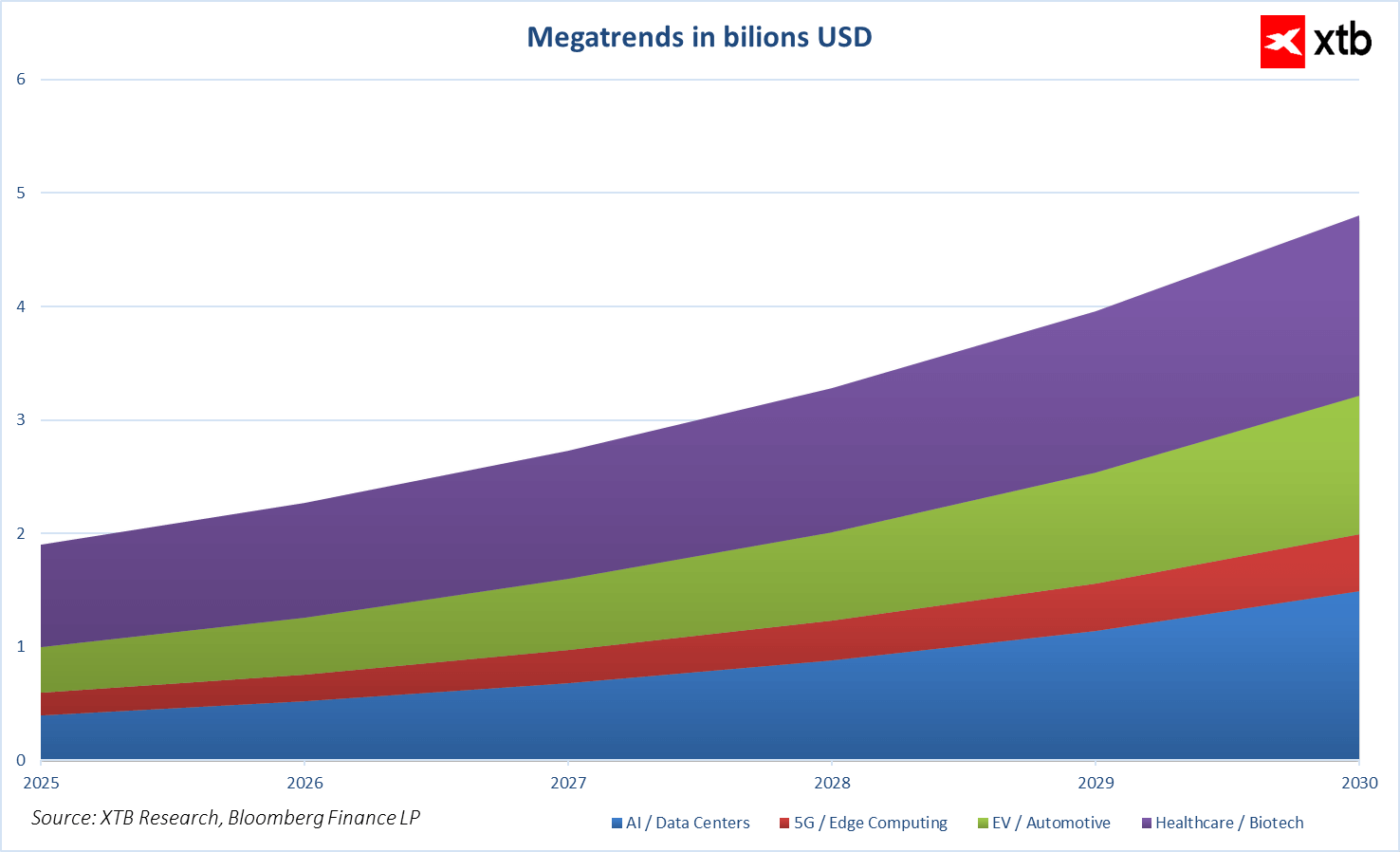

Megatrends Shaping the Company’s Future

Jabil operates within key technological megatrends driving global electronics growth. These include AI and data centers, electric vehicles and automotive, healthcare and biotechnology, as well as 5G and edge computing. The AI and data center market is expanding rapidly, increasing demand for GPU servers and modular data centers, areas in which Jabil is heavily involved. Electric vehicles and related automotive solutions represent another fast-growing sector, including battery module production and industrial robotics, part of Jabil’s offerings. Healthcare and biotechnology segments experience stable and strong growth, where the company provides advanced medical devices and contract manufacturing services for the pharmaceutical sector. Finally, 5G and edge computing support network infrastructure development and warehouse automation, further strengthening Jabil’s relationships with clients such as Apple, HP, and Amazon. The combination of these megatrends provides a solid foundation for Jabil’s revenue and margin growth, making it an attractive company in the electronics contract manufacturing market.

Financial Analysis

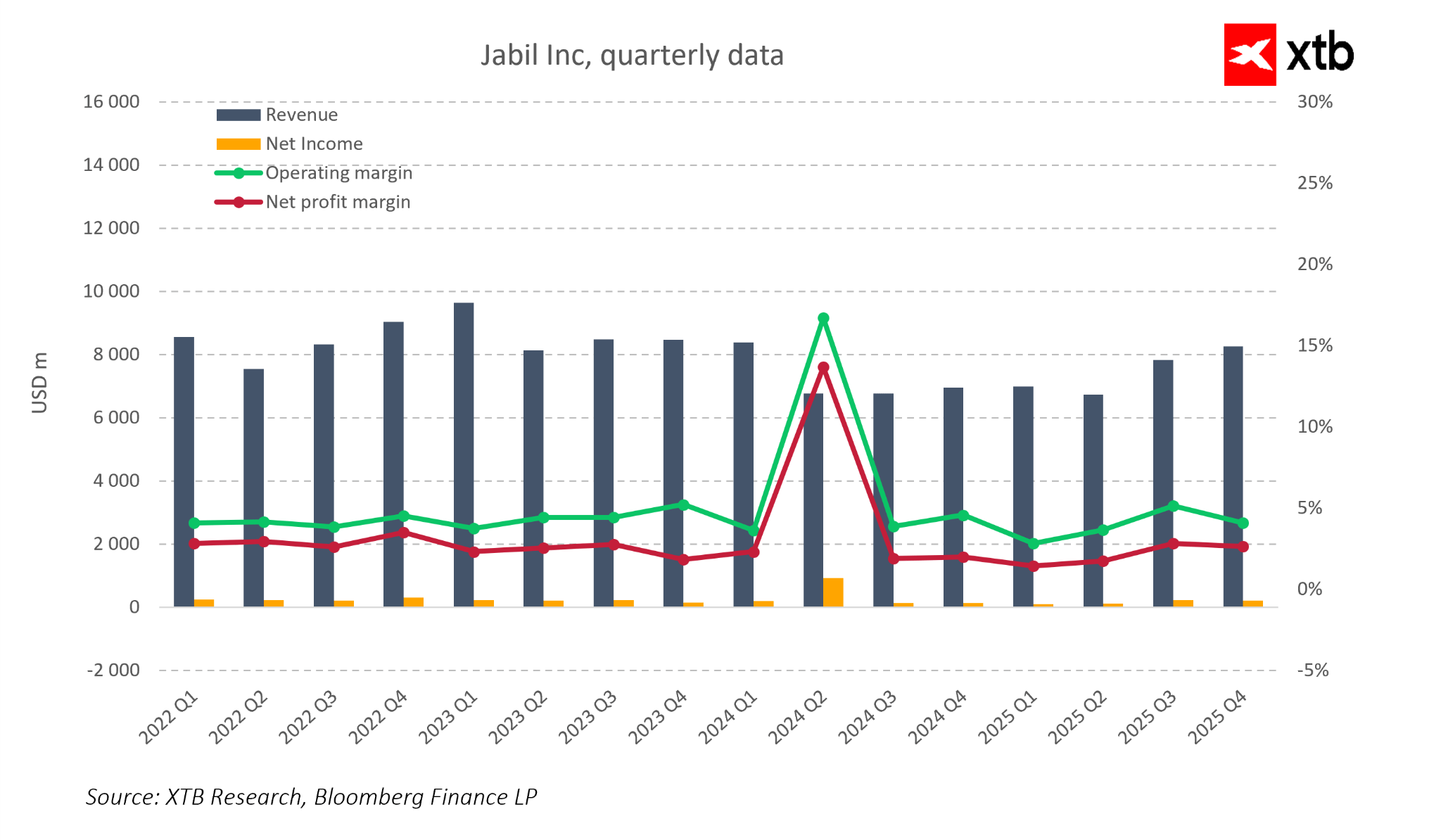

Jabil closes fiscal year 2025 in a very strong operational position. In Q4, revenues reached approximately $8.1 billion, marking a clear rebound after a period of weaker sales. Operating and net margins stabilized at around 4–5% and 2%, following a one-off and unnatural spike in profitability in 2024 due to favorable, non-recurring factors. Business growth is accompanied by improved operational efficiency rather than margin compression.

Particularly noteworthy is the high return on equity (ROE), which has remained in the 30–35% range in recent quarters—a very strong result for such a complex manufacturing business. Combined with solid growth in earnings per share over the past eight quarters, this demonstrates that management effectively converts megatrends, such as AI infrastructure growth, into real value for shareholders.

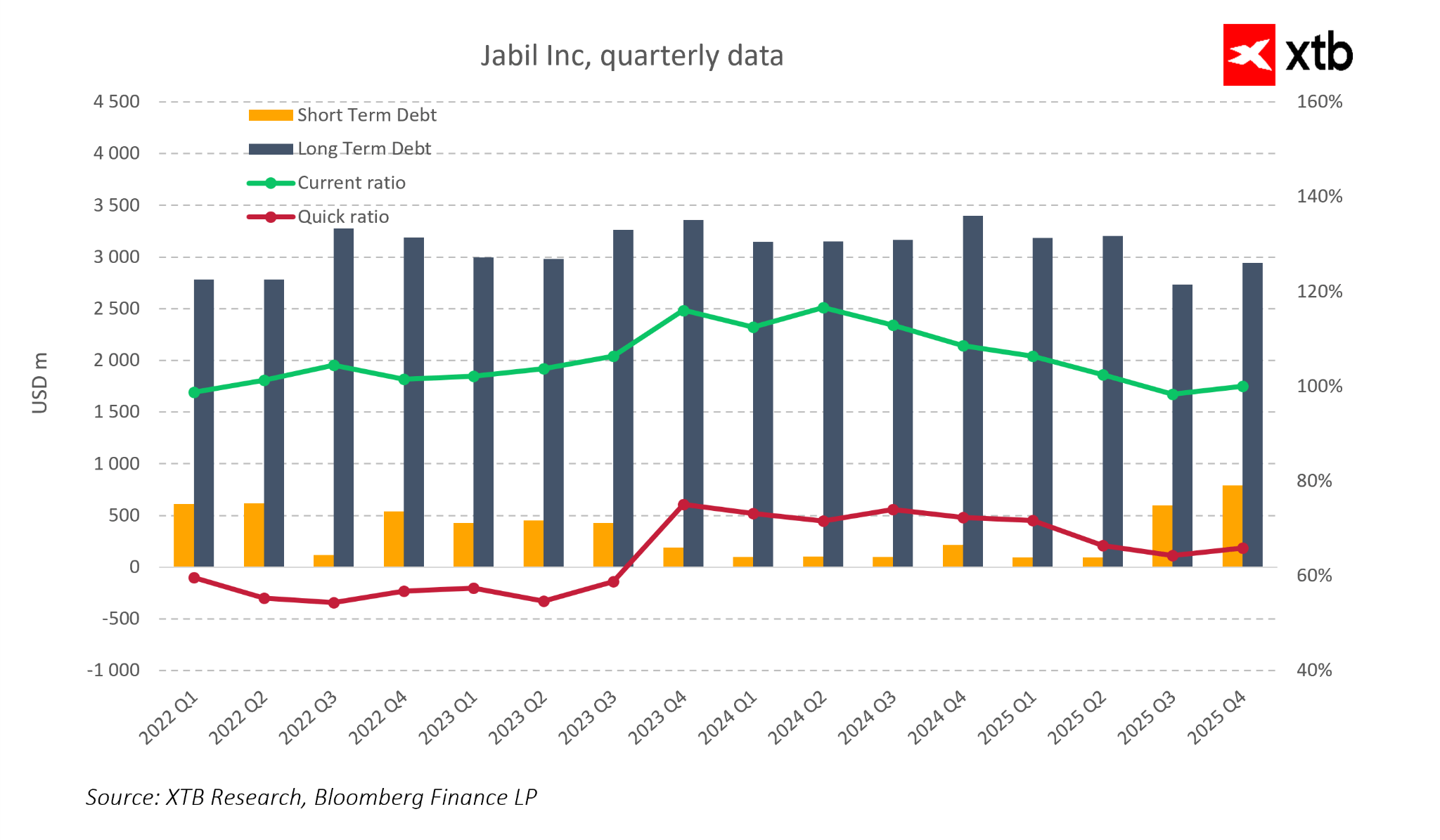

The company’s debt structure indicates that Jabil is entering the next phase of investments with a safe balance sheet. Long-term debt has remained between $2.7–3.3 billion, while short-term debt has only increased in recent quarters, starting from a very low base. The current ratio remains comfortably above 1.0, and the quick ratio has improved compared to 2022–2023, indicating that the company finances strategic growth segments such as AI and data centers from a position of strong liquidity.

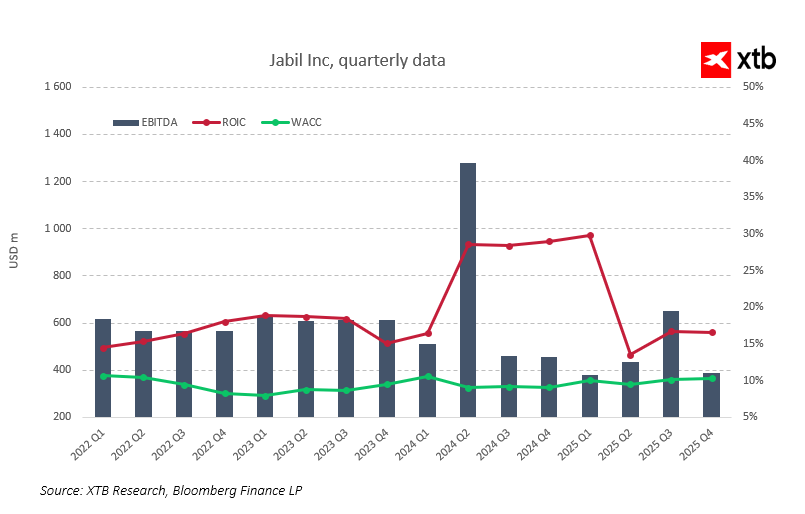

The relationship between generated EBITDA, return on invested capital (ROIC), and cost of capital (WACC) is also positive. ROIC has consistently exceeded WACC, meaning that each additional unit of capital invested generates a return above the cost of financing. Jabil not only grows, but creates real value for shareholders.

The company’s financial results and operational metrics paint a coherent picture of an “invisible architect of the AI boom.” Jabil benefits from rising demand for data center infrastructure and advanced electronics while maintaining a healthy balance sheet, high ROE, and strong liquidity. This combination gives management the space to continue investing in production capacity for AI and allows for an attractive shareholder policy, both through share buybacks and stable long-term cash flows.

Revenue Outlook

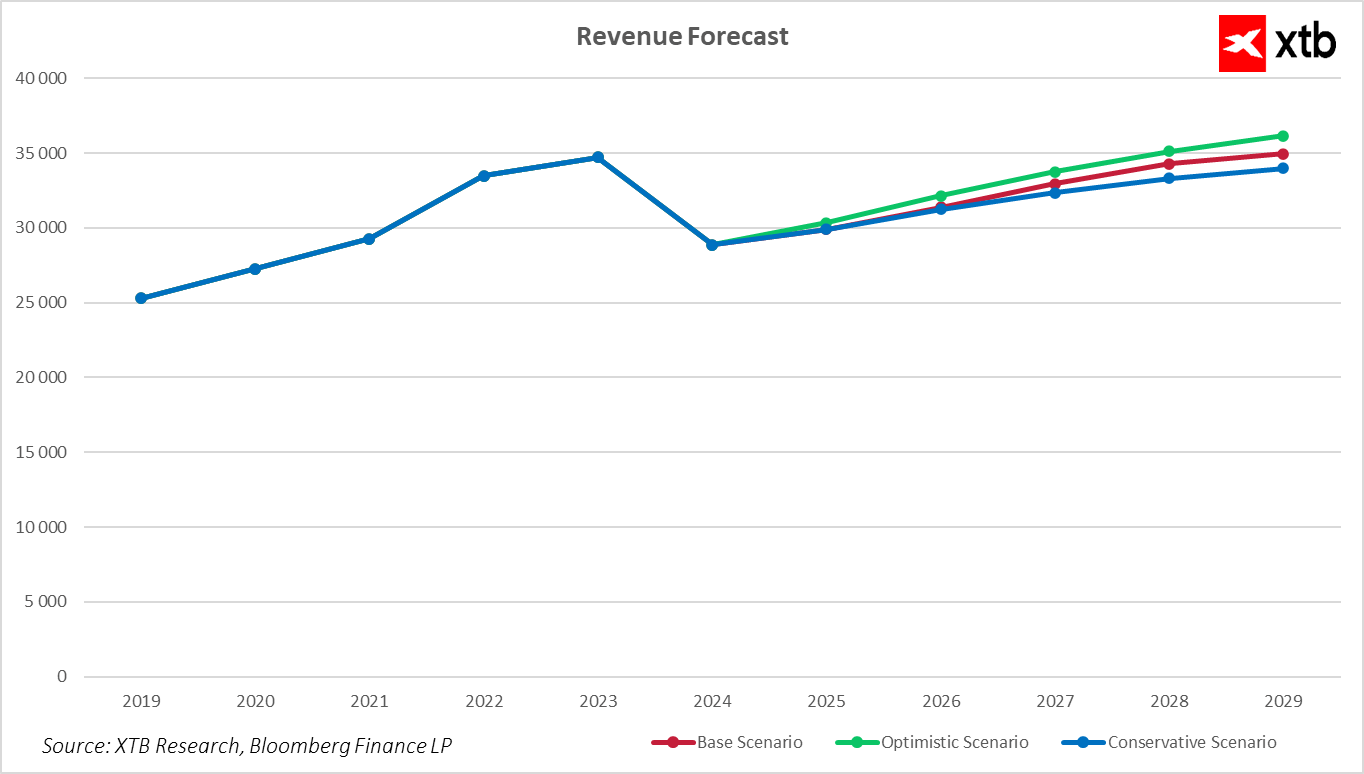

Jabil’s revenue forecasts show that after a temporary setback in 2024, the company is returning to a stable growth path, regardless of the scenario. Jabil enters the next fiscal year with a strong financial position and favorable demand for AI-related technologies, data centers, and both consumer and industrial electronics. Based on historical results from 2019 and observed market trends, three revenue forecast scenarios for 2026–2029 have been prepared, illustrating potential business development under different market conditions.

In the base scenario, Jabil’s revenues grow gradually, reaching approximately $31.4 billion in 2026 and continuing to $34.96 billion in 2029. This scenario assumes moderate, steady demand growth in key segments such as AI infrastructure, automotive, and consumer electronics. The company maintains a balance between expansion and cost control, enabling stable margins and value creation for shareholders.

The optimistic scenario envisions faster revenue growth driven by increasing demand for AI- and data center-related products and the EV sector. Revenues in 2026 could reach $32.15 billion, rising to $36.16 billion by 2029. This assumes effective utilization of production capacity, improved operational efficiency, and strengthened relationships with key clients, allowing accelerated growth without excessive balance sheet risk.

The conservative scenario assumes slower revenue growth, reaching about $31.24 billion in 2026 and $33.97 billion in 2029. This scenario reflects possible demand slowdowns in selected segments or supply chain constraints. Despite slower growth, the company maintains stable profitability and cost control, retaining the ability to generate cash flow and invest in strategic market segments.

Valuation

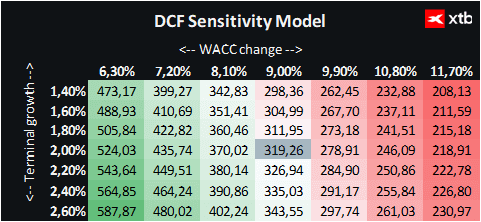

We present a valuation of Jabil Inc. using the discounted cash flow (DCF) method. It should be emphasized that this analysis is for informational purposes only and should not be considered investment advice or a precise valuation.

Jabil Inc. is a global provider of contract electronics manufacturing services, serving the world’s leading technology brands. The company benefits from growing demand related to data center infrastructure, AI, and industrial electronics, providing a solid foundation for further growth.

The valuation is based on the base-case revenue and financial forecast scenario, with a weighted average cost of capital (WACC) of 9% and a conservative terminal growth rate of 2%. Financial parameters are based on average data from recent years, providing a realistic view of the company’s situation.

On this basis, we estimate the value of one Jabil share at approximately $319, representing a potential upside of 41% compared to the current market price of $227.14. This indicates an attractive investment opportunity, especially for investors who believe in the company’s continued growth in AI infrastructure, data centers, and advanced electronics.

The valuation also accounts for market and competitive risks, and the company’s long-term success will depend on maintaining stable growth, effectively managing costs, and converting technological megatrends into real shareholder value.

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Market wrap: European and US stocks try to rebound rebound 📈

Paramount Skydance shares under pressure after S&P warning

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.