- The new Optum Real system reduces denied claims and accelerates benefit approvals

- The technology has potential to generate additional revenues and lower operating costs

- The new Optum Real system reduces denied claims and accelerates benefit approvals

- The technology has potential to generate additional revenues and lower operating costs

UnitedHealth Group is making significant strides in the digital transformation of the healthcare sector by introducing an AI-powered system called Optum Real. This solution aims to streamline one of the most complex and costly processes in the industry — medical claims processing. The system is currently being tested across a network of 12 Allina Health hospitals, where it has already delivered results by reducing the number of denied claims, speeding up benefit approvals, and simplifying administrative procedures. Optum Real analyzes complex insurance rules in real time, detects documentation gaps, and lowers the risk of costly disputes between healthcare providers and insurers.

Although the tool is currently used internally within UnitedHealthcare, the company plans to make it more widely available in the market, covering other insurers and healthcare providers. Basic functions will be offered for free, with revenues generated through additional digital services and advanced analytics.

From an investor’s perspective, this is an important signal that UnitedHealth is not only focused on cost reduction but is also developing new technology-based business areas. Optum Real has the potential to bring both cost savings in the insurance segment and generate additional revenue from technology solutions in the coming years. This could improve operating margins and increase shareholder value without the need for large investments or aggressive expansion.

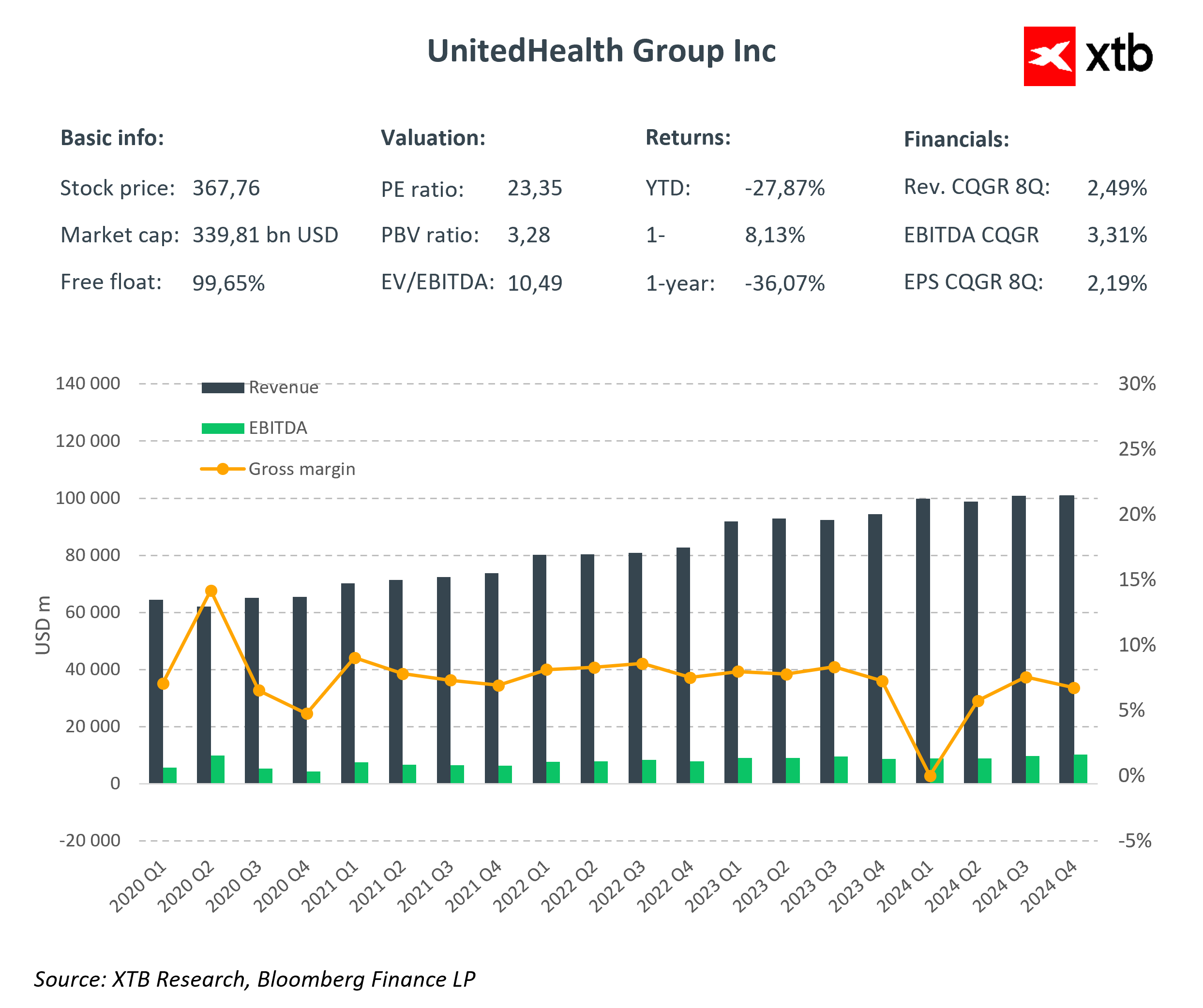

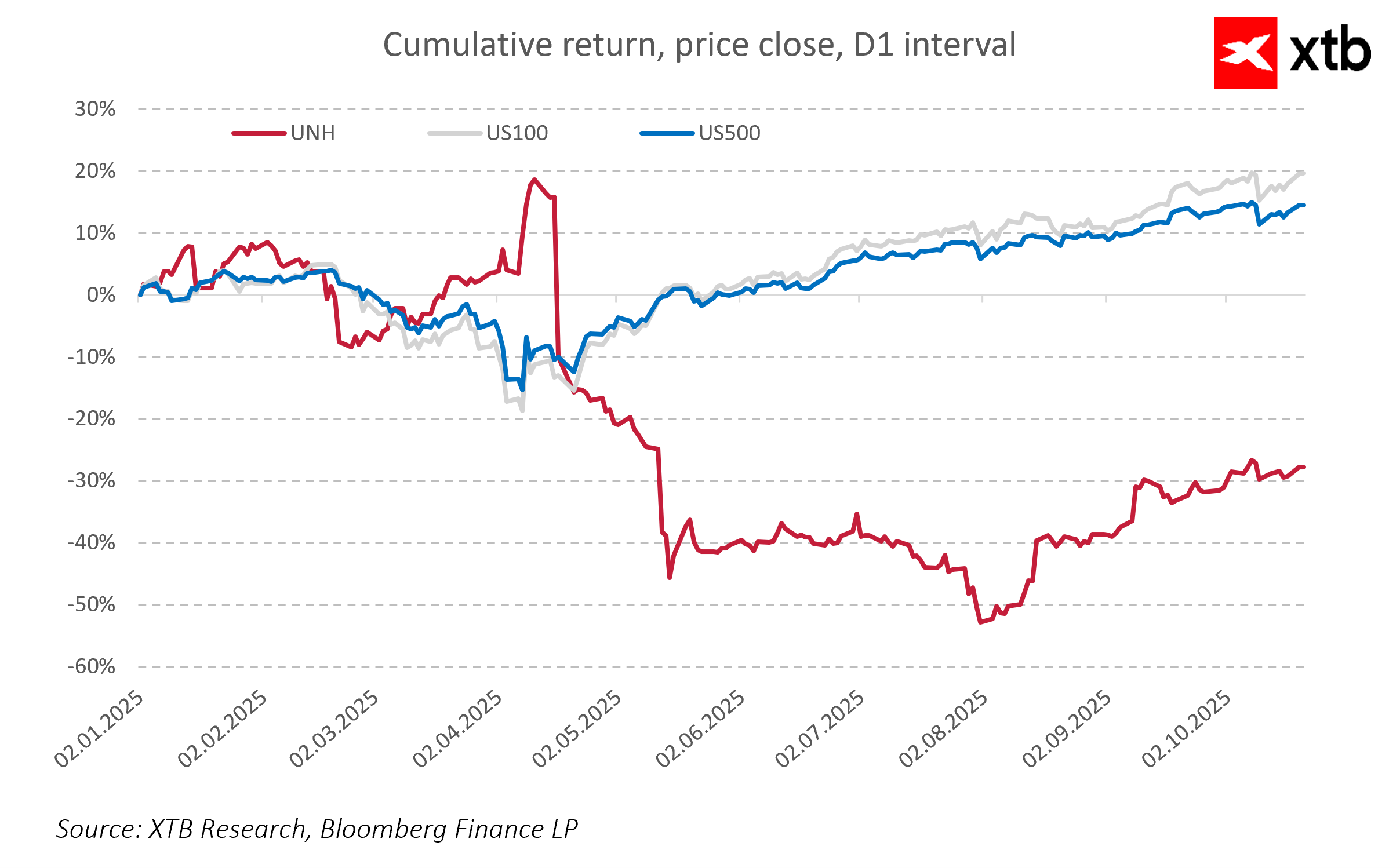

In 2025, UnitedHealth’s stock price fell by nearly 30 percent due to rising healthcare costs, regulatory challenges, and uncertainty about profitability. The stock has retreated from historic highs, which on one hand reflects current difficulties, but on the other hand presents a long-term investment opportunity. The implementation and expansion of Optum Real could become a key catalyst for improving market sentiment. Streamlining claims processes, reducing costs, and the potential to generate new revenue streams may positively impact the company’s financial results and attractiveness.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Does the current sell-off signal the end of quantum companies?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.