Micron Technology Delivers One of the Strongest Earnings Reports in the Semiconductor Sector

Micron Technology delivered one of the strongest earnings reports in the entire semiconductor sector, clearly exceeding market expectations and confirming that the current memory cycle has entered a phase of exceptionally high profitability. Results for the first quarter of fiscal 2026 not only demonstrate significant revenue growth but, more importantly, reveal a qualitative shift in the company’s business structure, driven by the AI boom and data center infrastructure expansion.

Key Q1 FY2026 Financial Results:

-

Revenue: $13.64 billion vs. consensus of $12.8–12.9 billion

-

Non-GAAP EPS: $4.78 vs. expected $3.94

-

GAAP EPS: $4.60

-

GAAP Net Income: $5.24 billion

-

Non-GAAP Gross Margin: 56.8%

-

Operating Cash Flow: $8.41 billion

The revenue level alone confirms that Micron is operating significantly above market assumptions. Surpassing consensus by 6–7% is rare for a company of this scale and clearly indicates strong demand for DRAM and NAND memory. A key driver remains HBM solutions, which are becoming the backbone of AI infrastructure and hyperscaler servers, while also shifting the sales mix toward higher-margin products.

The dynamics of profits and profitability are even more impressive. Micron not only scaled up its operations but did so with a clear improvement in operational efficiency. Margins have returned to historical peaks of the memory cycle, and high operating leverage has translated revenue growth into disproportionate profit growth. This is particularly significant given earlier market concerns about the sustainability of margin improvement in the semiconductor industry.

Operational Performance Dynamics:

-

Revenue: +20.6% QoQ, +56.7% YoY

-

Non-GAAP Operating Income: +62% QoQ, +168% YoY

-

GAAP Net Income: +63.7% QoQ, +180% YoY

-

Non-GAAP EPS: +57.8% QoQ, +167% YoY

-

Operating Cash Flow: +46.8% QoQ, +159% YoY

Such strong improvement across all key income statement and cash flow items confirms that Micron is currently in the most profitable phase of the cycle, where scale and technology begin to work exponentially in the company’s favor.

The segmental growth structure is also noteworthy. While the cloud and data center business remains the main growth driver, improvement is visible across all business units. The rising share of high-value-added products, such as HBM3E and HBM4, combined with production cost optimization, has allowed average gross margins in each business unit to increase by 10–15 percentage points quarter over quarter.

Segment Revenue and Profitability:

-

Cloud Memory Business Unit: $5.28 billion, operating margin 55%

-

Core Data Center Business Unit: $2.38 billion, +50.9% QoQ, margin 51%

-

Mobile and Client Business Unit: $4.26 billion, +13.2% QoQ, margin 54%

-

Automotive and Embedded Business Unit: $1.72 billion, ~+20% QoQ, margin 45%

The highlight of the report is the forward guidance for Q2 FY2026, which significantly raises short-term market expectations for the company.

Q2 FY2026 Guidance:

-

Revenue: $18.7 billion

-

Non-GAAP EPS: approximately $8.42

-

Non-GAAP Gross Margin: 67–68%

Such ambitious guidance clearly exceeds market consensus and confirms that demand for memory, especially HBM, remains structurally higher than supply. Management emphasizes that HBM production capacity for the entire fiscal year 2026 is effectively sold out, providing exceptional visibility into results for the upcoming quarters.

Micron has delivered a report combining spectacular earnings beats, record profitability, and highly aggressive guidance. The company demonstrates that the current memory cycle is structural and supported by long-term AI and data infrastructure growth. Despite risks related to market cyclicality, competition, and geopolitical factors, Micron’s current fundamentals indicate potential for further earnings growth and possible valuation expansion in the coming quarters.

Market Analysis

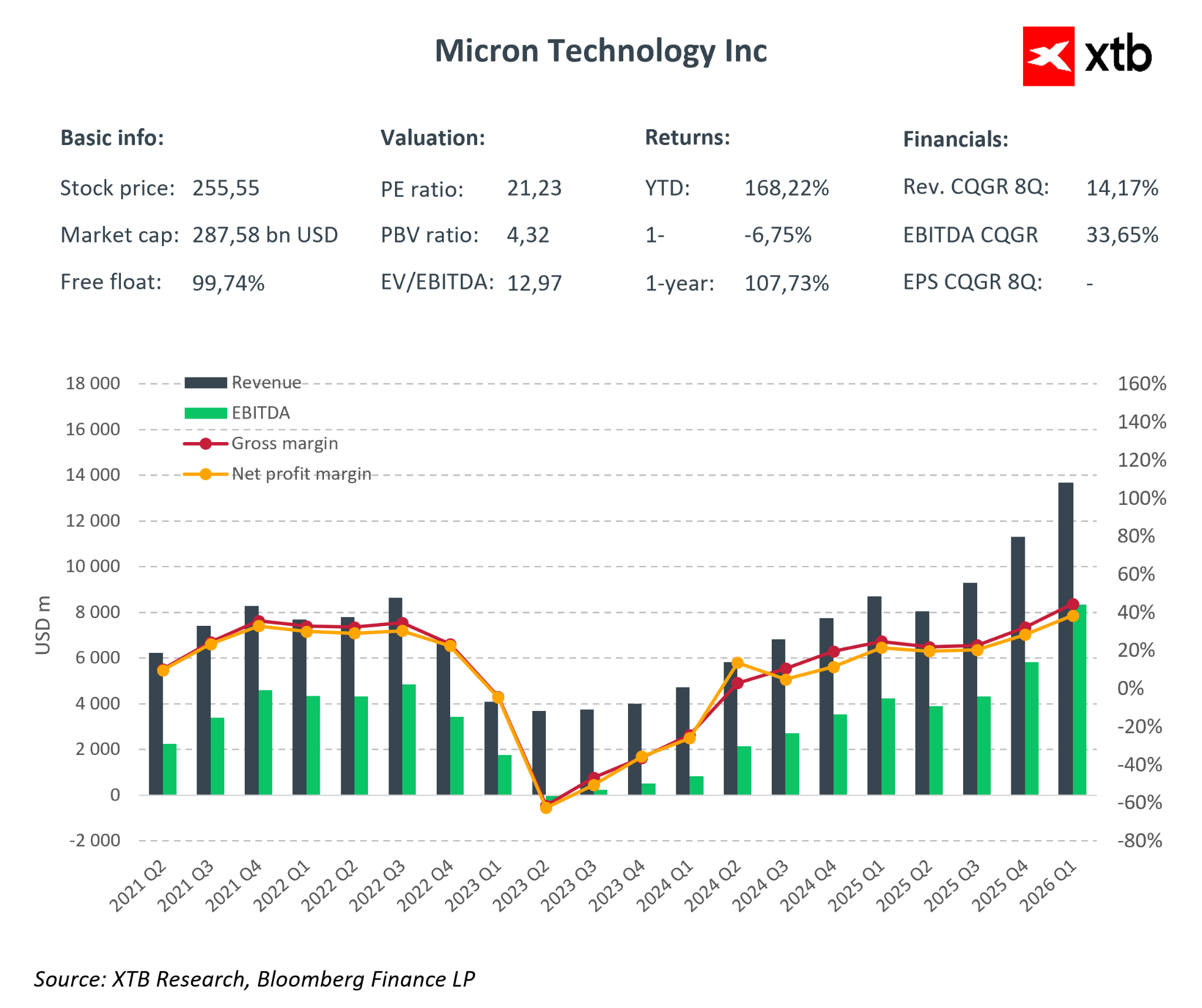

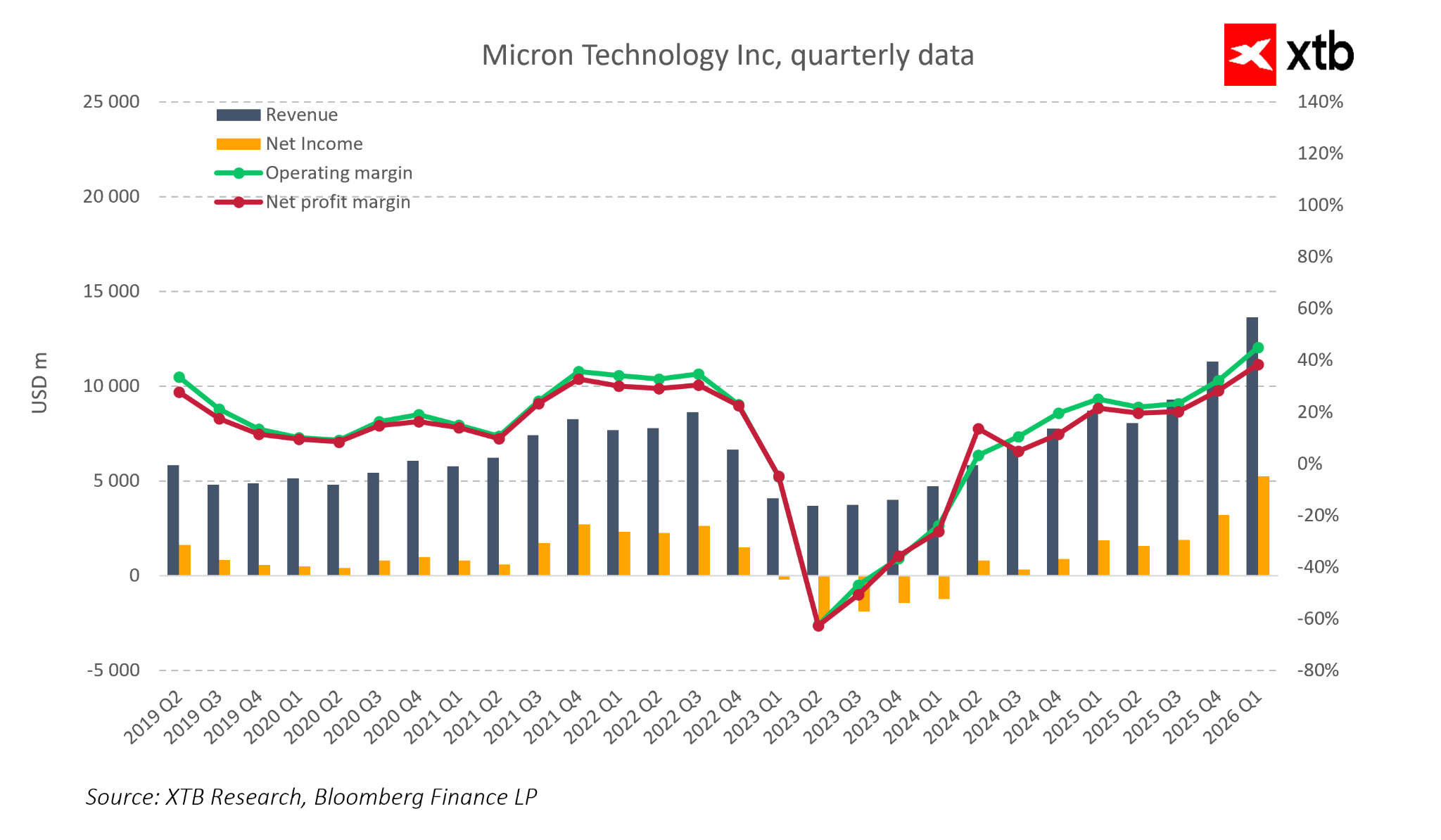

Micron Technology is now one of the most interesting companies in the semiconductor sector. Financial data over recent years show a company that has completed a full business cycle. After a very strong period in 2021–2022, there was a deep downturn in 2023 when memory oversupply and price pressure significantly impacted results. However, Micron emerged from this trough faster and in better shape than in previous cycles, and the current growth phase has much stronger foundations.

The key difference compared to the past is that current growth is not solely based on a rebound in DRAM and NAND prices. This time, the main demand driver is structural trends related to AI development, data centers, and next-generation computing infrastructure. This makes the memory cycle more long-term in nature and less dependent on short-term consumer demand fluctuations.

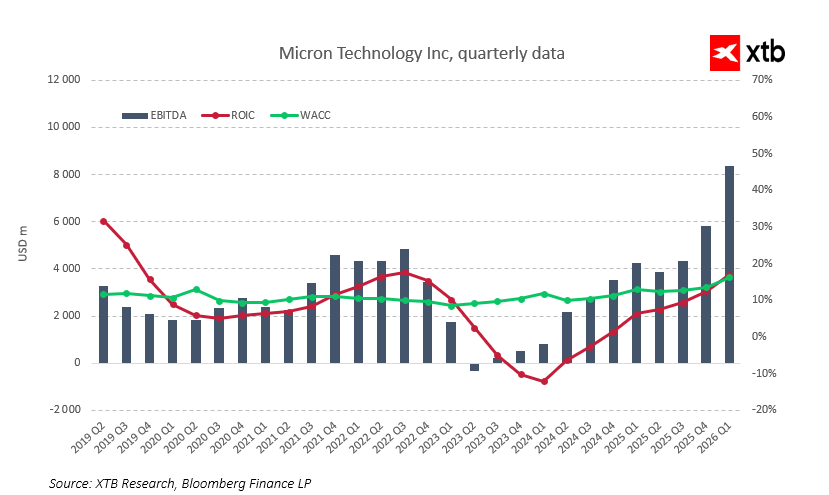

From a performance standpoint, Micron is in one of the best positions in its history. Quarterly revenues increased from around $4–5 billion at the 2023 cycle low to $13.64 billion in Q1 FY2026. Sales growth remains very high, while profitability has improved significantly. Operating margins have recovered from negative levels to around 45%, and net income reached record levels. The scale of EBITDA demonstrates the strong operating leverage arising from demand recovery and a shift in the sales mix.

This improvement is neither one-off nor purely cyclical. Micron now sells more advanced, high-margin products, such as HBM memory and modern DRAM solutions for data centers and AI applications. These are high-barrier, limited-supplier segments with long-term contracts, making revenues more predictable and resilient to short-term economic slowdowns. Consequently, the company is far less vulnerable to abrupt cycle downturns than it was a few years ago.

From an industry perspective, it is also important that the current cycle began after a deep market "clean-up." In 2023, producers significantly cut investments, reduced inventories, and disciplined supply. As a result, AI-driven demand now meets a market not flooded with excess production capacity. This supports the maintenance of high prices and margins over a longer period and increases the likelihood that the current growth phase will be more extended than in the past.

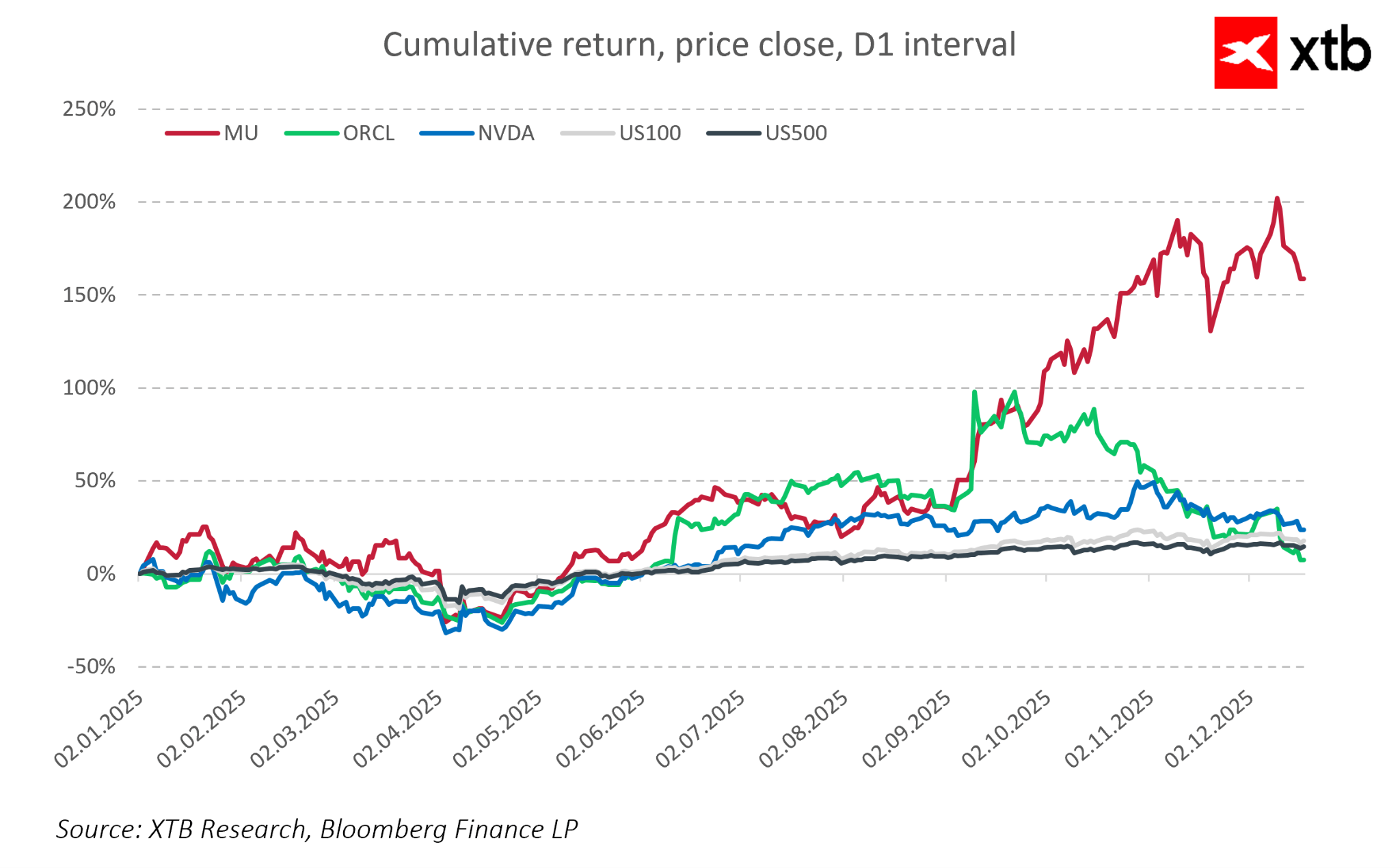

From a market perspective, Micron’s stock has recently outperformed broad U.S. indices and is increasingly compared to AI trend leaders such as NVIDIA. Investors are beginning to view Micron as one of the few “pure” beneficiaries of the AI boom in memory. At the same time, while the valuation is significantly higher than at the cycle low, it remains relatively attractive compared to GPU manufacturers, suggesting that some of the upside potential from further earnings growth may not yet be fully priced in.

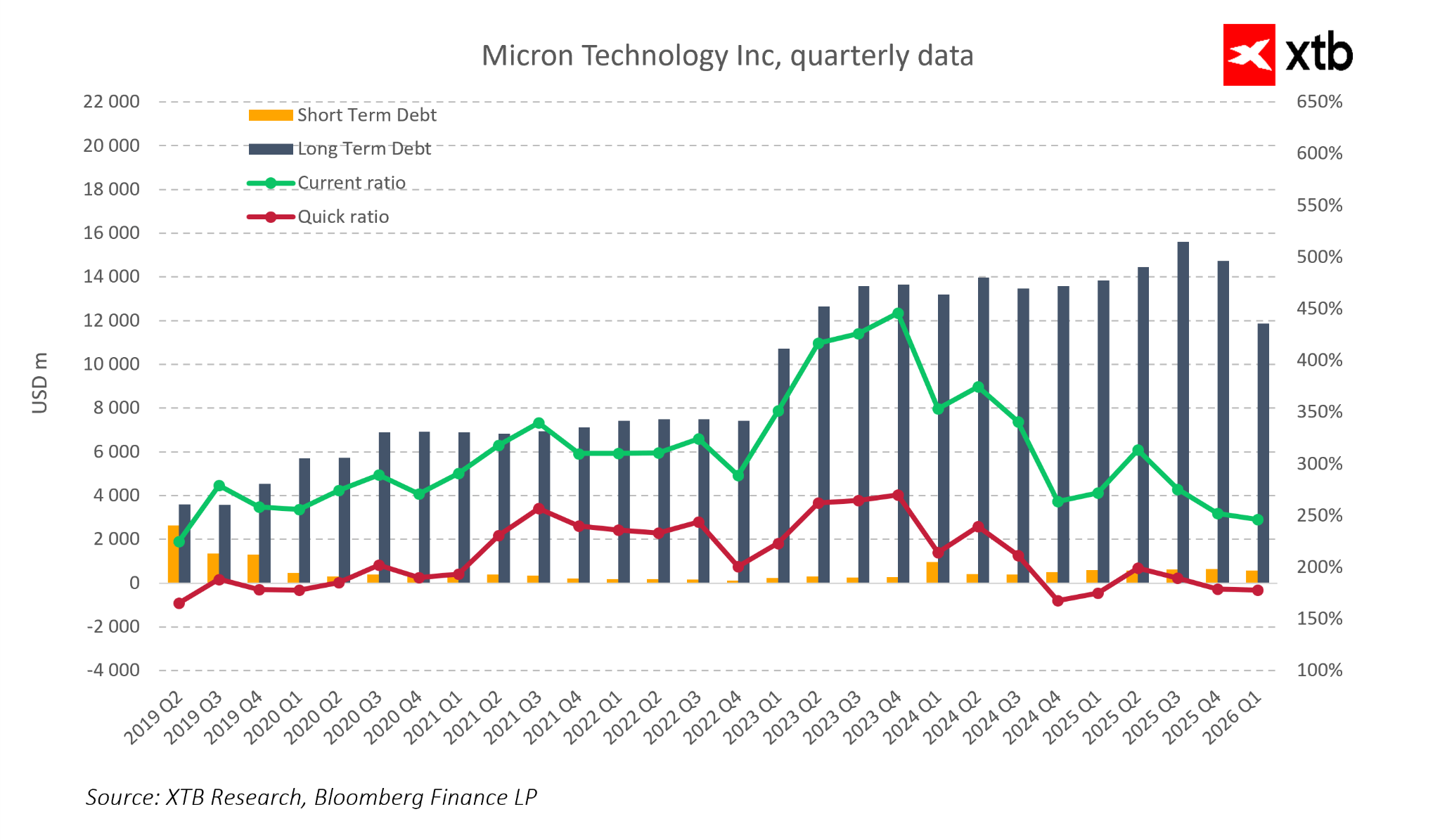

The company’s financial position is also strong. Micron maintains comfortable liquidity, and the debt structure remains under control, providing significant flexibility for further growth. This is particularly important in the semiconductor industry, where technological advantage requires ongoing high investments, and a weak balance sheet can quickly become a strategic constraint.

Revenue Forecasts for the Coming Years

Micron Technology enters the next phase of its development with a strong position in the semiconductor memory segment and growing significance in AI and data center infrastructure.

Demand for memory used in AI and data centers is expected to continue rising, even if more cyclical segments, such as PCs or smartphones, grow more slowly. Limited supply and high entry barriers in the HBM segment support above-average margins. At the same time, improved business quality and a stronger financial structure enhance the company’s resilience and support continued value growth.

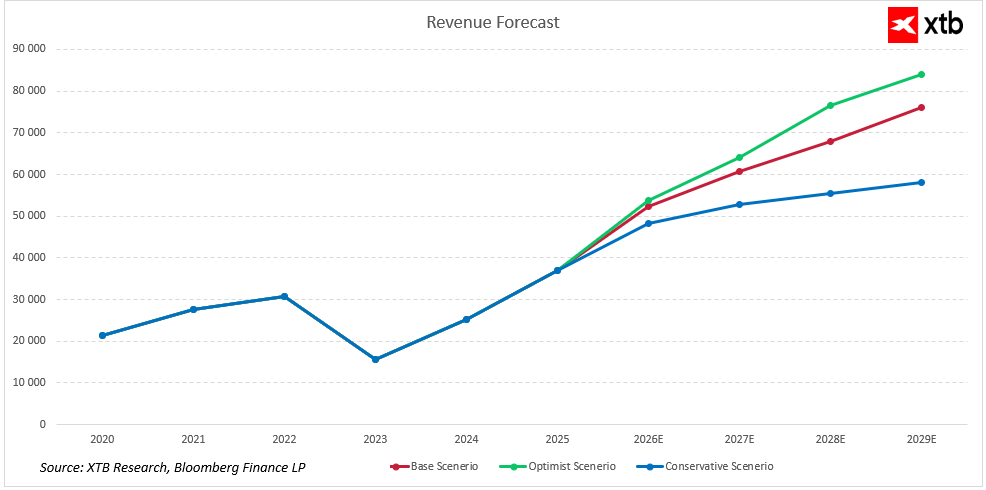

Revenue forecasts indicate further steady expansion, driven by structural trends, growing share of advanced DRAM and HBM memory and products for data centers and AI infrastructure. Even in a more conservative scenario, sales remain on an upward trajectory, demonstrating the company’s resilience to consumer cycle fluctuations and typical memory price swings.

Different growth scenarios reflect market potential and investment dynamics in AI infrastructure. The optimistic scenario assumes faster expansion as volumes increase while maintaining a favorable product mix, while the base scenario anticipates steady growth with stable profitability. Key factors include Micron’s technological edge, high entry barriers in HBM and DRAM segments, and long-term contracts with hyperscalers and data center operators.

Valuation Perspective

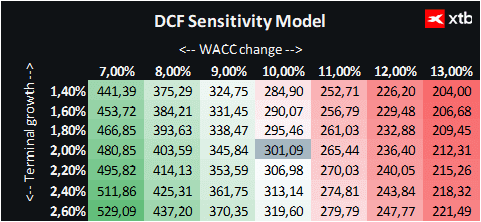

For Micron Technologies, we used a discounted cash flow (DCF) approach. This analysis is for informational purposes and does not constitute investment advice or an exact stock valuation.

The model assumes dynamic revenue growth, primarily driven by DRAM and NAND memory segments, which form the foundation of the company’s business. In the early forecast period, growth is particularly strong, fueled by rising demand for advanced memory solutions, especially in AI, data centers, and mobile devices.

Further growth prospects are supported by technological innovation, including the introduction of next-generation memory, which enhances Micron’s product performance and capabilities. At the same time, the semiconductor memory industry remains highly cyclical, and fluctuations in demand and competitive pressures from major players such as Samsung and SK Hynix represent material risks that could affect revenue and margin stability.

The valuation model assumes a weighted average cost of capital (WACC) of 10% throughout the forecast period, reflecting the sector’s characteristics and Micron’s moderate leverage. The terminal value is based on a conservative revenue growth rate of 2%.

Based on this analysis, Micron Technology Inc is valued at $301.09 per share, above the current market price of $255.55. Current conditions and forecasts confirm that Micron occupies a particularly favorable position in the semiconductor cycle. The company combines classic cyclical rebound characteristics with a long-term growth trend driven by AI and modern data center expansion.

At the same time, it is important to remember the cyclical nature of the market and competitive pressures from major players, which may affect short-term performance and valuation. Assessing valuation in a broader context allows one to integrate the company’s financial fundamentals with market trends and its technological potential.

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China

US Open: Wall Street in Blood

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.