Confidence has not returned to investors in the cryptocurrency market. This can be seen by the fact that the positive news that comes out does not necessarily affect the recovery of the market. PayPal (PYPL.US) announces the launch of the ability to transfer, send and receive Bitcoin, Ethereum, Bitcoin Cash and Litecoin. Despite this, there is no price reaction in sight.

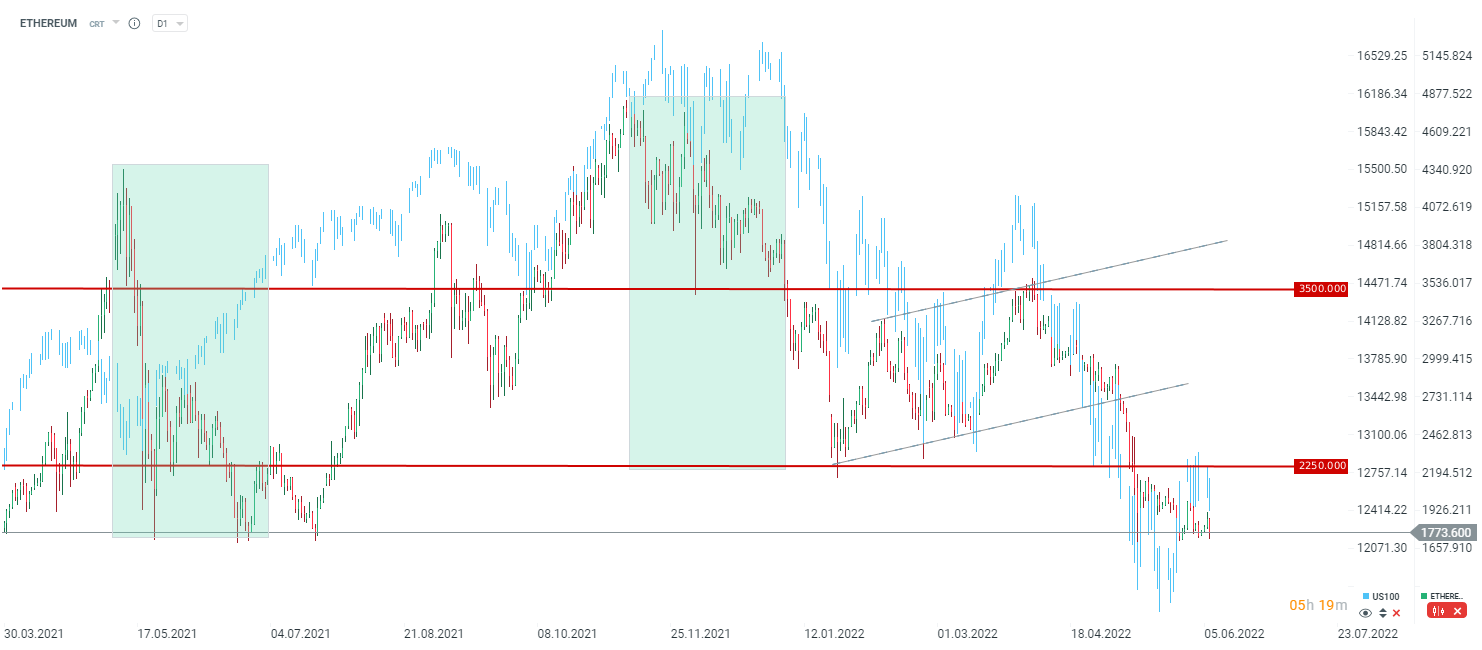

Despite this, Ethereum is once again at a key location, the $1750 support. From a short-term perspective, we can see that we have a 4th test of this area, which means that theoretically we have the best chance to break through. At the same time, if today's bounce is bigger, from a technical point of view, we should break out upwards from the current consolidation.

For a bullish signal, we need to break through the downward trend line and exit above $2250, a very important place of resistance, which is marked by local lows from the beginning of 2022. Source: xStation5

From a long-term perspective, it can be seen that from May to July 2021, also 4 times, resulting in a powerful rebound that led prices to historical highs. However, it is worth noting that the stock market was in a strong bull market then, in contrast to the current state.

Source: xStation5

Bitcoin loses momentum falling to $111k 📉Ethereum loses 3%

Crypto news: Bitcoin rebounds after the sell-off 📈Ethereum above $4000

Daily Summary: Gold and Indices lower, Dollar bounces back💲

Chart of the day - ETHEREUM (09.10.2025)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.