Gold and silver have seen spectacular gains over the last 10 years. Not long ago, the rise in gold prices over the past decade even outpaced the return on the S&P 500 index, but the index managed to overcome its challenges and reach new historical highs. Nevertheless, the return on the gold market in the last 10 years has been just over 190%, with a 27% increase this year, while for the silver market, it's a 152% increase with a 21% rise since the beginning of this year. The S&P 500 index, during the same period, grew by almost 200% and a mere 6% this year, respectively.

Of course, it's worth remembering that such strong returns on precious metals wouldn't have been possible without the correction after 2011, which was linked to expectations of significant interest rate hikes in the United States. Currently, the situation looks completely different, as gold is gaining even during a period of sustained high interest rates by the Fed. This means that a crucial factor behind gold's strength is its role as a safe haven. In recent years, many global events have prompted investors to seek protection for their assets. Equally important, central banks have also joined the ranks of those seeking safe havens, opting for stronger diversification of their reserves due to concerns about the stability and position of the U.S. dollar. Among the leading buyers in recent years, we can observe the National Bank of Poland. Over the past three years, central bank have purchased over1000 tons annually, accounting for over 20% of the total global demand for gold. It is expected that 2025 will be another year when demand from these institutions surpasses 1000 tons. Moreover, after several years of stagnation, we are also seeing a return to greater activity from ETF funds. Investors are purchasing new units in these funds, which requires ETFs to buy physical gold on the market if they employ such a hedging policy.

Silver is not purchased by central banks. It also has a completely different demand structure compared to gold. The vast majority of silver demand is generated by industry, including increasingly new technologies. In the case of silver, we have observed a clear market deficit for several years. Consequently, with the investment segment also waking up, an even larger deficit is expected in the market.

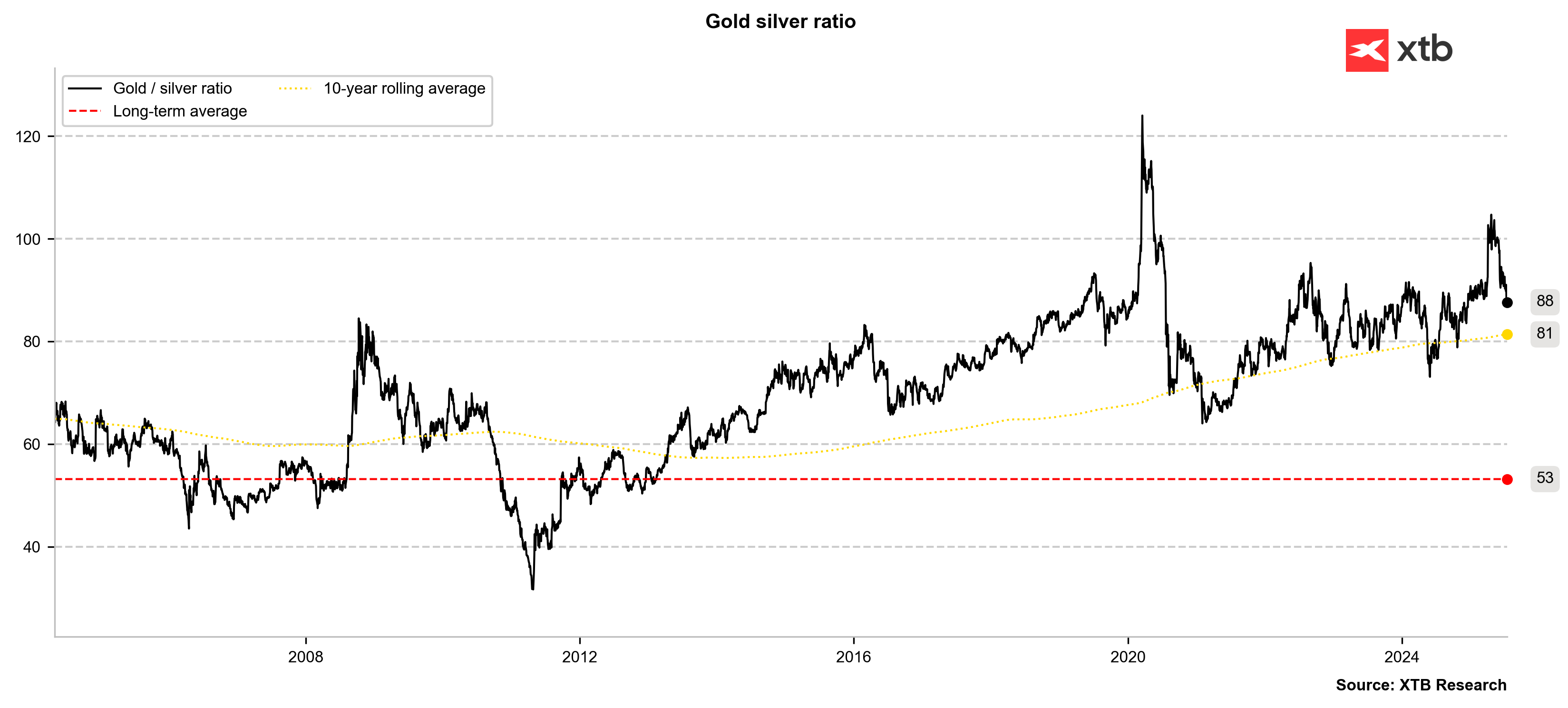

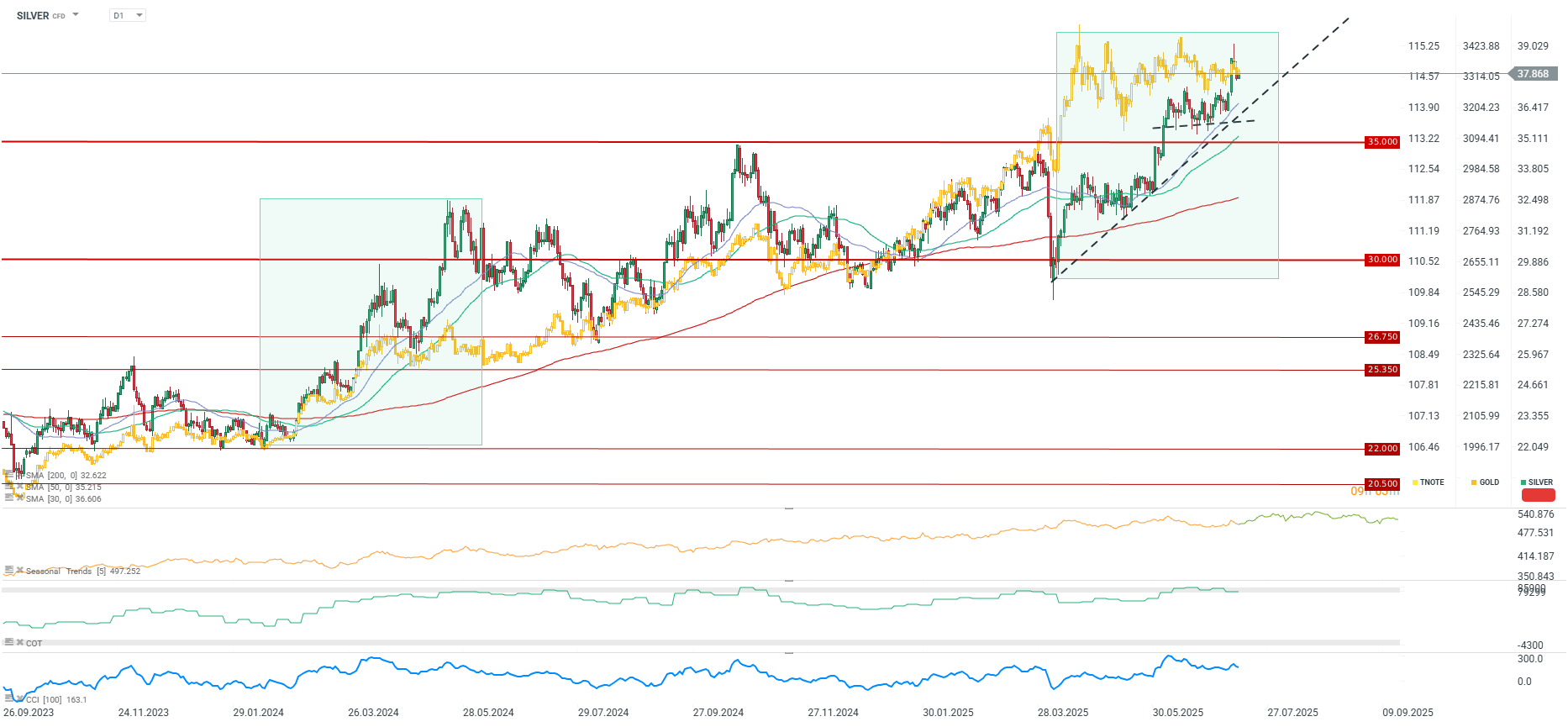

Due to the perception of both commodities as precious metals, their correlation is quite significant. Therefore, looking at the gold-to-silver ratio, one can still observe a significant undervaluation of the "cheaper" metal relative to the "more expensive" one. The gold-to-silver ratio is currently at 88, while the 10-year average indicates a level of 80 points. Furthermore, the long-term average stands at 53 points. Assuming stability or increases in gold prices, silver prices still have significant upside potential. This is also evidenced by the fact that silver is still relatively far from its historical highs. Silver's historical peaks were reached in January 1980 at nearly $50 per ounce when concerns about the availability of this metal arose. With further development of new technologies and growing investment demand, a repeat of such a scenario cannot be ruled out.

The price ratio is clearly falling. If the price of gold were to stabilize, but the price ratio continued to drop to its 10-year average, it would imply that a short-term target for silver could be $40-42 per ounce. Source: Bloomberg Finance LP, XTB.

Silver's price has adjusted to gold's volatility in recent years. While further increases in silver, with gold consolidating, are possible, the best-case scenario for silver is continued moderate increases in gold prices. Excessive increases in gold prices are often associated with excessive market risk, which in turn is not very good for silver given its demand structure. Source: xStation5

Daily summary: Equities rally as markets await Trump-Xi talks; precious metals decline on risk-on (27.10.2025)

OPEC+ to raise production at the next meeting❓🛢️ Oil in stagnation

Coffee falls for the third straight session amid improving weather in Brazil and Vietnam ☕️ 📉

⏬Gold Sinks Below $4,000!

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.