TESLA (TSLA.US) is scheduled to release its Q2 earnings report today after the close of the US session. As usual, a conference call and Q&A with Tesla’s management is scheduled after the results. The world's most popular electric carmaker finished its first full year of profitability in 2020. During the last three quarters, Tesla recorded sharp increases in earnings, revenue and vehicle deliveries and maintained its position as the most popular stock among both consumers and investors.

Let's take a look at what investors are expecting from today's report.

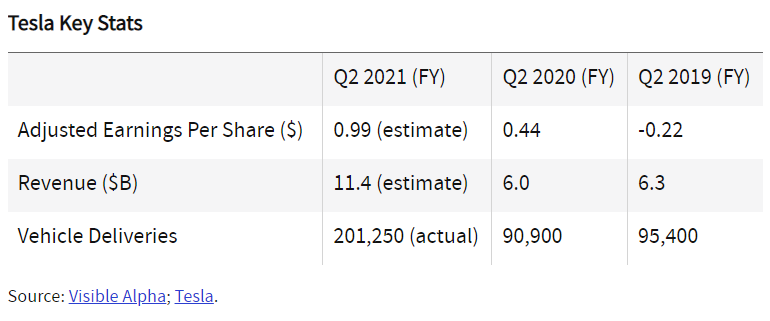

As was the case in the past, investors will primarily focus on the vehicle deliveries figures as they account for the majority of the company's earnings results. The company's primary business is making electric cars and it needs to continue expanding production in order to grow revenue and profits, however this may be difficult in the future due to rising competition mainly from Volkswagen. Although the company already reported delivery figures earlier this month, these numbers are always slightly adjusted during earning results. Total deliveries for Q2 FY 2021 came in at 201,250, up 122.0% compared to the same quarter a year-ago. Any significant deviations from these figures, could lead to significant price movements. Also investors may want to hear more updates regarding two gigafactories in Berlin and Texas and their impact on the future production levels.

When it comes to earnings, Tesla is expected to report adjusted EPS of $0.99, while the Earnings Whisper number, or the Street’s unofficial view on earnings, stands at $0.91 per share.

Meanwhile revenue is expected to rise at its fastest pace since the second quarter of 2018 amid strong vehicle deliveries. The Wall Street analysts' expect revenue of $11.4 billion, and Estimize -the financial estimate crowdsourcing website, expects a slightly higher revenue of $11.615 billion. This is about $ 1 billion more than in the previous quarter and more than double the amount in the second quarter of 2020.

The delivery figures will be the key metric to watch. Source: Visible Alpha; Tesla.

The delivery figures will be the key metric to watch. Source: Visible Alpha; Tesla.

Tesla (TSLA.US) stock price broke above the downward trend line, which potentially signals that buyers have taken control of the market. Currently, the horizontal zone at $ 631.00 acts as the key support and as long as the price sits above it, the trend remains upward. Only the negation of the aforementioned support at $631.00 may lead to a deeper pullback towards $ 545.00. Source. xStation5

Tesla (TSLA.US) stock price broke above the downward trend line, which potentially signals that buyers have taken control of the market. Currently, the horizontal zone at $ 631.00 acts as the key support and as long as the price sits above it, the trend remains upward. Only the negation of the aforementioned support at $631.00 may lead to a deeper pullback towards $ 545.00. Source. xStation5

Rivian Automotive: Rising star or a meteorite?

US OPEN: Valuations under pressure amid deregulation spree

DE40: DAX gains 0.5%📈Lufthansa surges almost 5% amid Kepler recommendation

Broadcom shares drop 5% despite robust earnings and AI demand 🗽

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.