Traders are waiting for the FOMC minutes scheduled for this evening (7:00 pm BST). Volatility is expected to be elevated as investors hope for some details on taper discussion.t US indices including US30, EURUSD and DE30 are among markets that may experience bigger moves today’s evening.

US30

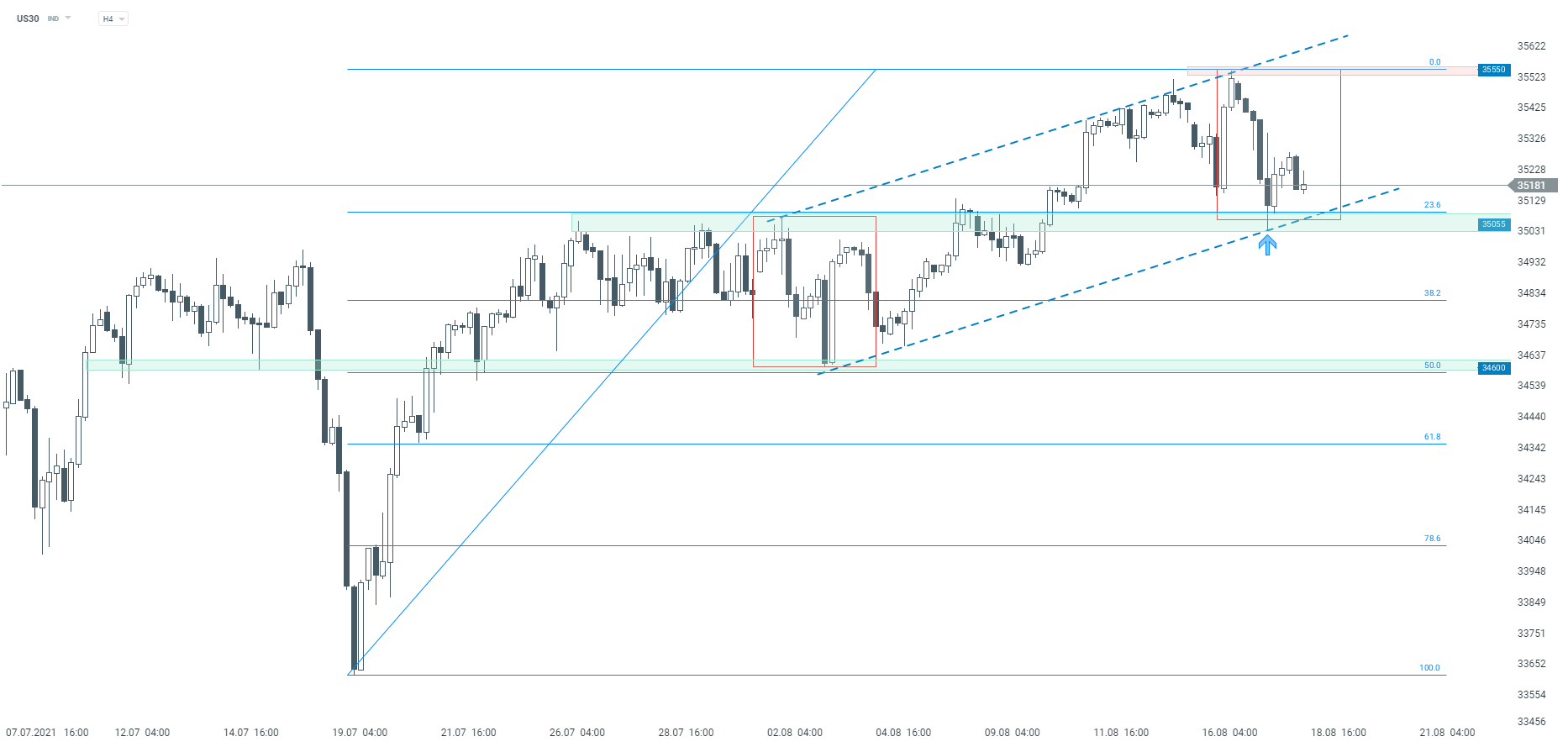

Let’s start today’s analysis with the Dow Jones Industrial Average Index - US30 on xStation platform. Looking at the H4 interval, one can see that yesterday's downward correction stopped at the key support near 35,055 pts, which is a result of previous price reactions, 23.6% Fibonacci retracement, as well as lower limit of local 1:1 structure.Should buyers manage to hold the price above it, an upward move may be resumed and reach new all time highs. On the other hand, if the price breaks below 35,055 pts, downward correction may deepen. In such a scenario, the key next support to watch can be found at 34,600 pts, where the 50% Fibonacci retracement can be found.

US30 H4 interval. Source: xStation5

US30 H4 interval. Source: xStation5

EURUSD

Moving on to the EURUSD chart, we can see that the main currency pair has been trading in a downward trend recently. However, looking at the H4 interval, a potential ABC correction can be spotted on the chart (pattern began to form at the beginning of the 2021). If buyers manage to regain control at the 1.17 or 1.16 support, the nearest resistance to watch lies at 1.19 and is marked with the previous price reactions as well as 38.2% Fibonacci retracement. On the other hand, should buyers give up control and the price breaks below the 1.16 handle, the downward move may accelerate.

EURUSD H4 interval. Source: xStation5

EURUSD H4 interval. Source: xStation5

DE30

Last but not least, let’s take a look at the German index - DAX (DE30). Looking at the H4 interval, one can see that the recent upward move stopped at the 127.2% Fibonacci exterior retracement and the downward correction started. However, the market bulls regained control at the earlier broken support area at 15,800 pts. According to the classic technical analysis, as long as the price sits above, the main trend remains upward. On the other hand, if the index resumes decline and the aforementioned 15,800 pts support is breached, the next key support to watch can be found at 15,280 pts, where lies the lower limit of 1:1 structure.

D30 H4 interval. Source: xStation5

D30 H4 interval. Source: xStation5

Key support on Ethereum 💡

S&P 500 futures retreat 1% amid hawkish Fed rhetoric and robust data

Technical Analysis - Ethereum (14.01.2026)

Technical Analysis - GOLD (02.01.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.