The TEZOS cryptocurrency is gaining nearly 7% although it has seen a slight correction after a euphoric rise. The increase can be linked to the prospect of TZ APAC partnering with Web3's debut search engine, Adot AI. The search engine is expected to use solutions from Tezos. A demonstration of Adot AI's capabilities is scheduled to take place on July 5 at 'Demo Day', in Singapore.

- The search engine is expected to enable more efficient, intuitive search for Tezos users. Intelligent prompts, simplification of the world of decentralized applications and so-called 'smart contracts' are to be added value.

- The beneficiary of the search engine's possible growth in popularity is expected to be the growth of the Tezos ecosystem and adoption especially among developers in data search and specialized services, improving the user experience;

- However, it is worth noting that information regarding the Adot search engine itself is very vague at the moment, and cryptocurrencies are extremely volatile assets;

- Characteristic of the sector are so-called 'rallies under the event' - periods when the price rises in the face of some important milestone planned for the project. After it is reached, the price often records a correction - in the case of Tezos, that day could be July 5. In February of this year, Tezos reported, among other things, that it was partnering with Google Cloud, but the price has since fallen nearly 40%.

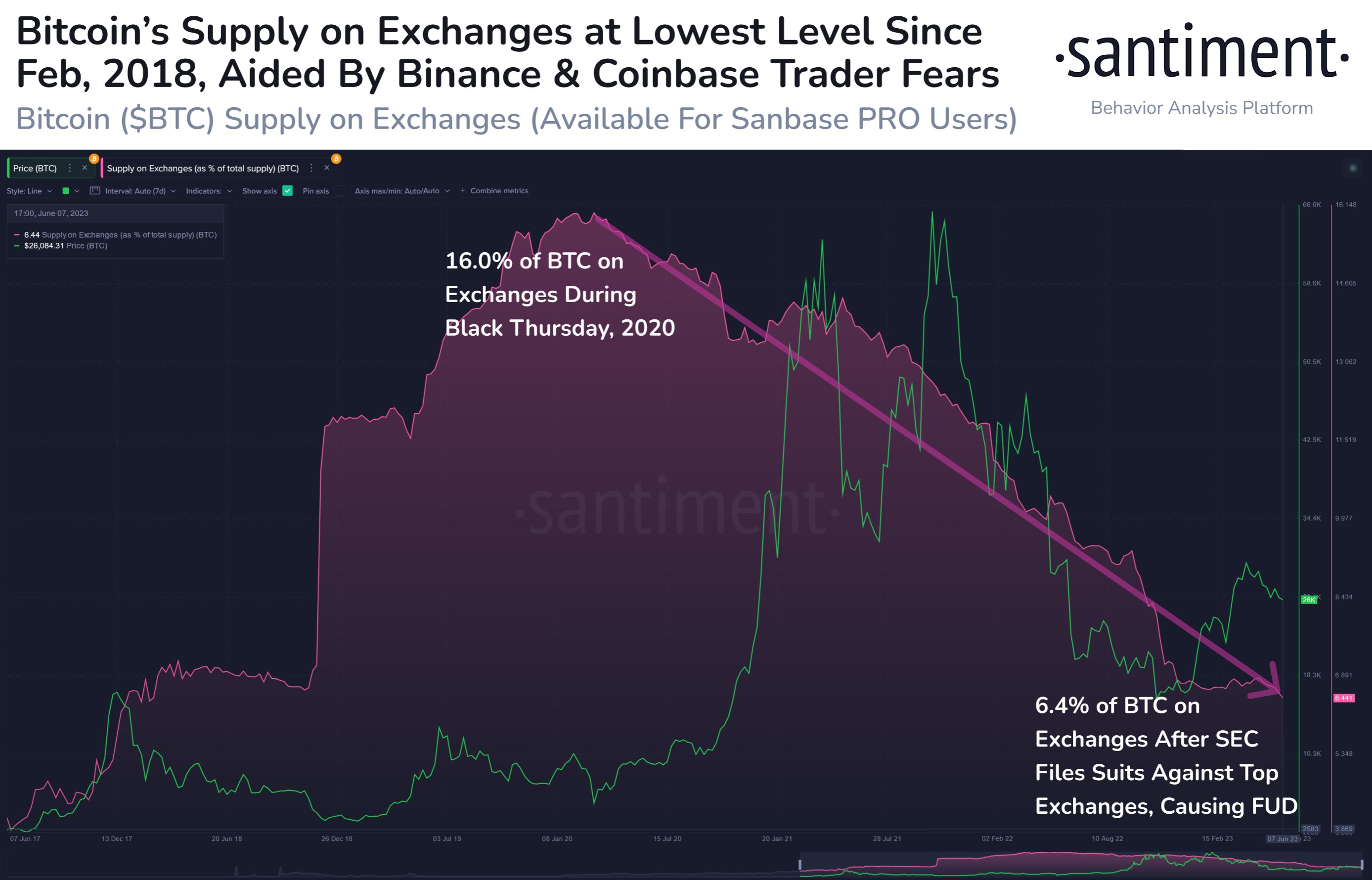

Uncertainty weighs on crypto sentiments. Bitcoin has stabilized at $26,000 but the CEX outflow is exceptional.

The amount of BTC on centralized cryptocurrency exchanges (CEX) is now at its lowest since 2018 as the market fears a possible systemic crisis. Faced with regulatory uncertainty around Binance, investors again felt insecure and are withdrawing their cryptocurrencies en masse to so-called 'cold wallets'. Marasm in the market and lower volumes could potentially reveal further 'cracks' and, in the extreme case, bankruptcies. Source: Santiment

TEZOS, M30 interval. The cryptocurrency is trying to limit the recent dynamic sell-off. The SMA200 and SMA100 averages on the low interval have formed a 'golden cross' indicating possibly more fuel for growth. However, it is worth noting that Tezos can be extremely sensitive to the sentiment of the main cryptocurrency, the Bitcoin. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.