Nvidia has long been one of the most important players in the world of artificial intelligence. The company, which started in the gaming market, now accounts for a significant portion of the global computing infrastructure powering the latest generative models as well as solutions used in science and industry. Its chips drive data centers, research labs, and enterprises building advanced AI systems.

The latest financial results for the third quarter of fiscal year 2026 confirm that demand for AI accelerators continues to grow. The data center segment has not only strengthened its lead but also demonstrated Nvidia’s ability to scale operations without compromising quality and performance. The company is simultaneously developing entire technology ecosystems, including software, networks, and platforms that enable the creation and training of complex models at scale.

This report analyzes the most recent quarterly data, discusses developments across each key business area, and highlights the main factors that may influence the company’s future. Before we take a broader look, let’s start with the key financial figures for the third quarter of fiscal year 2026.

Outstanding results for Q3 2026

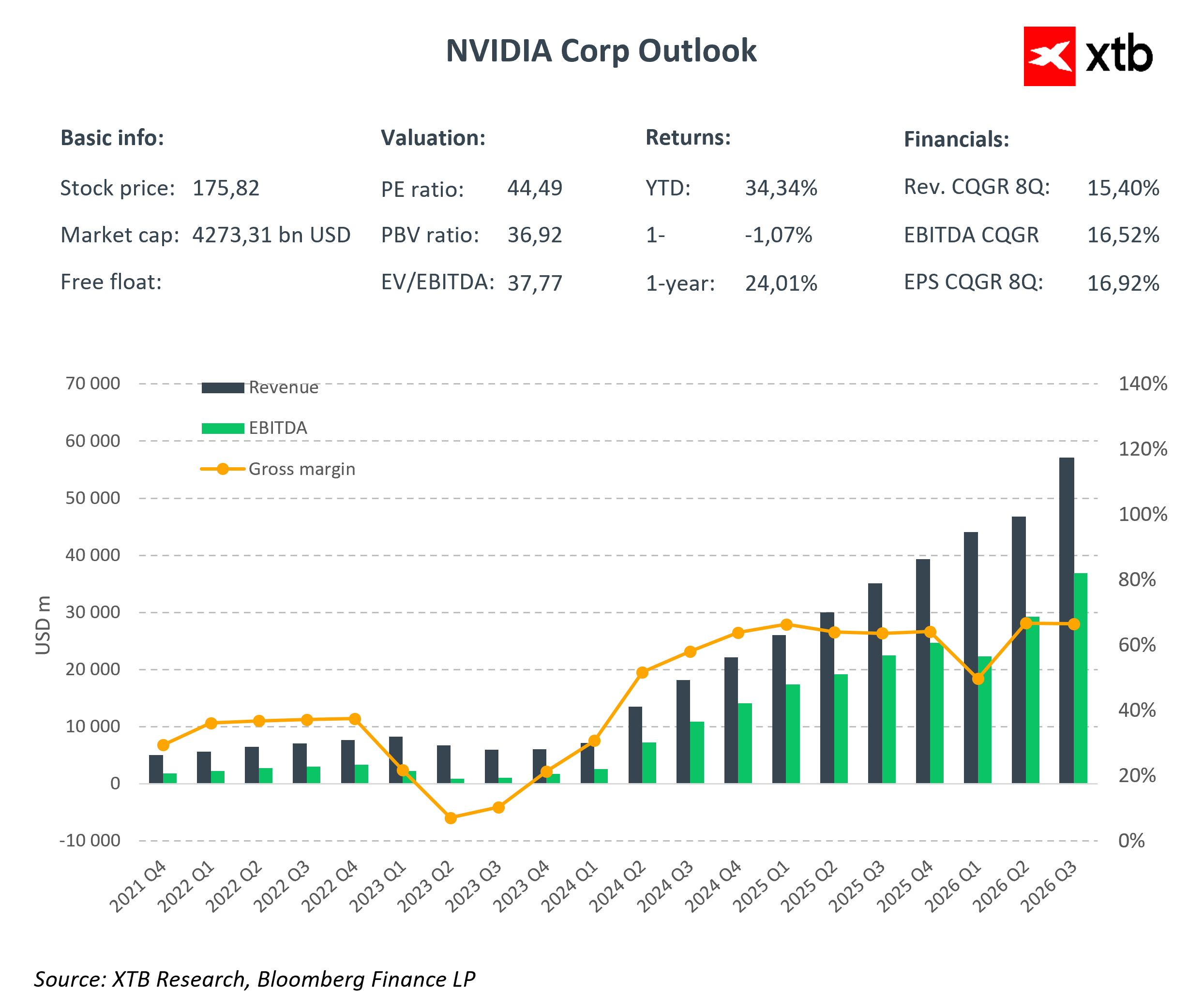

Nvidia once again proved its crucial role in AI development by posting revenues of 57 billion USD in Q3 2026. This represents a 22% increase over the previous quarter and a 62% year-over-year growth. Such growth is not just about scale; it clearly demonstrates Nvidia’s dominance in the global digital transformation.

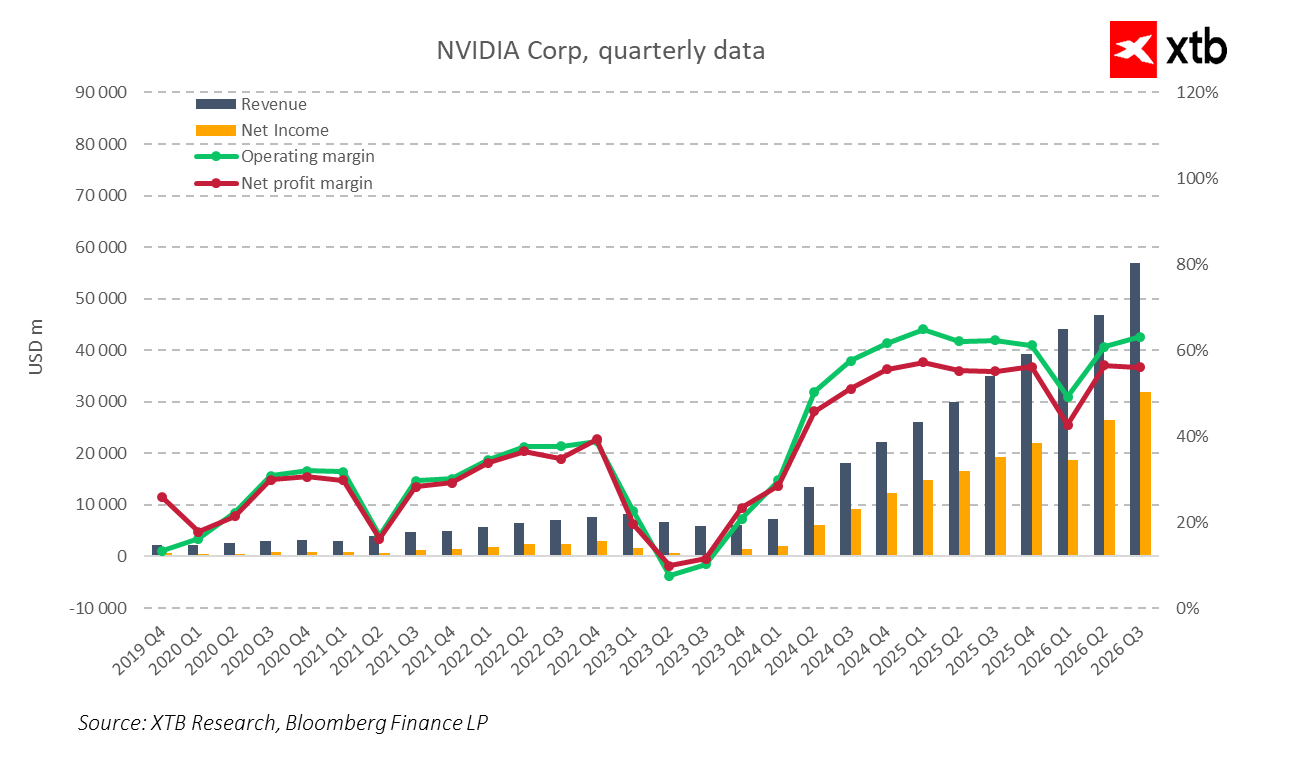

Gross margin remains very high at around 73.4%. Despite heavy investments in research, development, and operational expansion, the company effectively converts revenue into profit. Operating expenses, including R&D and administration, totaled 5.839 billion USD, while operating income reached 36 billion USD. On a net basis, Nvidia generated nearly 32 billion USD, translating to earnings per share of 1.30 USD. This result exceeded analyst expectations and shows the company’s ability to generate strong cash flows even amid macroeconomic uncertainty.

The main growth driver remains the data center segment, with record revenues of 51.2 billion USD. This is driven not only by increasing demand but also by the innovative Blackwell GPU architecture, which combines high performance with energy efficiency, and strategic partnerships with major players in cloud and AI industries. This solidifies Nvidia’s position as the foundation of global AI infrastructure. The gaming segment also holds a strong position, generating 4.3 billion USD in revenue, reflecting a balanced business model that combines consumer innovation with the data center business.

For the next quarter, Nvidia forecasts revenues around 65 billion USD while maintaining high margins, demonstrating its ambition not only to sustain but also to strengthen its dominance.

The company’s success is not based solely on recent results. Analysis of recent years shows consistent outperformance of market expectations in both revenue and earnings per share. Before Q3 2026, forecasts projected revenues of about 55.2 billion USD and EPS of 1.26 USD; the actual results exceeded these estimates. This consistency reflects the company’s stable and sustainable growth and its ability to operate effectively in a rapidly evolving tech sector. This builds investor confidence and underscores Nvidia’s role as one of the pillars of the global technological revolution.

Quarterly financial data confirm the company’s impressive growth. Revenues have grown dynamically since 2023, reaching record highs. Net profits are also approaching 32 billion USD. Stable and high operating and net margins indicate effective cost control and operational efficiency.

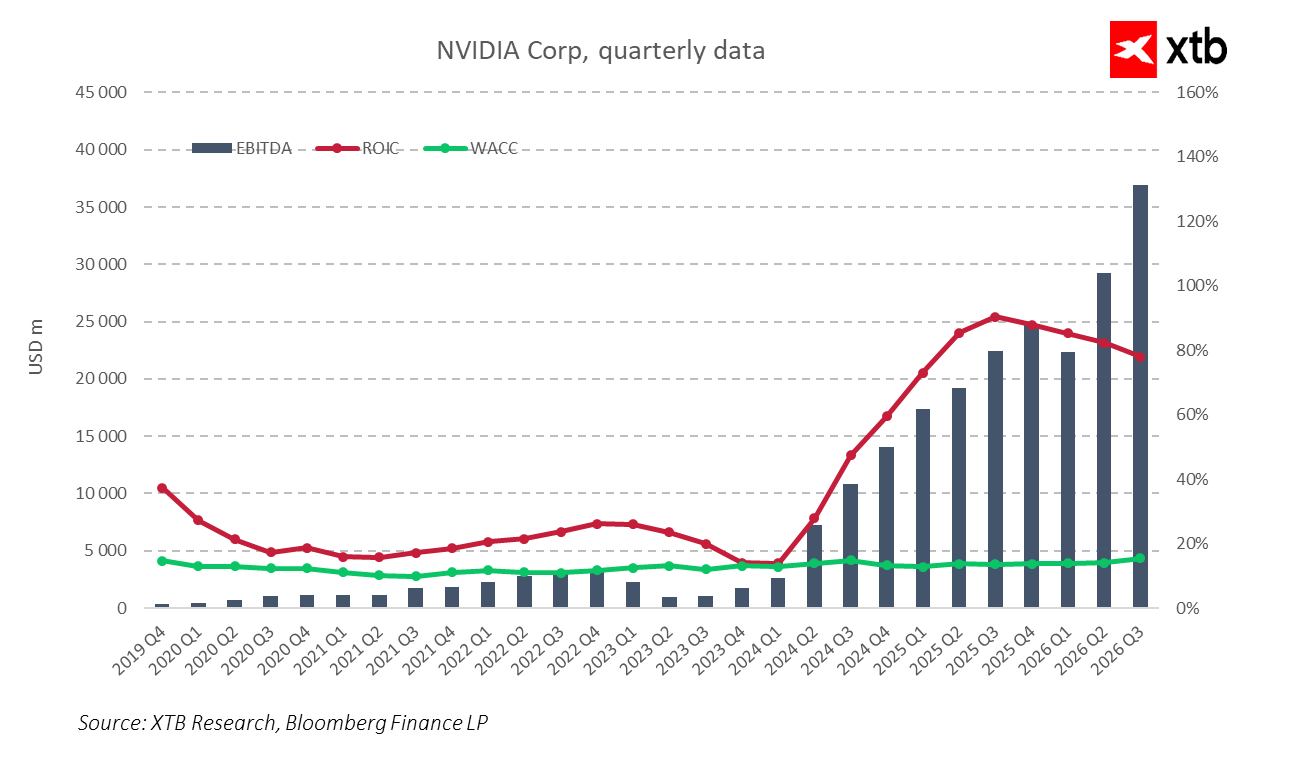

EBITDA is growing rapidly, surpassing 37 billion USD in Q3 2026. The return on invested capital remains above 80%, indicating exceptional resource management efficiency. A relatively low cost of capital highlights a strong competitive position and the ability to generate value for shareholders. This combination of growth, profitability, and efficient management forms a solid foundation for further development and leadership strengthening in the industry.

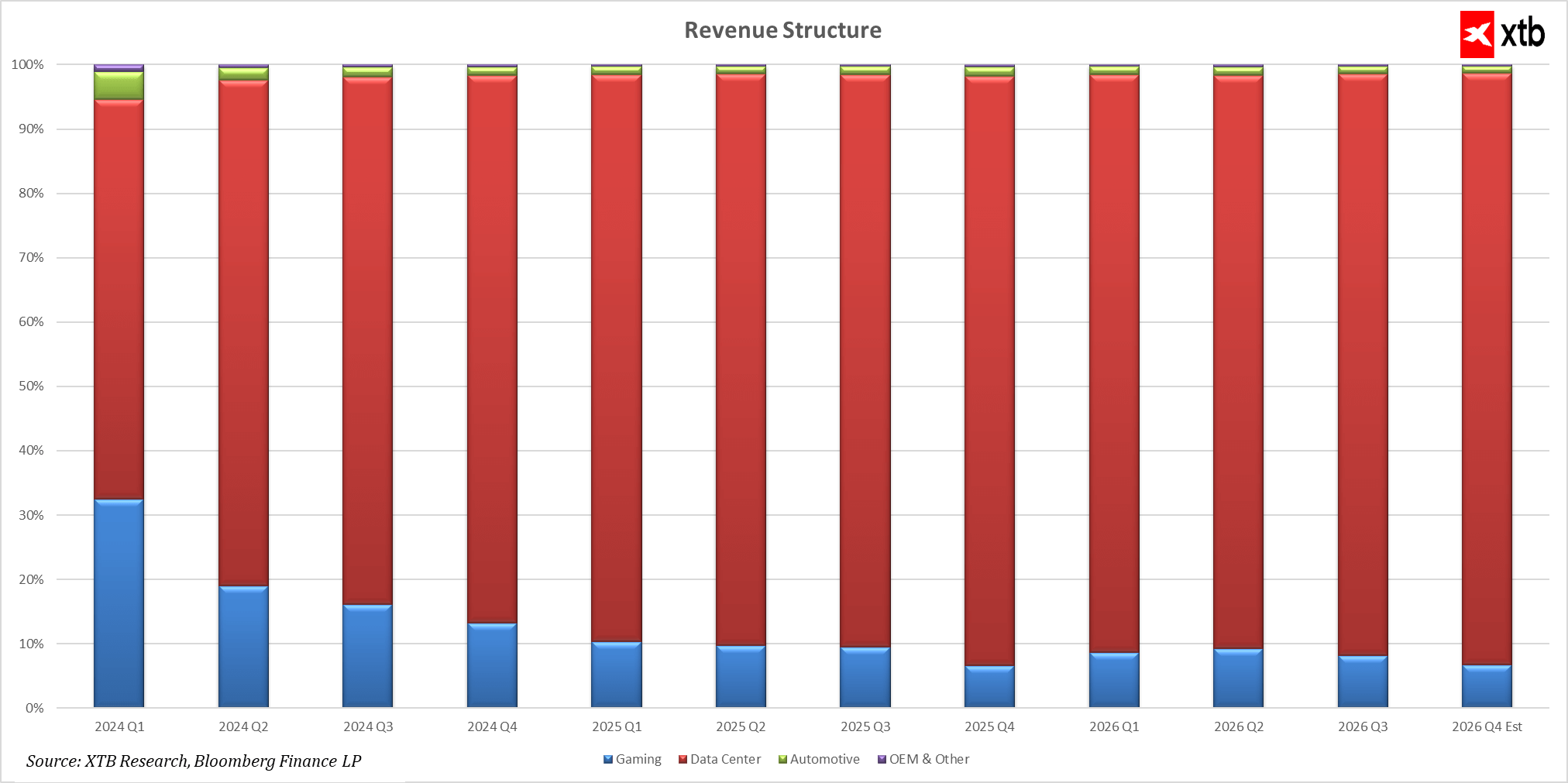

Nvidia consistently strengthens its position mainly through rapid growth in the data center segment. Since early 2024, revenues in this area have increased at an impressive pace, achieving several hundred percent year-over-year growth in consecutive quarters. This segment generates the majority of the company’s revenues and is forecast to grow to over 56 billion USD by the end of 2026.

The gaming segment, while more volatile, is recovering from declines earlier in 2024 and continues to contribute significantly, with revenues projected at around 4 billion USD by the end of 2026. The automotive segment is also growing steadily, developing from just under 300 million USD to over 680 million USD, with fluctuations indicating rising interest and investments. Other areas, such as OEM and others, though smaller, also show solid growth and increasing importance for overall operations. Together, these trends demonstrate Nvidia’s effective revenue diversification, strengthening its leadership in digital transformation and AI.

Valuation overview

We analyze Nvidia’s valuation using the discounted cash flow (DCF) method. It is important to emphasize that this analysis is for informational purposes only and should not be considered investment advice or an exact stock price forecast.

Our projections assume an average annual revenue growth rate in the double digits, estimated at around 40 to 60 percent over the next few years. In subsequent years, the revenue growth rate will gradually decline due to market saturation and increasing competition.

The Blackwell GPU architecture is becoming a key element of Nvidia’s strategy for the coming years. The latest chips have received enormous interest, significantly exceeding the company’s initial expectations. Blackwell drives the global AI hardware boom thanks to its exceptional performance and its role in training and deploying the most advanced AI models. It is this architecture that helps Nvidia maintain a dominant position in the data center and latest chip segments, which fuel the company’s further dynamic growth.

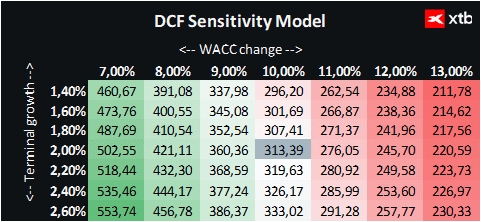

Our valuation also incorporates a weighted average cost of capital (WACC) estimated at around 10%, reflecting current market conditions and the tech sector’s specifics. Nvidia has a moderate level of debt, which is managed effectively, so the cost of debt has a limited but meaningful impact on the overall capital cost. We assumed a terminal growth rate of 2%, with other parameters based on averages from the last five years.

Based on these assumptions, Nvidia’s valuation stands at approximately 313 USD per share, indicating a growth potential of about 78% compared to the current market price of around 175 USD. The current valuation may not fully reflect the company’s value and growth prospects. Nvidia faces the opportunity for further dynamic expansion driven by rising demand for cutting-edge AI, data center, and gaming solutions, as well as successive generations of the Blackwell architecture gaining global recognition.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.