Uber Technologies Inc. rallied as much as 6.4% to $34.7 on Tuesday, after the tech giant reported its Q1 earnings and revenues that beat analysts estimates.

Key highlights from company report:

-

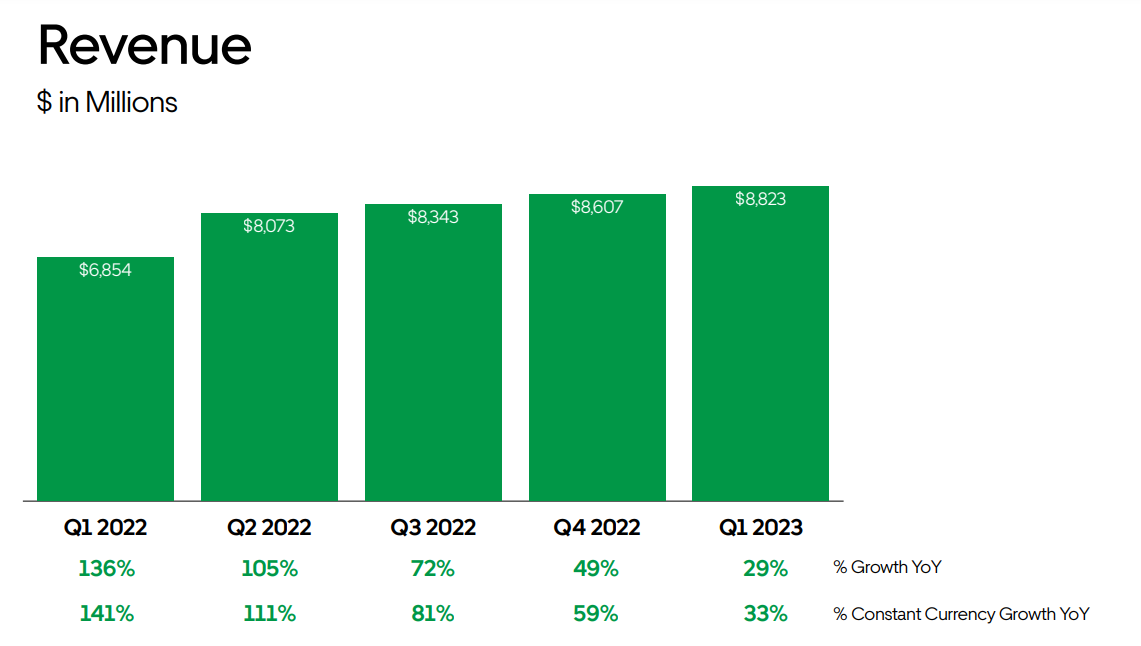

Revenue grew 29% YoY to $8.8 billion, estimate $8.72 billion - revenue growth significantly outpaced Gross Bookings growth due to a change in the business model for our UK Mobility business.

-

Gross Bookings grew 19% YoY to $31.4 billion, estimate $31.47 billion

-

Mobility Gross Bookings of $15.0 billion +40% YoY, estimate $14.83 billion

-

Delivery Gross Bookings of $15.0 billion +8% YoY, estimate $14.96 billion

-

Trips during the quarter grew 24% YoY to 2.1 billion, estimate $1.67 billion

-

-

Net loss $157 million, includes $320m net benefit (pre tax) primarily due to net unrealized gains related to the revaluation of Uber’s equity investments.

-

Adjusted Ebitda $761 million, estimate $678.6 million. Adjusted EBITDA margin as a percentage of Gross Bookings was 2.4%, up from 0.6% in Q1 2022. Incremental margin as a percentage of Gross Bookings was 12.0% YoY.

-

Net cash provided by operating activities was $606 million and free cash flow, defined as net cash flows from operating activities less capital expenditures, was $549 million.

-

Unrestricted cash, cash equivalents, and short-term investments were $4.2 billion at the end of the first quarter.

Uber revenue in millions, source: Company's Financia Statement

In the financial statements, the company stated that despite a sluggish economic outlook and rising inflation, consumers are spending more on rides and food delivery, leading to increased engagement and profitability for Uber. The company's adjusted earnings before interest, taxes, depreciation, and amortization reached $761 million, beating expectations. The report also highlighted Uber's success in weathering the economic slowdown better than its rival, Lyft, which is set to report its results later this week. Despite fewer-than-expected monthly active users, Uber's ride-hailing bookings of $15 billion beat projections, with the increased engagement attributed in part to lower fares and new mobility products. The company has also seen an increase in active ride-share drivers, up 35% from last year, reflecting an increase of over one million. Uber Eats, which grew rapidly during the pandemic, has helped to cushion the impact of the decrease in ride-hailing demand.

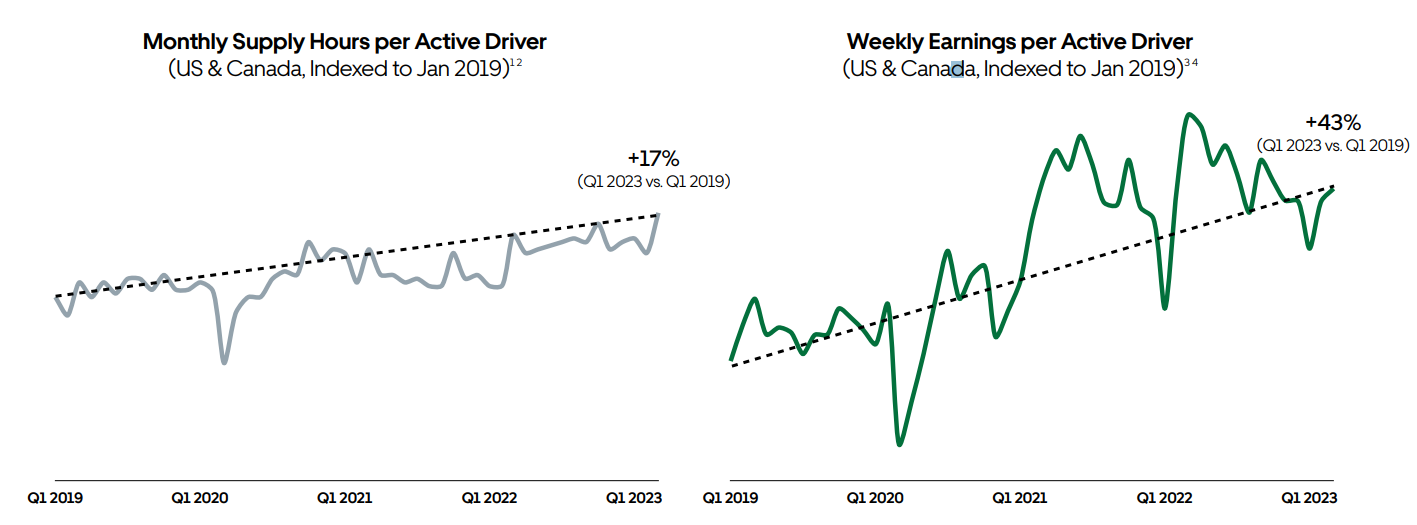

Company also highlighted that drivers engagement is at an all-time high, with strong earnings levels.

By rolling out innovative new Mobility products, we have not only attracted new drivers and riders to the platform, but they are engaging with us more often. Consequently, we are seeing constructive category position trends across most of our major markets with expanding profitability, even as our competitors continue to compete on incentives and price.

Dara Khosrowshahi, CEO

Q2 outlook

Nelson Chain, CFO stated that the company delivered record profitability and free cash flow in Q1, and is poised to expand profitability again in Q2. The company expects adjusted earnings before interest, taxes, depreciation, and amortization of $800 million to $850 million in the current quarter. While Uber has not announced widespread cost cuts or layoffs, the company has lowered headcount through performance reviews during the first quarter and expects its workforce to be "flat to down" in the quarters ahead.

Uber (UBER.US) stock price is currently trading at $34.9, which is up by 6.9%. This indicates a bullish sentiment among investors towards Uber's future prospects after strong Q1 financials.

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.