Summary:

-

UK Manufacturing PMI: 47.4 vs 48.4 exp. 48.0 prior

-

Subcomponents also make for grim viewing

-

GBPUSD falls back beneath $1.21 handle

A widely viewed survey has raised alarm bells for the uK with the manufacturing PMI for August falling to its lowest level since July 2012. The print of 47.4 was below the 48.4 expected and marks the 3rd time in the past 4 months that this metric has disappointed and come in below consensus forecasts. Looking more closely at the report, the overall picture gets worse with rising inventories and a drop in exports - despite the recent GBP depreciation - key areas of weakness. In fact the latest decline in orders has only been exceeded once (in 2012) since the 2008/9 financial crisis.

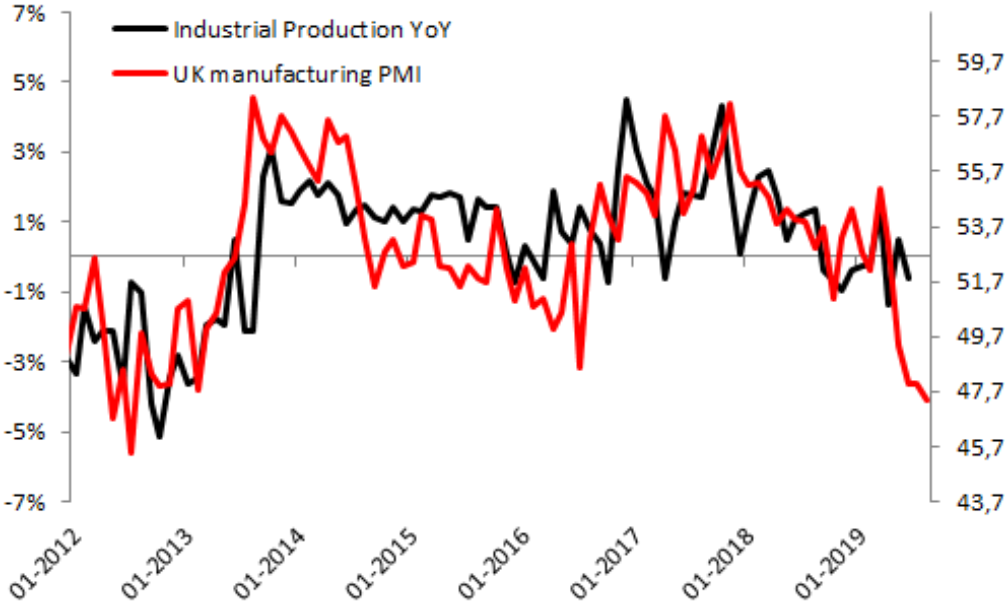

The recent decline in UK manufacturing is alarming and has opened up a large divergence with the industrial production equivalent. The PMI has tended to lead this relationship in the past 7 years so it could be worthwhile keeping a close eye on the industrial production releases next out. Source: XTB Macrobond

In terms of the market reaction it’s been fairly muted with economic data remaining very much of secondary importance for the pound at present, with the markets far more interested in the latest developments on the Brexit front. Before the release, the pound was already sliding lower at the start of what could be a big week for the currency, with the coming days set to reveal how opponents to the government’s Brexit plan will respond. Boris Johnson is clearly pursuing a confrontational approach with the PM threatening to purge any lawmaker in his party that votes against government and the end game is looking increasingly likely to be a so-called “people vs parliament” General Election. Following the announcement last week of the proroguing of parliament the battle lines have been quite clearly drawn and the emphasis is now very much on the opposition to make their move.

MPs are set to return from their summer recess and the opposition will waste little time in making their move, with the most likely plan being an attempt to pass legislation through parliament that will block a no-deal - similar to the Cooper-Letwin bill earlier this year. Another possible course could be to bring a vote of no-confidence in the government but this seems less likely as a first attempt.

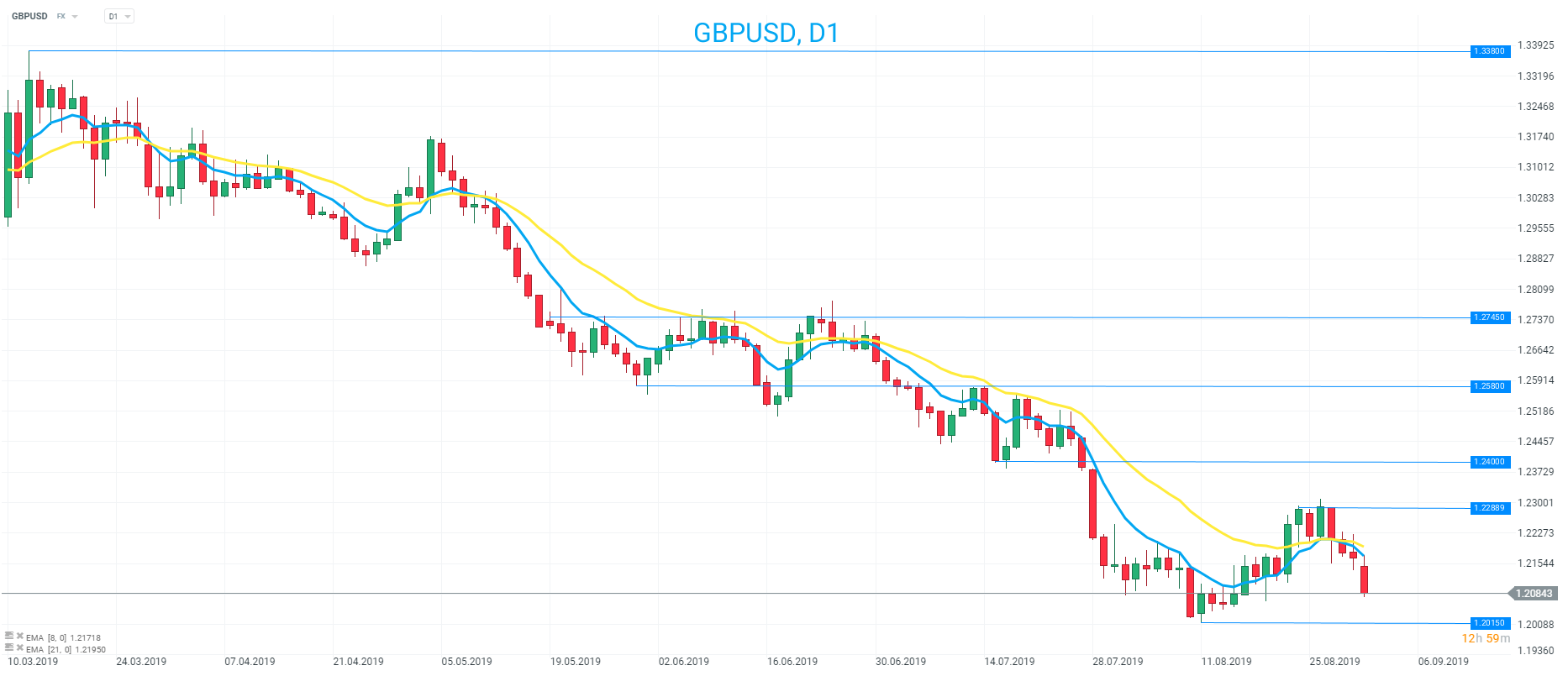

After an attempted move higher at the start of last week the pound is coming back under pressure and is once more languishing near multi-decade lows against the US dollar. 8/21 EMAs remain in a bearish orientation and the focus is now on whether recent lows around 1.2015 can hold on a retest. Source: xStation

After an attempted move higher at the start of last week the pound is coming back under pressure and is once more languishing near multi-decade lows against the US dollar. 8/21 EMAs remain in a bearish orientation and the focus is now on whether recent lows around 1.2015 can hold on a retest. Source: xStation

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.