Summary:

-

MPs to vote on withdrawal bill this evening (scheduled 7PM)

-

Government expected to have narrow victory

-

GBP pulls back as uncertainty ramps up

As far as UK assets are concerned the main events of the day will likely come this evening, after the stock market here in London has closed, with parliament set for two key votes. MPs will first vote on a second reading of the withdrawal agreement, with the consensus believing that the government will secure a narrow victory - which if it occurs would be the first time that MPs have back any Brexit deal.

However, as is often the case with most things Brexit-related this isn’t straight forward and even if it passes there’s a fair chance that a vote on the timetable shortly afterwards will fail. Several MPs have already voiced their displeasure at the lack of time to scrutinise the bill, and if they vote down the program motion this would make the timeframe incredibly tight for the UK to leave the EU by the end of the month.

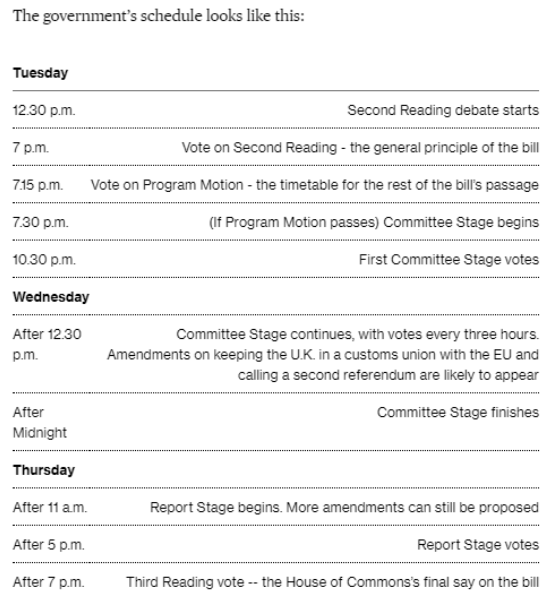

The schedule has two key events to watch this evening - first the vote on a second reading and then the vote on program motion. If the second fails to pass, then at the very least a short technical extension will likely be required. Source: Parliament.UK

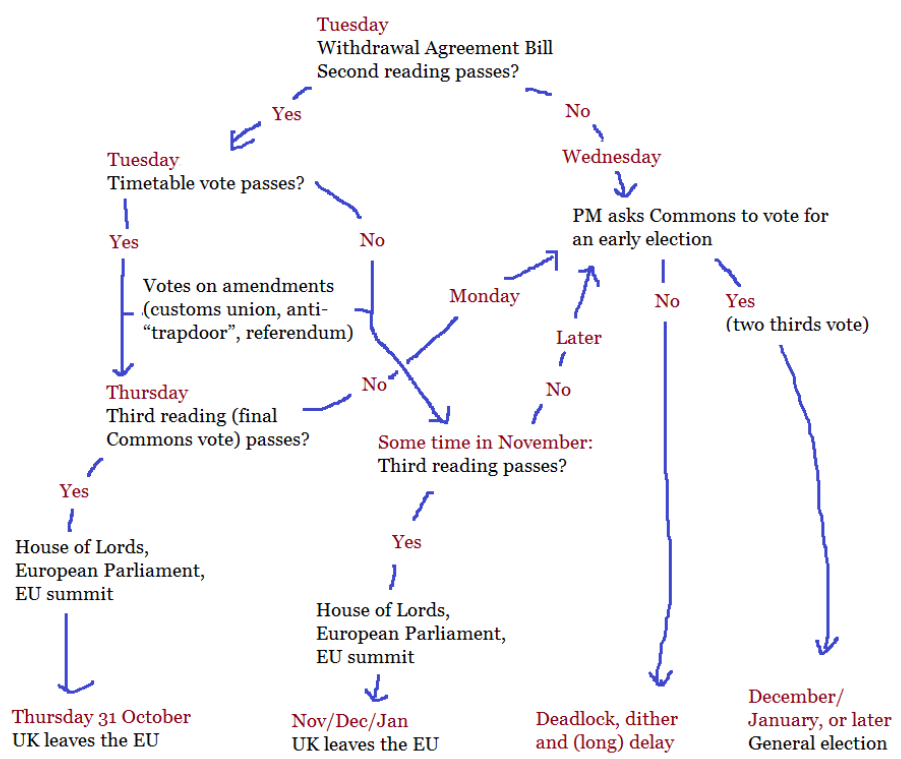

A flowchart showing several possible paths for Brexit after this evning's votes. Source: Twitter: @ JohnRentoul

A flowchart showing several possible paths for Brexit after this evning's votes. Source: Twitter: @ JohnRentoul

Should this play out then it would come as little surprise if the PM moved swiftly and attempts to call a general election, although this may well also be frustrated until an extension is guaranteed. If the whole Brexit process has taught us anything it is that trying to predict the next political development is something of a fool's errand and while the markets seem to remain cautiously optimistic that a deal could still come to pass, it would not be at all surprising if we see a relatively subdued day’s trade in UK assets as market participants await greater clarity before committing to any high conviction positions.

GBPUSD has dipped a little in recent trade and those looking for a further pullback may look to fibonacci retracements with the 23.6% seen at 1.2825. A break above the recent 5-month high of 1.3013 would pave the way for a further push higher. Source: xStation

The pound has dipped a little but remains well supported on the whole and not too far from recent highs. The FTSE 100 is edging a little higher and attempting to move back to the 7200 handle with Just Eat the standout performer. Shares have rallied by over 20% after the delivery firm rejected a hostile £4.9B takeover bid from Prosus, with the cash offer of 710p/share representing a 20% premium on the 594p/share bid from takeaway.com.

The prospect of a bidding war is buoying shares in Just Eat (JE.UK on xStatioN) which trade above 730p/share at the time of writing.

The prospect of a bidding war is buoying shares in Just Eat (JE.UK on xStatioN) which trade above 730p/share at the time of writing.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.