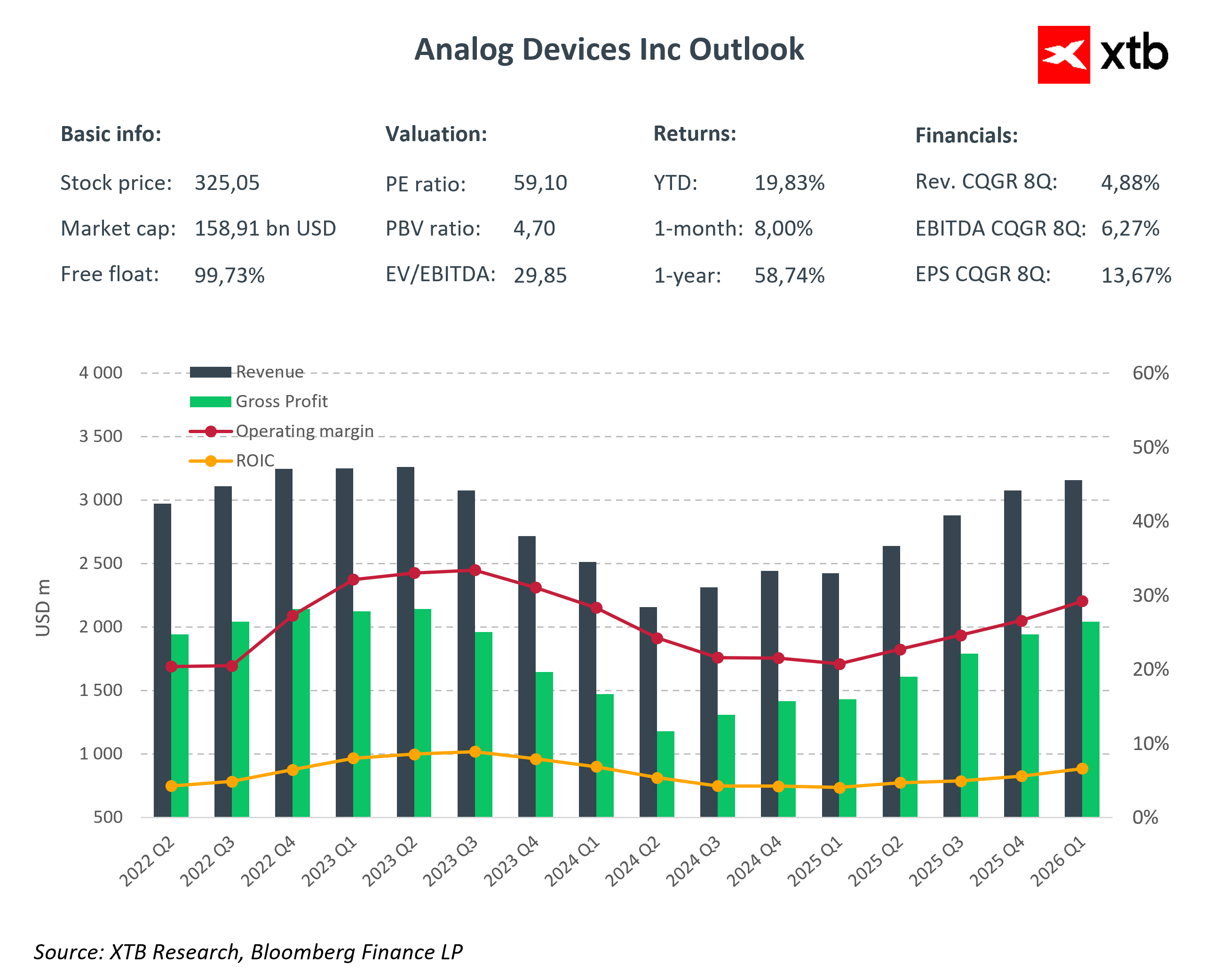

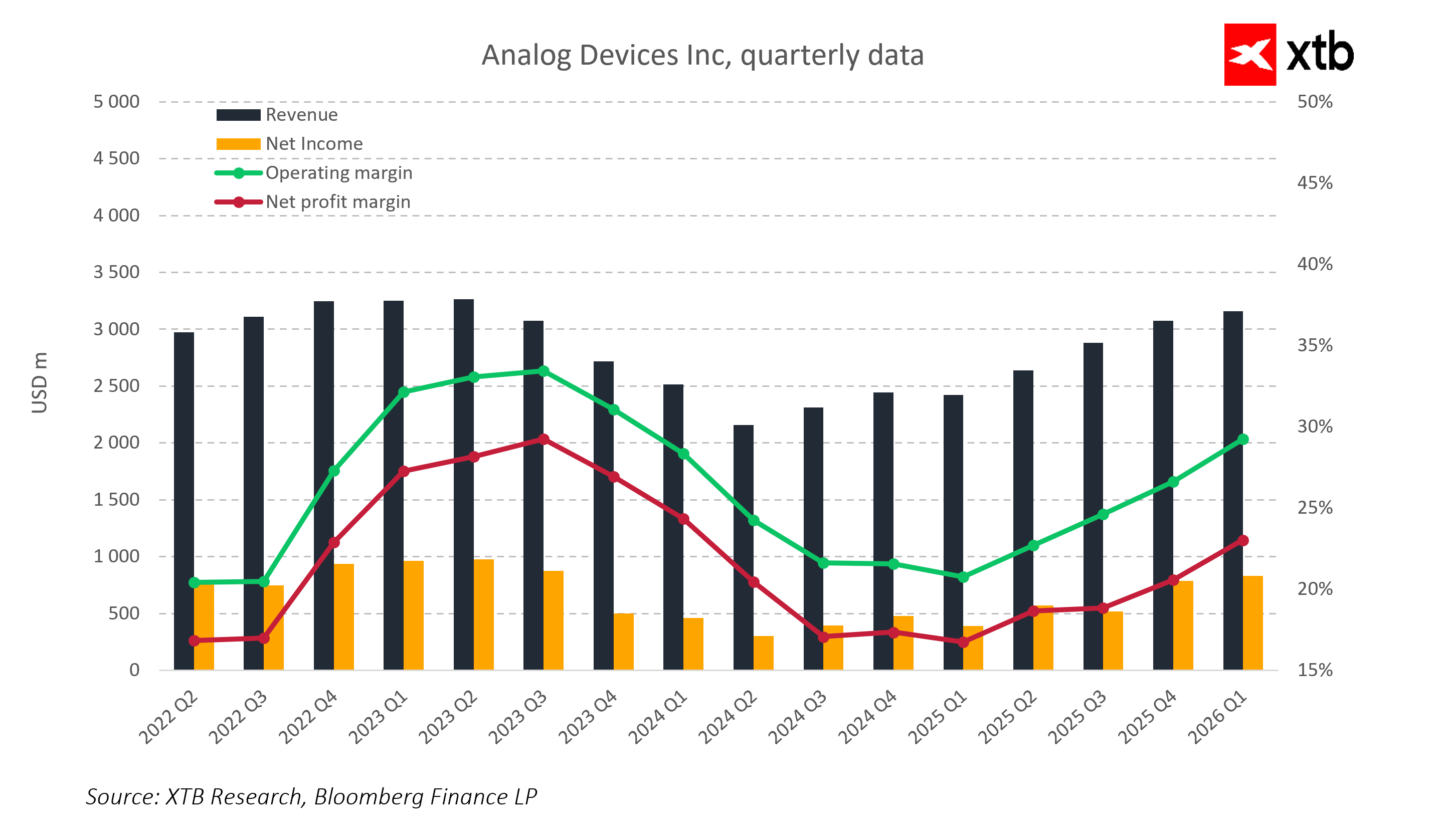

Analog Devices, a global leader in analog semiconductors and industrial solutions, reported fiscal first-quarter 2026 results that significantly exceeded market expectations. Second-quarter guidance also came in above analyst consensus, underscoring the company’s strong positioning across key industrial, data center, and AI infrastructure segments.

Q1 2026 Financial Results

-

Revenue: $3.16 billion (+30% YoY; consensus $3.12 billion)

-

Earnings per share (EPS): $2.46 (consensus $2.31; $1.63 a year ago)

Revenue by segment:

-

Industrial: $1.49 billion (consensus $1.50 billion)

-

Communications: $476.8 million (consensus $432 million)

-

Automotive: $794.4 million (consensus $815.3 million)

-

Consumer: $399.8 million (consensus $362.7 million)

-

Gross margin: 71.2% (consensus 70%)

-

Operating margin: 45.5% (consensus 43.8%)

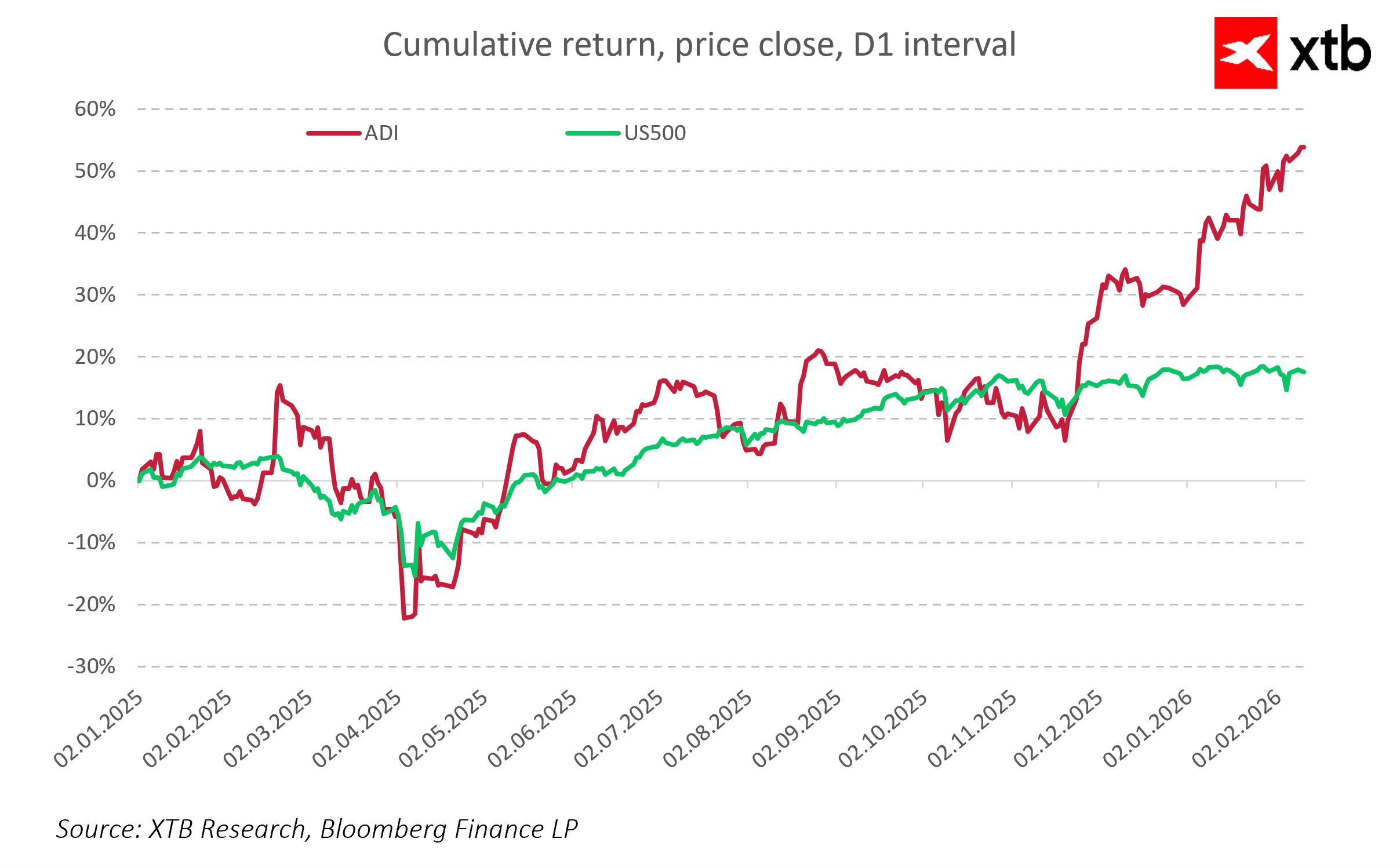

Following the earnings release, ADI shares rose by more than 3%, reflecting a positive market reaction.

Q2 2026 Outlook

-

Revenue: $3.50 billion (consensus $3.23 billion)

-

EPS: $2.88 (consensus $2.31)

The guidance points to sustained strong demand across industrial, communications, and data center markets, primarily driven by ongoing investment in generative artificial intelligence. Management highlighted that expected second-quarter revenue could mark a new record level for the company.

Market Reaction and Investor Implications

The positive share price response following the results and guidance reflects constructive investor sentiment. The quarterly performance and forward outlook indicate that the company continues to scale effectively while maintaining solid growth across strategic semiconductor and AI-related markets.

Business Context and Outlook

Analog Devices remains a leader in the analog semiconductor space and industrial solutions market. The company’s growth trajectory is supported by increasing investment in AI infrastructure, expansion of data centers, and resilient demand from core industrial customers.

Key strengths:

-

Operational scale and revenue visibility

-

Strong demand across industrial, communications, and consumer segments

-

High gross and operating margins

Key challenges:

-

Macroeconomic and geopolitical pressures

-

Intense competition within the semiconductor sector

-

The need to sustain innovation in a rapidly evolving market

Despite these factors, ADI’s recent performance and forward guidance suggest continued revenue and earnings growth potential, reinforcing its position in strategic technology and AI infrastructure markets.

Key Takeaways

-

Strong Q1 2026 results: Revenue of $3.16 billion (+30% YoY) and EPS of $2.46 — both above consensus.

-

Solid Q2 2026 guidance: Revenue of $3.50 billion and EPS of $2.88, supported by AI-driven infrastructure demand.

-

Positive market response: Share price appreciation reflects investor confidence.

-

Competitive positioning: Operational scale, revenue visibility, high margins, and strong exposure to AI and industrial semiconductor markets.

US Open: US100 gains 1% 📈 Nvidia gains amid big orders from Meta

Palo Alto earnings: Is security cheap now?

BAE Systems earnings: Record after record in the defense industry

US OPEN: Market under pressure from AI

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.