Tesla will publish its Q4 2025 results after the close of trading on Wednesday, January 28. Expectations for the automotive giant’s earnings do not appear to reflect the enormous hopes placed in the company. Referring to Tesla as an “automotive giant” is accurate, but in this context it carries a negative connotation. The company stopped being valued like a car manufacturer long ago, it is valued like a technology company, despite negligible success in that area. At the same time, the company’s fundamentals, the automotive segment that is supposed to serve as the foundation for further, more advanced ventures, are showing clear signs of strain.

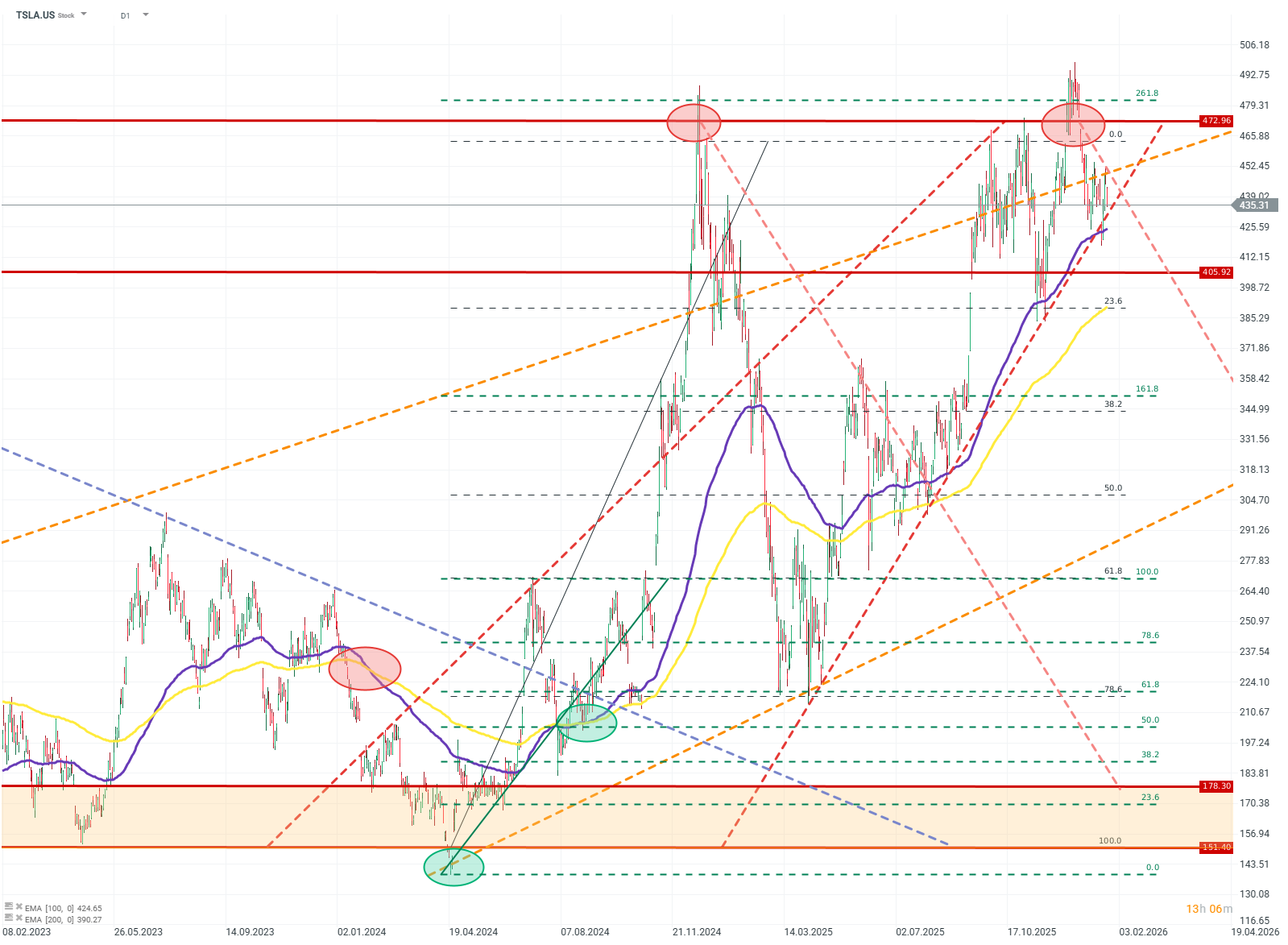

Since the last peak, Tesla’s share price has fallen by around 12%, yet it remains very high within its long-term price channel. Previous results do not justify this. In most of the last dozen earnings releases, Tesla disappointed analysts’ expectations on both EPS and revenue. Will it be different this time?

Ahead of the earnings release, Tesla published its vehicle delivery report. In the fourth quarter, the company recorded the largest drop in its history—down 16% year over year. The consensus for vehicle deliveries was around one million units. Tesla managed to deliver only 418,000.

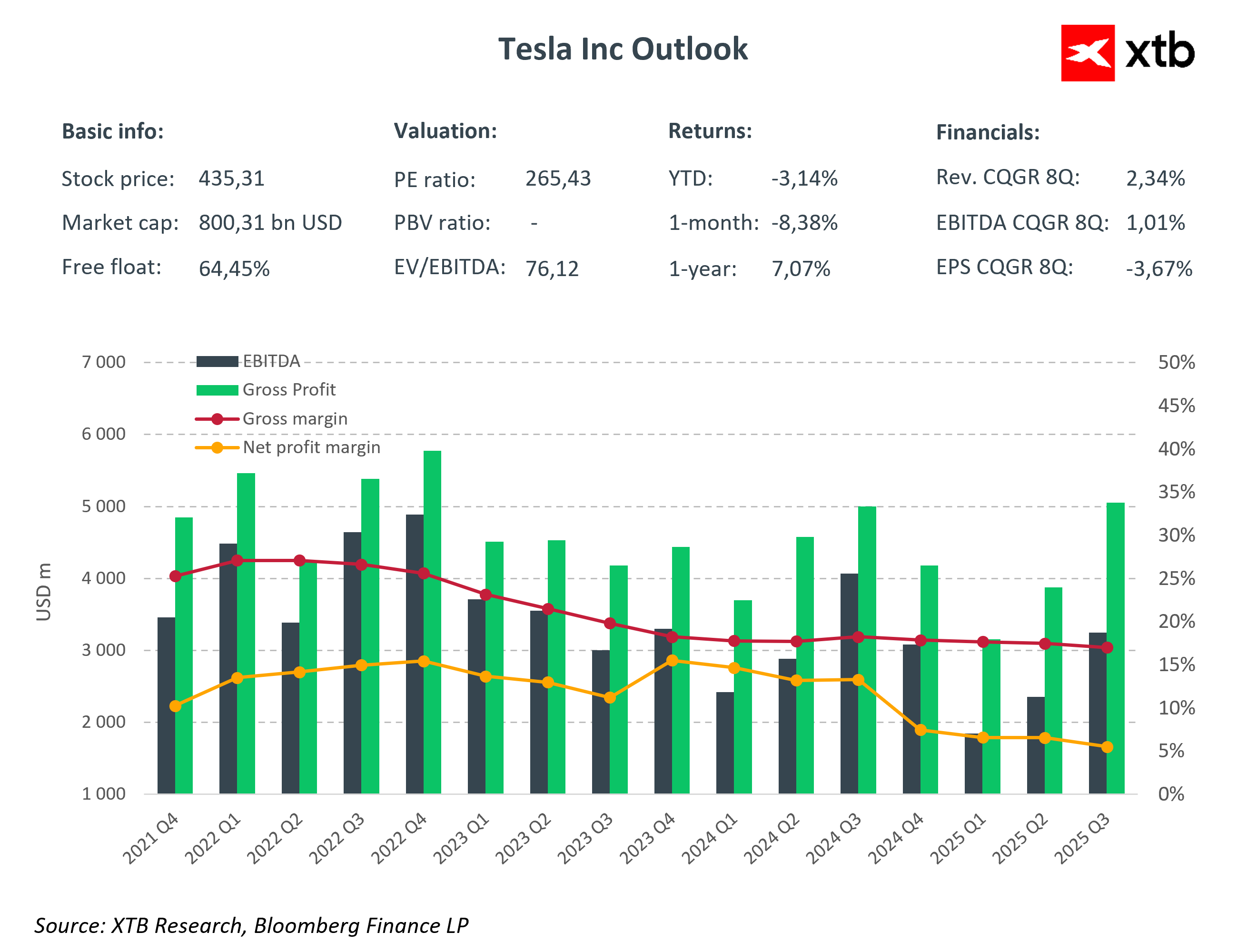

EPS expectations for Q4 are around USD 0.45. This represents a decline of more than 50% compared with 2022. This deterioration is also visible in the company’s margins.

Revenues look somewhat better: the market expects USD 24.7 billion, which is close to the quarterly average. However, this is still lower than in the corresponding periods of 2025 and 2024.

A significant portion of investors has stopped paying attention to financial ratios or hard data. There is a sizeable group of shareholders focused primarily on further announcements regarding the development of FSD and "robo-taxis". Tesla will have great difficulty meeting even these conservative earnings expectations. However, if the company presents promising indicators related to FSD and robo-taxis, it may temporarily sustain current valuations—or even see a rise. The absence of such signals, on the other hand, could lead to a significant sell-off following the earnings release.

Just a few days ago, Tesla introduced changes to access and distribution of its “Autopilot” and FSD, which may allow the company to show growth—if not in FSD subscriptions themselves, then at least in expectations surrounding them.

TSLA.US (D1)

Price has declined from its recent high. A return to growth may be difficult, and there is plenty of room for a correction. Source: xStation5

Block Inc. lays off 40% of its workforce and rises 16% - Is this a new paradigm?

US OPEN: Wall Street holds its breath ahead of Nvidia earnings

Michael Burry and Palantir: A well-known analyst levels serious accusations

Palo Alto earnings: Is security cheap now?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.