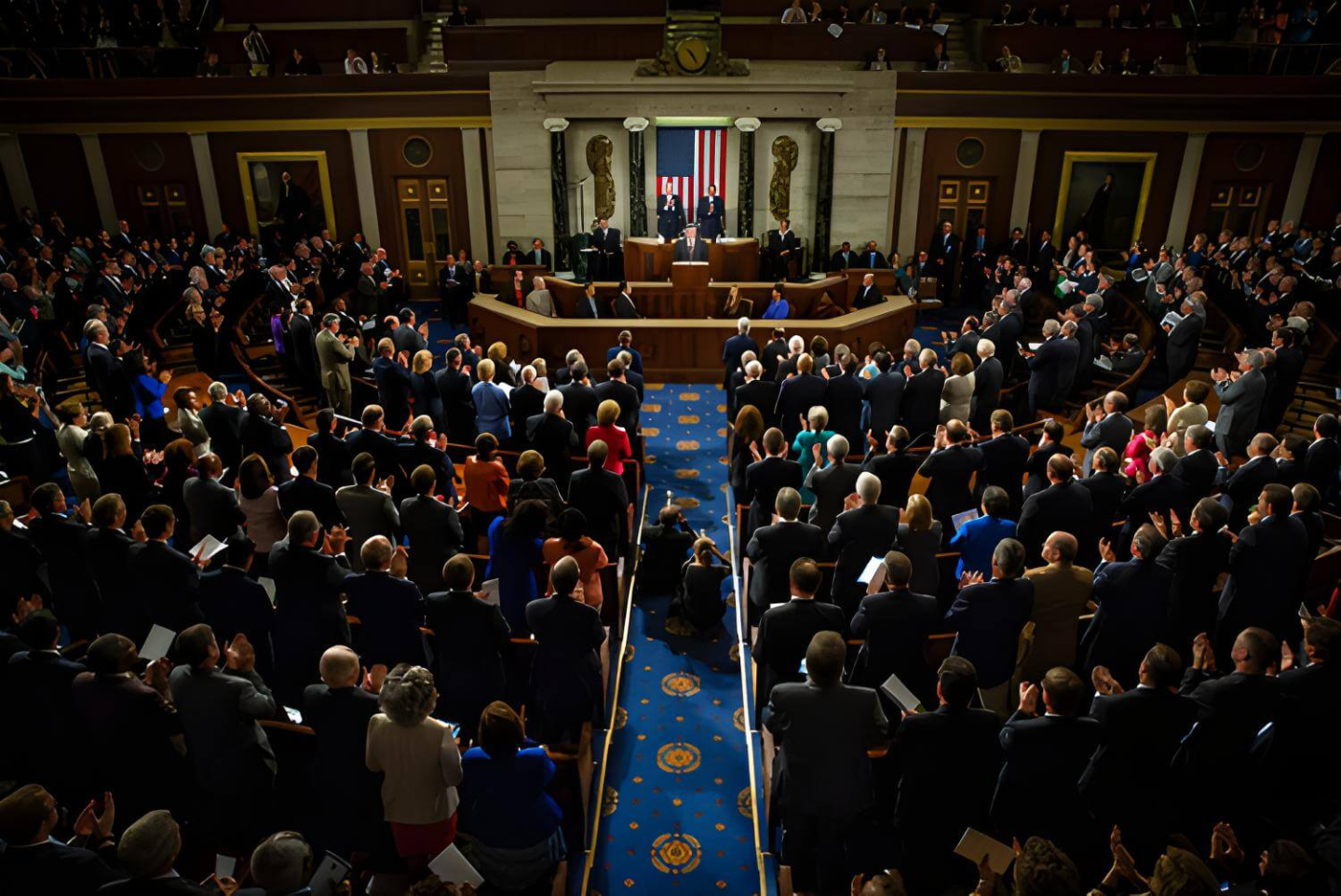

RTX Corp. (RTX.US), the largest U.S. defense prime and formerly Raytheon, delivered better than expected results for Q4 2025 and confirmed that momentum is carrying into 2026. Both revenue and earnings per share beat Wall Street estimates, reinforcing the broader uptrend across the defense space. The company’s most important long-term growth catalyst appears to be the “Golden Dome” program, although uncertainty around its execution, including political friction with Canada and discussions involving Greenland, may delay any valuation premium tied to potential profits from the project. RTX has also recently been singled out by Trump, who described the company as the least willing to align with new White House guidance. That guidance is increasing pressure on defense contractors to invest more aggressively in domestic factories and ramp production capacity as quickly as possible.

RTX Q4 2025 results

-

Revenue: $24.2B, up 12% YoY and clearly above market expectations (around $22.7B).

-

Adjusted EPS: $1.55, above consensus (around $1.47).

-

YoY EPS growth: +1%, suggesting the quarter was more volume-driven than margin-driven.

-

Cash generation: Free cash flow of $3.2B and operating cash flow of $4.2B were among the strongest highlights of the report.

Importantly, all key segments contributed to the quarter:

-

Collins Aerospace

-

Pratt & Whitney

-

Raytheon

GAAP EPS of $1.19 was weighed down by acquisition accounting and restructuring items. For the market, the backlog remains the core pillar of the story: RTX reported a $268B order backlog, including $161B in commercial and $107B directly tied to defense.

Full-year 2025 snapshot

The sharp improvement in free cash flow indicates RTX is moving beyond the “operational cleanup” phase seen in prior years:

-

Revenue: $88.6B (+10% YoY).

-

Adjusted EPS: $6.29 (+10% YoY).

-

Free cash flow: $7.9B, up $3.4B YoY.

2026 outlook

The 2026 guidance looks conservative but highly credible, with room for potential upgrades:

-

Revenue: $92–$93B (5%–6% organic growth).

-

Adjusted EPS: $6.60–$6.80.

-

Free cash flow: $8.25–$8.75B.

The gap between revenue growth (+12%) and adjusted EPS growth (+1%) in Q4 points to cost pressure and or capacity investment. In 2026, the market will be watching operating leverage closely. Overall, RTX enters 2026 with momentum, a large backlog, and improving cash flow, but the key story for the coming quarters will be margins and execution, not order intake alone.

Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.