- Company managed to slightly beat revenues expectations

- Operating profit feel, pressured by tariffs, which caused caution among investors

- Net profit raised substantially but mainly due to foreign exchange difference

- Guidance for end of the FY was lifted

- Company managed to slightly beat revenues expectations

- Operating profit feel, pressured by tariffs, which caused caution among investors

- Net profit raised substantially but mainly due to foreign exchange difference

- Guidance for end of the FY was lifted

Key financial information:

- Revenue is 12.38 trillion yen, an increase of 8% and above the consensus of 12.18 trillion.

- Net profit increased by a 62%, reaching 932 billion yen.

- A concerning fact is that operating profit fell by 27% year-on-year.

- The difference between operating profit and net profit was mainly due to investment returns and exchange rate differences. Operating profit itself was under significant pressure from labor costs and additional American tariffs.

The company communicated a series of important information regarding its strategy and future. Toyota continues its strategy of expansion in multiple sectors of the industry simultaneously. Other companies might struggle with this, but Toyota, due to its size, can not only afford it but is also in the best position to maximize benefits while taking relatively low risks.

The expansion mentioned primarily involves investing simultaneously in the EV market and Hybrids. Low-emission vehicles already account for 46.9% of the company's sales.

Toyota is also following other industry trends. The company boasts its new "Arene" system and proudly announces further development towards "Software Defined Vehicles."

Toyota shows its confidence by raising forecasts for the end of the fiscal year. By the end of FY2026, operating profit is expected to reach 3.4 trillion yen, an increase from the previous forecast of 3.2 trillion.

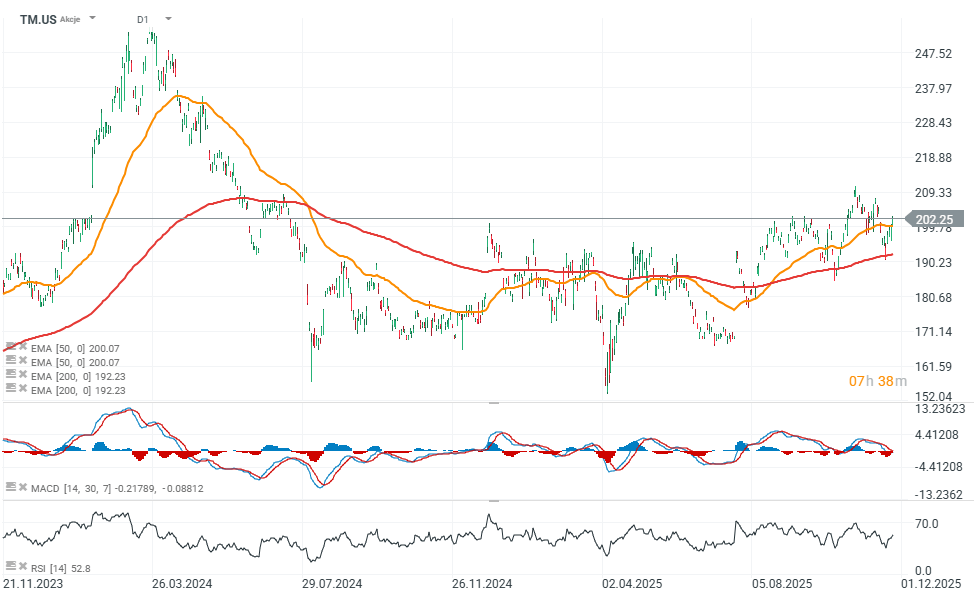

The market reacted with slight concern to the news of a significant drop in operating profit and the impact of tariffs. Initially, the company lost about 1.6% of its valuation. However, positive forecasts allowed the company's valuation to return to its previous levels over time.

TM.US (D1)

Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.