The agreement between the United States and the European Union, forged under pressure from President Trump and European Commission President Ursula von der Leyen, establishes a uniform 15% tariff on most European goods exported to the US. This compromise averts a potentially catastrophic tariff war, yet it falls short of an ideal outcome for European exporters. Prior to the weekend, the chances of reaching a deal were considered 50:50; without it, all EU goods would have faced 30% tariffs from August 1, 2025. Consequently, this agreement can be seen as having avoided the worst-case scenario, even at the cost of worsening the current trade landscape. A failure to agree with the US would have triggered retaliatory measures from the EU, potentially leading to a spiral of trade restrictions akin to those seen between the US and China just a few months ago.

Proportionality Principle: Who Gains More?

The newly minted agreement is asymmetrical. The EU has conceded to a 15% tariff on the vast majority of its exports to the US. In return, it secured "zero-for-zero" exemptions, granting tariff-free treatment for several strategic sectors, including aircraft and parts, selected chemical products, certain generic drugs, semiconductor manufacturing equipment, and some agricultural products and raw materials. European steel and aluminum continue to face steep 50% tariffs, though negotiations are anticipated, primarily to establish a threshold below which lower rates would apply. Nonetheless, with a general 15% tariff and a 50% rate on steel and aluminum, trade between the US and the EU is still expected to decline.

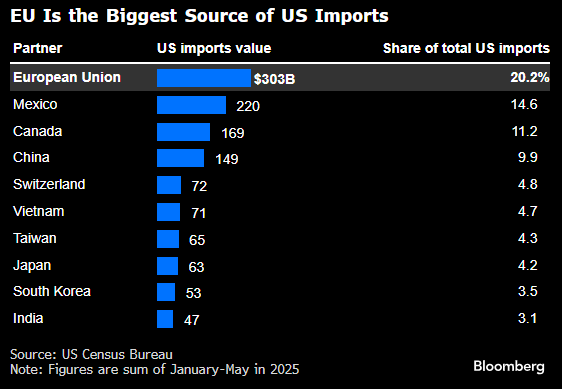

In practical terms, the EU's primary benefit is the avoidance of even more punitive tariffs and the preservation of market access to the US, especially for automotive manufacturers. In recent weeks, cars and parts were subject to a 27.5% tariff (a 2.5% base tariff plus an additional worldwide 25%). In exchange, the EU has committed to substantial purchases of US LNG, crude oil, nuclear fuels, and weaponry, alongside increasing investments in the US by several hundred billion dollars. Thus, the majority of concessions lie with the EU, while the United States stands to gain new jobs, investments, and exports. It is important to remember that the US imports the most goods from the EU, which could lead to increased inflation, albeit to a lesser extent than initially anticipated.

As much as one-fifth of foreign goods entering the US originate from EU countries. Source: Bloomberg Finance LP

Crucially, the EU has not announced a complete elimination of its tariffs on American goods. Europe's offer involves market openness—primarily in sectors where the EU imports from the US—but it is not an unconditional, unilateral lifting of all tariffs. Detailed lists of products from both sides are yet to be finalized during the agreement's implementation.

Europe's Future in a New Trade Reality

The current arrangement imposes a new reality on Europe's global trade position: tariff pressure from the US on one side, and dumping and oversupply from China on the other. Europe thus finds itself "between a rock and a hard place," having not eliminated either risk. As a result of US tariffs on China, some Chinese exports have been redirected to Europe, exerting even greater downward price pressure, particularly on the processing industry and the automotive sector.

The EU will need to actively respond to threats from Chinese exports (e.g., cheap electric cars or steel)—a European early warning system is already in place, and the EU is initiating anti-dumping investigations. Conversely, further market opening on US terms compels European companies to adapt to new, less favorable export conditions.

Navigating "Between a Rock and a Hard Place"

To navigate this challenging landscape, the EU should:

-

Focus on protecting strategic sectors: automotive, aviation, advanced technologies, and specialty chemicals—and strive for the maximum possible tariff exemptions here.

-

Control the influx of cheap products from China: through anti-dumping duties, quality standards, and investment oversight.

-

Diversify export markets: seeking partners beyond the US and China, such as Southeast Asian countries, Africa, and India. The EU has missed opportunities for broader agreements among countries impacted by US tariffs.

-

Maintain bilateral dialogue with the US: regarding further tariff exemptions for European goods, emphasizing the principle of reciprocity.

-

Strengthen industrial policy and investment in innovation: to offset the rising costs of accessing major markets.

Market Reaction

The market's clear perception is that this agreement primarily benefits the US, albeit with the risk of heightened inflationary pressure. Europe avoids the worst-case scenario, but economic growth will nonetheless be constrained. A key victory for Europe is undoubtedly the limitation of current tariffs on cars and the assurance that pharmaceutical tariffs will not be raised to 200%, as Donald Trump had recently indicated. Nevertheless, it is worth remembering that Donald Trump's propensity to change his mind and unilaterally withdraw from agreements, without consequence, cannot be ruled out, as he has accustomed investors to such actions in recent months.

With this agreement, pressure on the European Central Bank (ECB) to continue interest rate cuts will intensify. Conversely, in the US, the risk of elevated inflation might put a September rate cut in question. The current scenario sees EURUSD declining towards a potential neckline at 1.1600. Should this trend line be breached, the formation's scope suggests levels close to 1.1250. Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.