-

UBS raises Micron’s price target to $225.

-

Despite potential production constraints until 2027, investors remain optimistic.

-

UBS raises Micron’s price target to $225.

-

Despite potential production constraints until 2027, investors remain optimistic.

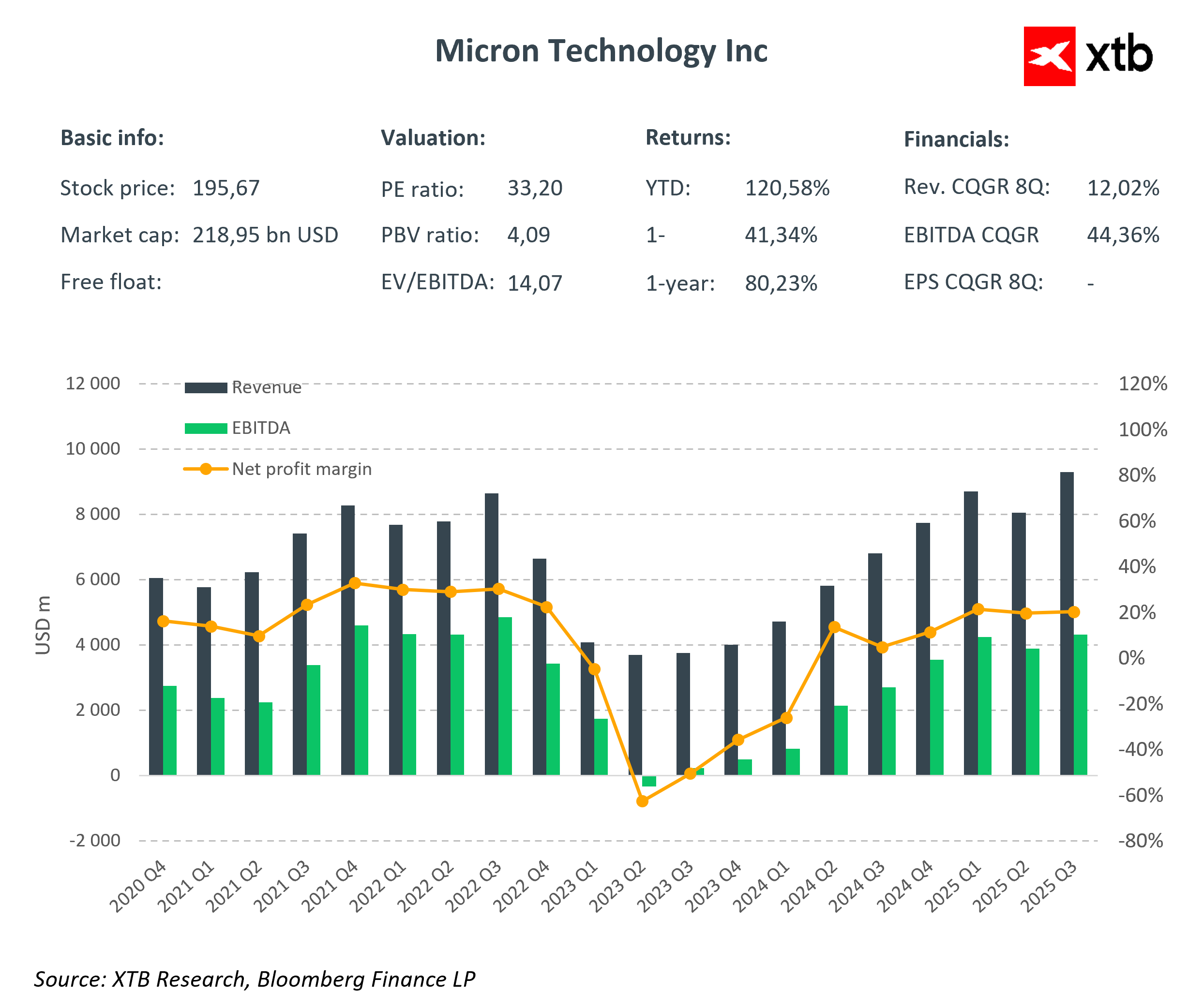

Positive news for Micron seems to be coming nonstop. UBS has just raised the stock price target from $195 to $225, maintaining its “Buy” recommendation. This is another sign of growing optimism around the memory chip manufacturer, mainly driven by the dynamic increase in demand for HBM (High Bandwidth Memory), a key component in the development of artificial intelligence and advanced computing systems.

UBS has revised its forecasts, expecting global demand for HBM to reach 17.1 billion GB in 2025 and rise to 27.2 billion GB in 2026, which is higher than previous estimates. One of the key customers is expected to be NVIDIA, further strengthening Micron’s revenue growth prospects. On the other hand, UBS points out production capacity constraints. The full capacity of the new factory in Idaho will only be reached in the second half of 2027, which may limit the pace of expansion. Despite this, the market remains positive.

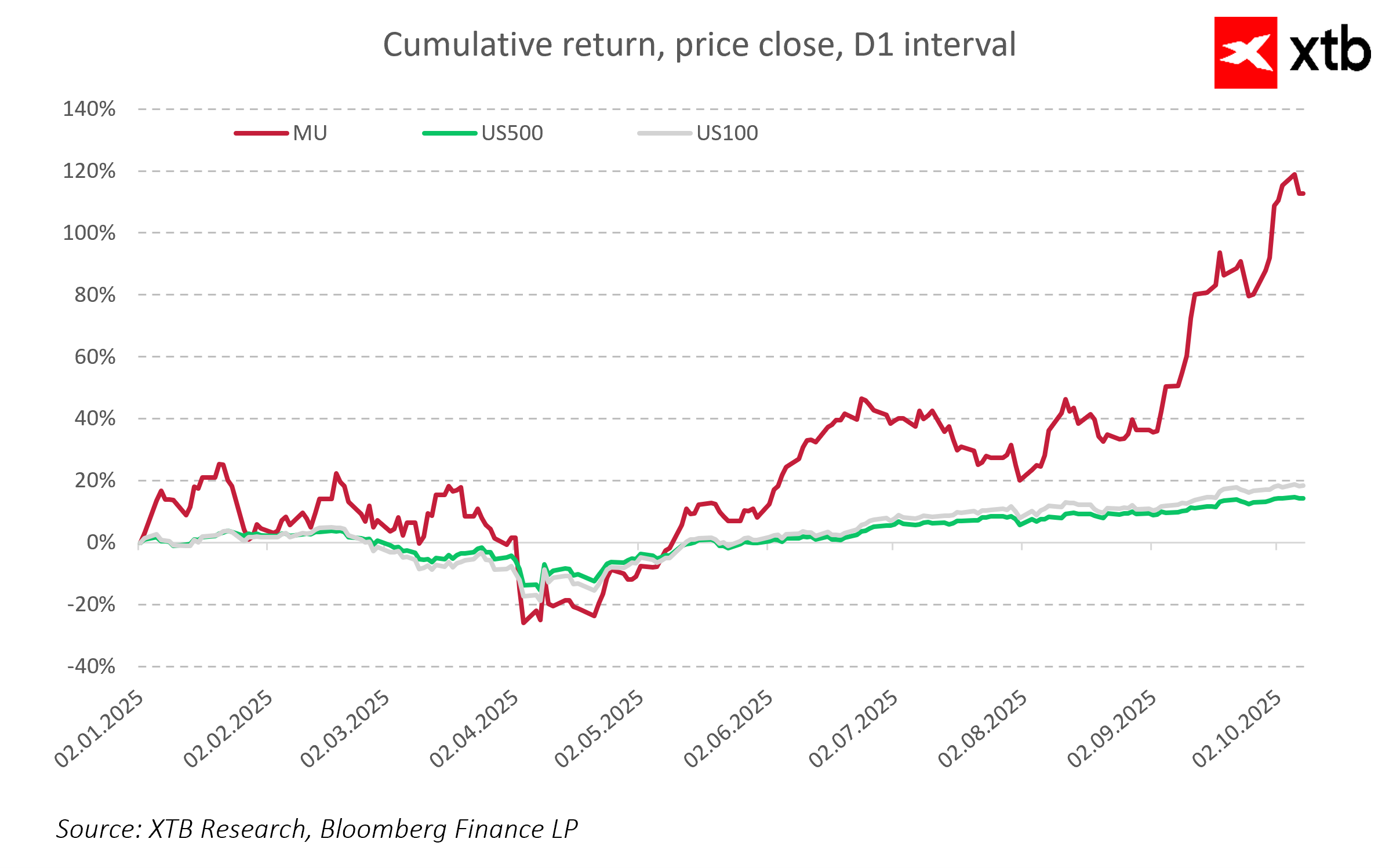

Micron’s shares are up 5 percent in today’s session and have already gained over 120 percent since january. The new valuation from UBS may act as an additional catalyst, but with such dynamic growth, it is wise to remain cautious and closely monitor whether the company can maintain its current growth pace.

Daily Summary: Euphoria on Wall Street; SILVER rebounds 10% 📱

Three markets to watch next week (09.02.2026)

US100 gains after the UoM report🗽Nvidia surges 5%

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.