This Sunday, Turkey will elect 600 Members of Parliament and a president. Will there be a change in power after 20 years of rule by the AKP party, headed by Recep Tayyip Erdogan?

Some key facts

-

On 14 May, Turks will go to the polls to elect their representatives to parliament and the president. 64 million Turks are eligible to vote

- If no candidate receives 50% of the vote, a second round of elections will be held on 18 June

-

Erdogan remains 20 years in power, but this will be the first election after the change from a parliamentary to a presidential system, which took place in 2018

-

Erdogan was prime minister for 11 years, while he became president in 2014

-

The AKP party is likely to win the election, but may not be given the opportunity to govern on its own

-

The Justice and Development Party (AKP) is losing support heavily due to significant inflation and a massive drop in the exchange rate. In addition, the opposition has accused the ruling party of poorly managing the problem after a series of earthquakes this year

-

Inflation in Turkey fell to 50.5% for March from 85.5% in October, a 24-year high. Erdogan is known for his unconventional approach to inflation and pushing for interest rate cuts

-

Kemel Kilindaroglu of the Republican People's Party (CHP) is Erdogan's biggest rival in the presidential race. Most polls put him in a position to win the first round, but a second round could be more evenly matched

-

The chances of defeating the AKP have increased significantly due to the first coalition bloc of as many as six parties in years, which has backed Kemal Kilindaroglu

-

The opposition candidate is a supporter of democracy and is known for his anti-corruption rhetoric. Domestically, however, he is accused of having too many connotations with the 'West', he would like more integration with the EU.

The economy is the most important issue

There is no talk of war or NATO in Turkey at the moment. By far the most important problem is the economy, and its problems were reinforced by the earthquakes at the beginning of February in which 50,000 people died and 14 million people, or about 16% of the total population, were affected. Many have criticized the government for failing to deal with the problem, and the presidential system has failed since 2018. The opposition wants a return to a parliamentary system. At the same time, the opposition finds it difficult to present its critical view of the government due to the fact that 90% of the media is influenced by Erdogan's party.

Kilindaroglu has announced a desire to fight inflation and improve conditions for foreign capital in the country. The opposition also has far fewer objections over NATO enlargement, although even in the event of Erdogan's victory, the opposition is likely to agree to Sweden joining NATO. This may happen because of Turkey's willingness to purchase fighter jets from the United States. However, the conflict between Turkey and the United States has been exacerbated in recent years due to Turkey's desire to purchase a missile system from Russia.

Average support for candidates in Turkey's presidential election. However, the withdrawal of one of the candidates in recent weeks makes it increasingly likely that Kilindaroglu will win in the first round. Source: politpro.eu

Market sees massive risks

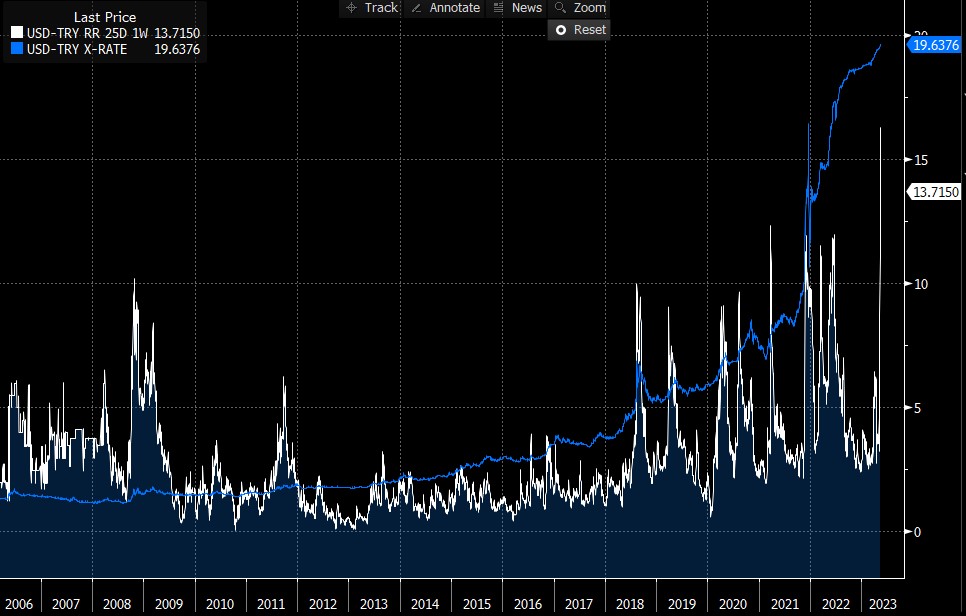

Looking at the behavior of the options market, the market sees potential massive volatility in the week ahead. The Weekly Risk Reversal was trading near the 15 level, the highest reading on record, which shows how strongly the market is hedging against a potential further rise in the lira. At the same time, an opposition win could lead to a massive strengthening of the lira. The lira has lost almost 50% of its value since the beginning of 2022.

The market is hedging against a potential further rise. Some commentators believe that the AKP and Erdogan staying in power could mean the 'bankruptcy' of the country within the next few months, given the continued withdrawal of foreign capital from the country. Source: Bloomberg

The market is hedging against a potential further rise. Some commentators believe that the AKP and Erdogan staying in power could mean the 'bankruptcy' of the country within the next few months, given the continued withdrawal of foreign capital from the country. Source: Bloomberg

The lira exchange rate has been stabilized by the central bank since October, when we had the highest inflation in 24 years. Despite this, the lira has continued to lose, although it is "only" around 6% drop since October. Source: xStation5

The lira exchange rate has been stabilized by the central bank since October, when we had the highest inflation in 24 years. Despite this, the lira has continued to lose, although it is "only" around 6% drop since October. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.