-

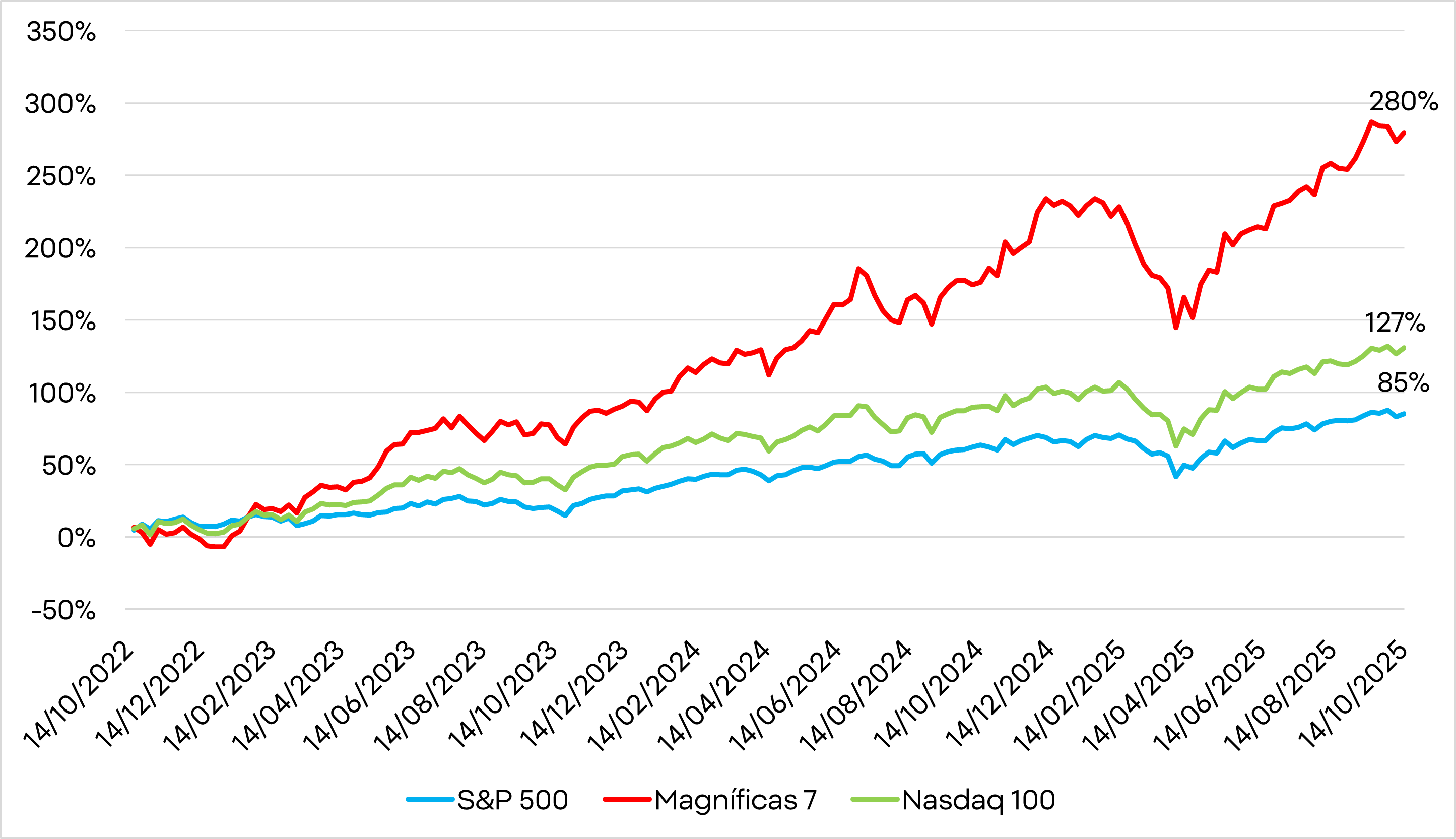

Artificial intelligence is powering the strongest bull run since 2022, with the S&P 500 up 85% and the “Magnificent 7” soaring 280%.

-

Unlike the dot-com bubble, today’s tech giants are delivering real profits and trade at far lower valuations.

-

Returns on invested capital still exceed funding costs, suggesting the expansion may continue.

-

Rather than a bubble, AI appears to be the driving force of a new global economic transformation.

-

Artificial intelligence is powering the strongest bull run since 2022, with the S&P 500 up 85% and the “Magnificent 7” soaring 280%.

-

Unlike the dot-com bubble, today’s tech giants are delivering real profits and trade at far lower valuations.

-

Returns on invested capital still exceed funding costs, suggesting the expansion may continue.

-

Rather than a bubble, AI appears to be the driving force of a new global economic transformation.

Artificial intelligence has gone from being a promise to becoming the driving force behind a new stock market era. The S&P 500 began its current bullish streak on October 12, 2022, shortly before the launch of ChatGPT. Since then, it has gained 85%. Over the past twelve months, the index has risen 15%—double the average increase seen in the third year of a bull market. Investors, fascinated yet uneasy, are asking whether we’re witnessing a genuine technological revolution or the prelude to another financial bubble.

The numbers speak for themselves. Nvidia has surged 1,500% in just three years; Meta Platforms, more than 450%. The ten largest companies on Wall Street now account for 40% of the S&P 500 and 22% of global market capitalization. At the peak of the dot-com bubble, that figure barely reached 14%. Current levels are historic, but unlike back then, today’s tech giants are generating real profits—not empty promises.

Across the ten biggest market bubbles of the past century, average gains from trough to peak were around 244%. That suggests that the “Magnificent Seven” may still have some room left—but not much. And the timing also aligns with the historical average of roughly two and a half years. Are we in a bubble?

High Valuations—but With Real Support

Valuations are high, yes—but not the highest in history. And more importantly, today’s leading tech companies are delivering strong, sustained profits.

While current valuations are elevated compared to the broader market and historical averages, they remain far below those of Internet stocks before the dot-com crash.

In late 1999, Cisco traded at 96.7 times future earnings, Oracle at 92.1, and eBay at an incredible 351.7. Today’s AI leaders are much more restrained: Microsoft (32.2), Apple (31.9), Meta (24.1), and Alphabet (23.4). Even Amazon (30) and Nvidia (31.8) sit below their five-year averages. Only Tesla stands out with a multiple of 186.

In other words, prices are demanding, but they’re backed by tangible earnings—not by speculative dreams.

Stock prices have risen sharply, but so far this has been accompanied by solid and sustained earnings growth, rather than wild speculation about the future. This is unusual compared to past bubbles, where favored companies were often driven by lofty expectations of dominance, not by proven performance.

Previous bubbles also tended to coincide with periods of intense competition, as investors and newcomers flooded the market. This time, enthusiasm for AI is concentrated in just a handful of companies.

A key metric to watch is the gap between return on invested capital (ROIC) and the weighted average cost of capital (WACC). Today, that spread remains positive—meaning firms are still generating returns well above their financing costs. As long as it stays that way, the expansion cycle can continue. True bubbles burst when capital costs rise or returns fall enough to close that gap.

On a macro level, the context is also different. During the dot-com era, the Federal Reserve began raising interest rates, triggering a wave of defaults. Today, the opposite is happening: rates are being cut, and the Fed’s balance-sheet reduction program has been paused.

A Revaluation, Not a Fad

The rise of artificial intelligence is concentrated in a few hands, but it’s not built on pure speculation.

The profits of leading companies are growing in step with their stock prices. Taiwan Semiconductor, the world’s largest chipmaker, recently raised its already-lofty revenue forecasts—clear evidence that demand remains red-hot.

One of the companies most exposed to the AI boom is OpenAI. Its latest deal with Broadcom—adding to agreements with Nvidia and AMD—pushes its estimated spending above one trillion dollars. Despite skepticism around that number, the company reportedly has $100 billion available from Nvidia investments, hasn’t yet tapped debt markets, and enjoys support from the Trump administration.

That last point may prove crucial. The race for AI dominance is also a geopolitical battle. Whoever leads—whether the U.S. or China—will control the global economy of the future. Economic efforts and government spending to secure that lead will likely intensify in the coming months, benefiting the industry’s key players.

Lessons from the Past

The comparison to the 1990s is inevitable, but the differences are profound. Then, soaring stocks often belonged to young, unprofitable startups.

Today, the leaders of the AI rally are mature, profitable giants.

Take OpenAI: it now has about 700 million users—roughly 9% of the world’s population—up from 500 million in March. Its revenues are on track to triple from 2024 levels.

There are also at least three additional reasons why AI doesn’t resemble a classic bubble:

- Cross-industry integration: AI is embedded across nearly every sector, not isolated in one niche.

- Immediate productivity gains: measurable efficiency and cost savings are already visible.

- Strategic backing: governments and economic blocs are funding AI as a geopolitical priority, justifying unprecedented levels of investment and debt.

Risks on the Horizon

Of course, risks remain. The gap between investment and returns could widen if spending accelerates too fast.

Rising leverage, China’s capital race, and the possible use of opaque financial vehicles could inflate systemic risks.

There’s also a chance that AI might fall short of its revolutionary promises—or that today’s data-center chips could become obsolete before delivering their expected returns.

And mounting energy costs, driven by the electricity demands of massive data centers, add another layer of pressure.

Conclusion: The Road Ahead

History shows that bubbles burst when profits no longer justify valuations or when credit dries up. So far, there’s no sign of either.

Artificial intelligence is creating real value, boosting productivity, and opening new economic opportunities.

Far from being a bubble, this could well be the beginning of the greatest economic transformation in modern history. The challenge is no longer to fear AI’s rise, but to learn how to harness it. Those who understand it first will lead the next decad

With earnings season underway and results so far looking strong, the Nasdaq 100 could be the best-performing U.S. index for the rest of the year, at a time when some doubts are beginning to emerge about regional banks. Source: Xstation

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.