- CPI inflation for May should not bring many surprises and is unlikely to change the view from the Federal Reserve

- The labour market remains strong, but despite on that, inflation may confirm that the Fed remains on track to cut interest rates this year

- US core inflation is expected to remain at 3.4% y/y and core inflation is expected to fall slightly to 3.5% y/y

Market expectations

Inflation for April was the first publication this year that did not surprise with higher readings than expected. No big surprises are expected for the May publication either, given several factors such as further slowing rental inflation and the drop in fuel prices in recent weeks. Let's take a little closer look at expectations and the key factors affecting inflation:

- Core CPI inflation is expected to remain at 3.4% y/y, but this is expected to be matched by just 0.1% growth on a monthly basis with 0.3% m/m growth for April

- The scenario of a 0.3% m/m reading in the coming months points to stabilization. A reading of 0.1% m/m would be a step in the right direction that would guarantee inflation at the target within the forecast period. On the other hand, core inflation is susceptible to fluctuations in food and energy prices

- Core inflation, however, is expected to slow to 3.5% y/y from 3.6% y/y, but on a monthly basis it is expected to continue rising at 0.3% m/m, slightly above the level desired by the Fed

- Rental inflation is still expected to be a very large contributor to inflation, but on the other hand, fuels should have a negative impact on inflation. Fuels should also flow negatively on inflation in June, given the continuation of price declines

- Food prices continue to fall, but are no longer as large as they were at the end of 2024

- Used car prices are still lower on an annualized basis, and in theory the impact on CPI inflation should be negative

- The price sub-index from the ISM report for the service sector scored a very slight decline but it was still high

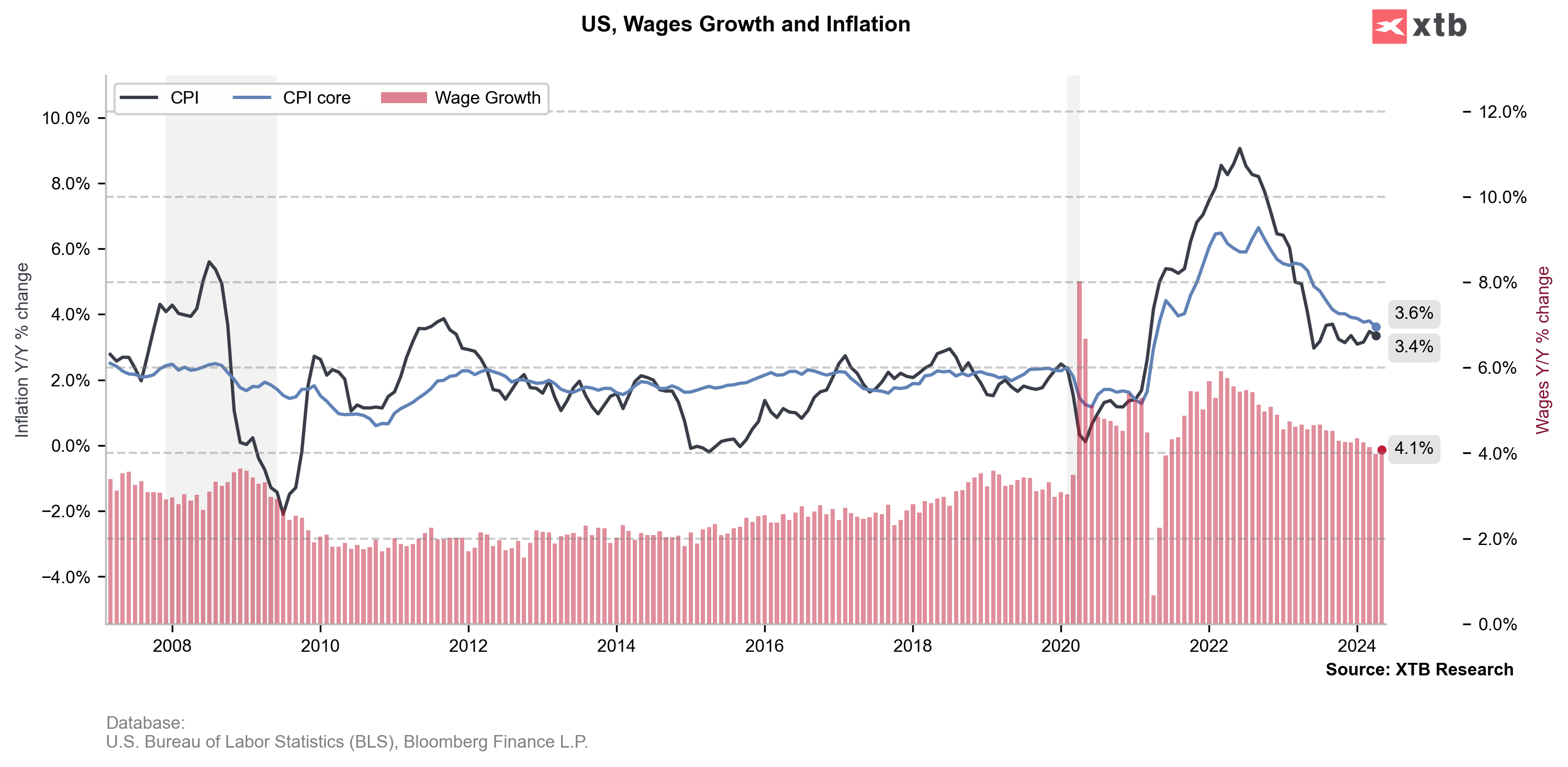

- Core inflation may remain sticky, given support from the recent rebound in wage growth

The Manheim index suggests that a further decline in inflation related to used cars is possible. Source: Bloomberg Finance LP, XTB

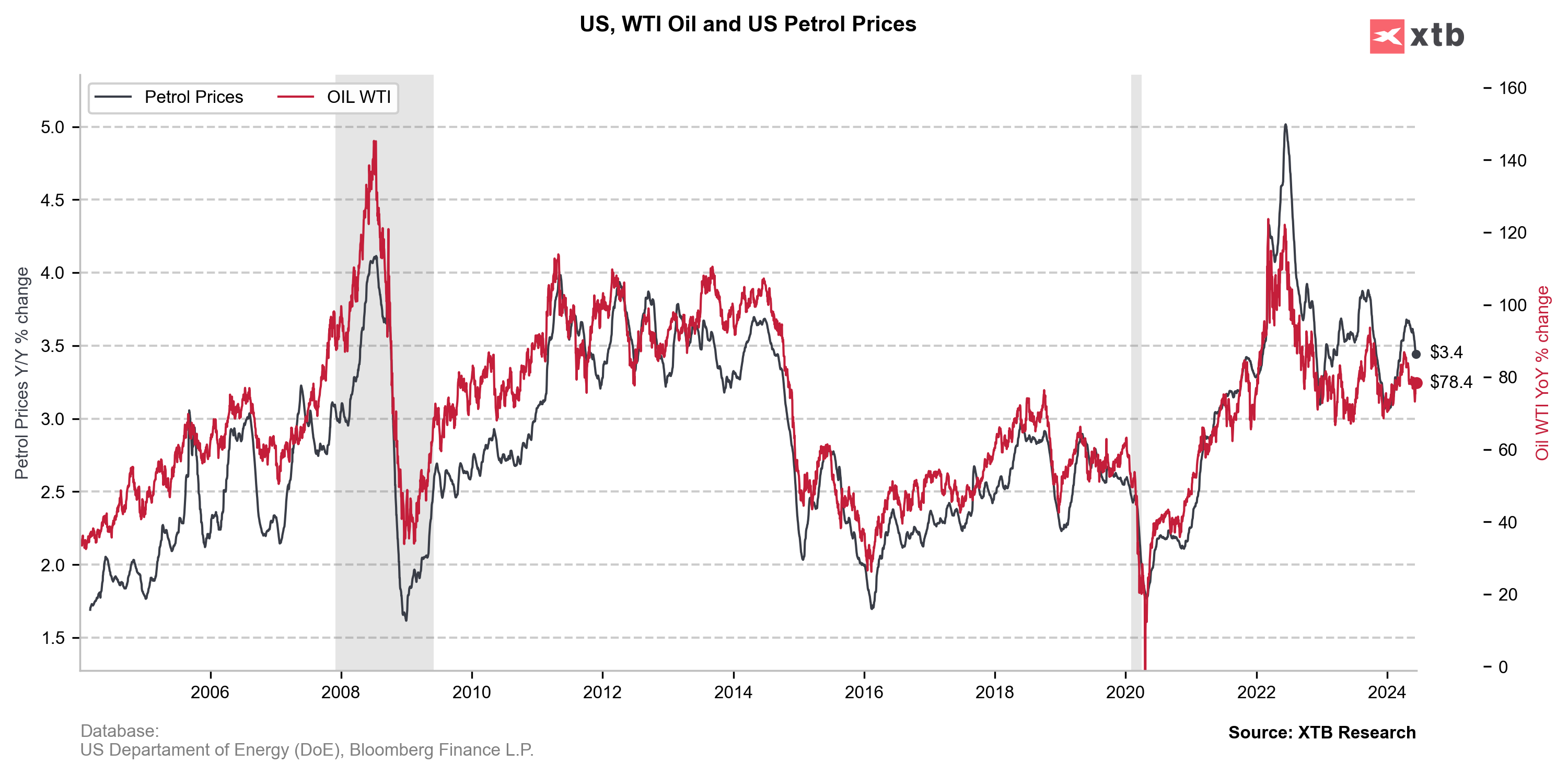

Fuel prices have fallen noticeably, and the still-low oil prices should suggest a further decline. The impact of fuel inflation should be negative for inflation. Source: Bloomberg Finance LP, XTB The Case Shiller index suggests a further decline in rent-related inflation, but at the same time a reduction in the rate of decline can be seen. Rent inflation may remain sticky and influence a limited decline in inflation in the months ahead. Source: Bloomberg Finance LP

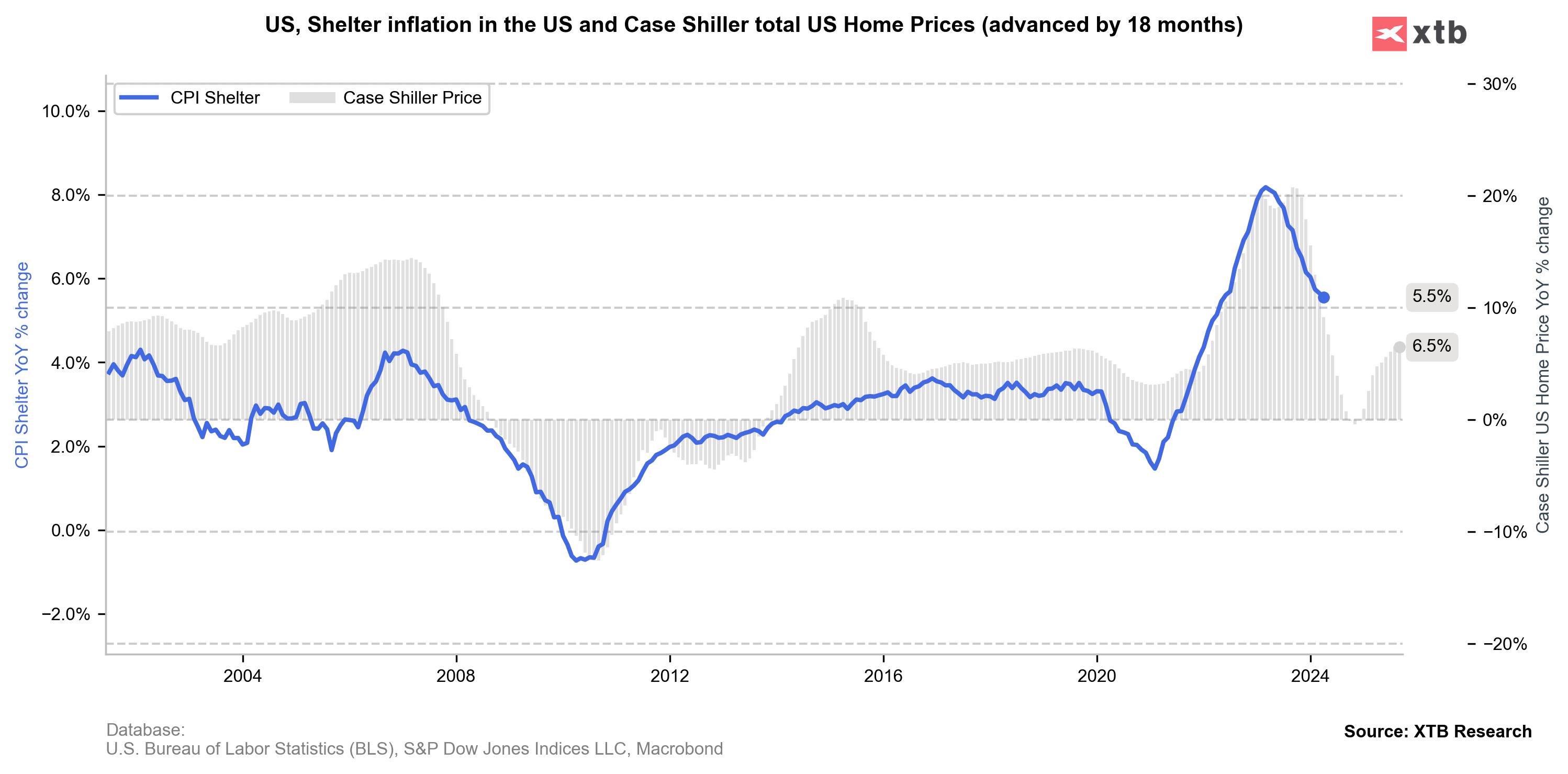

The Case Shiller index suggests a further decline in rent-related inflation, but at the same time a reduction in the rate of decline can be seen. Rent inflation may remain sticky and influence a limited decline in inflation in the months ahead. Source: Bloomberg Finance LP

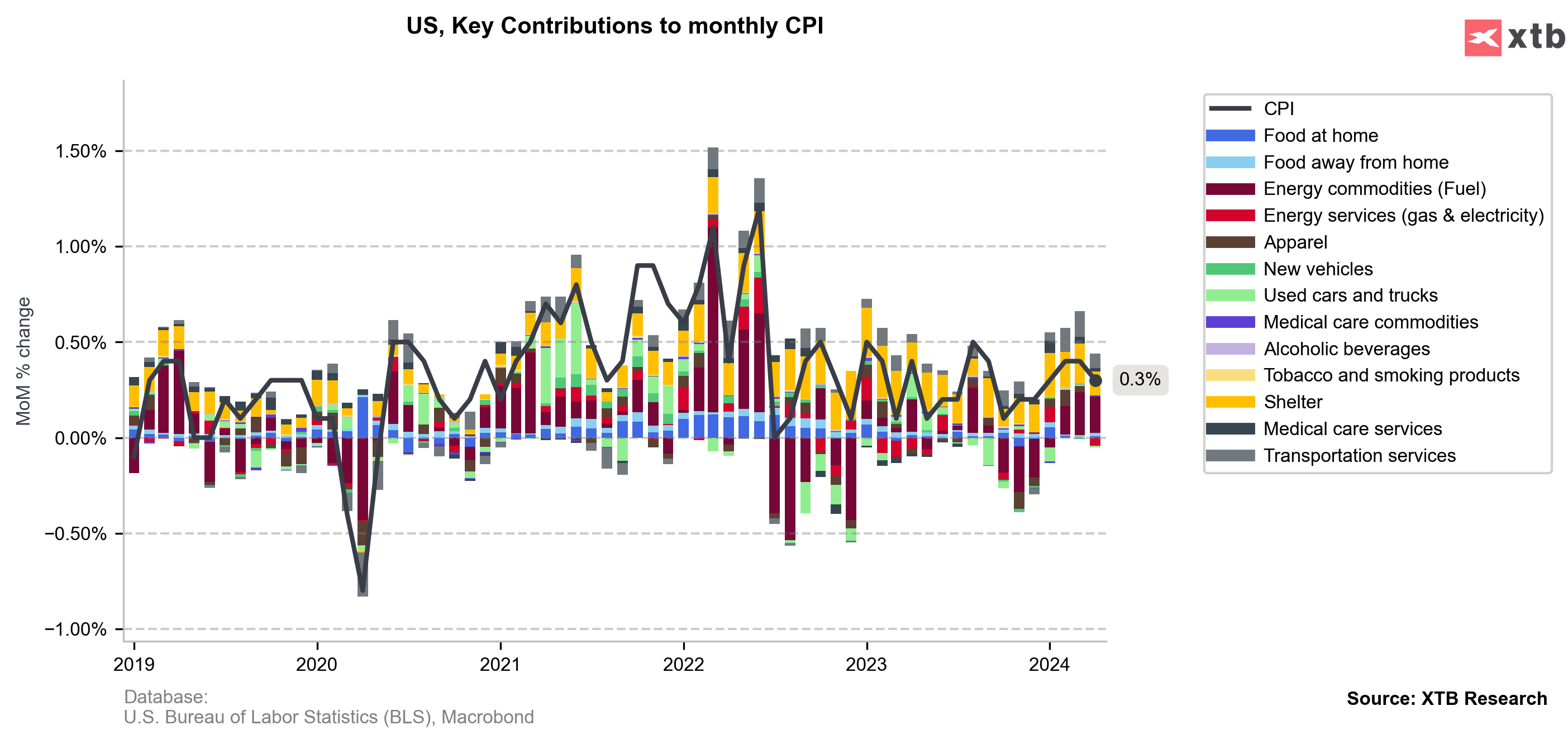

Fuels prices had a positive contribution for April, but this should change to the downside in the May report. The contribution of rental inflation on a monthly basis remains high, although significantly lower than in the first three months of this year. If the next inflation reports come in as expected at 0.1%-0.2% on a monthly basis, as was the case at the end of last year, then the discussion of cuts will begin again during a holidays and the Fed will be ready to cut in September. Source: Macrobond, XTB

Fuels prices had a positive contribution for April, but this should change to the downside in the May report. The contribution of rental inflation on a monthly basis remains high, although significantly lower than in the first three months of this year. If the next inflation reports come in as expected at 0.1%-0.2% on a monthly basis, as was the case at the end of last year, then the discussion of cuts will begin again during a holidays and the Fed will be ready to cut in September. Source: Macrobond, XTB

Headline inflation is expected to remain unchanged at 3.4%, but core inflation should fall to 3.5%. Source: Bloomberg Finance LP, XTB

Headline inflation is expected to remain unchanged at 3.4%, but core inflation should fall to 3.5%. Source: Bloomberg Finance LP, XTB

Inflation will not change the view from the Fed

Today's Fed decision will not depend on today's inflation reading. The exception would be if there is a clear upward surprise. Nevertheless, the Fed should still remain on the path of wanting to cut interest rates this year, and even with a strong labour market, there will be a chance to start the cycle in September, allowing for a cut in December as well. Nonetheless, the Fed is likely to raise inflation forecasts this year and much will depend on interest rate projections. The expectation of two rate cuts this year can lead to dovish market reaction, but a deal suggesting even only one cut could clearly strengthen the dollar.

How will the market react?

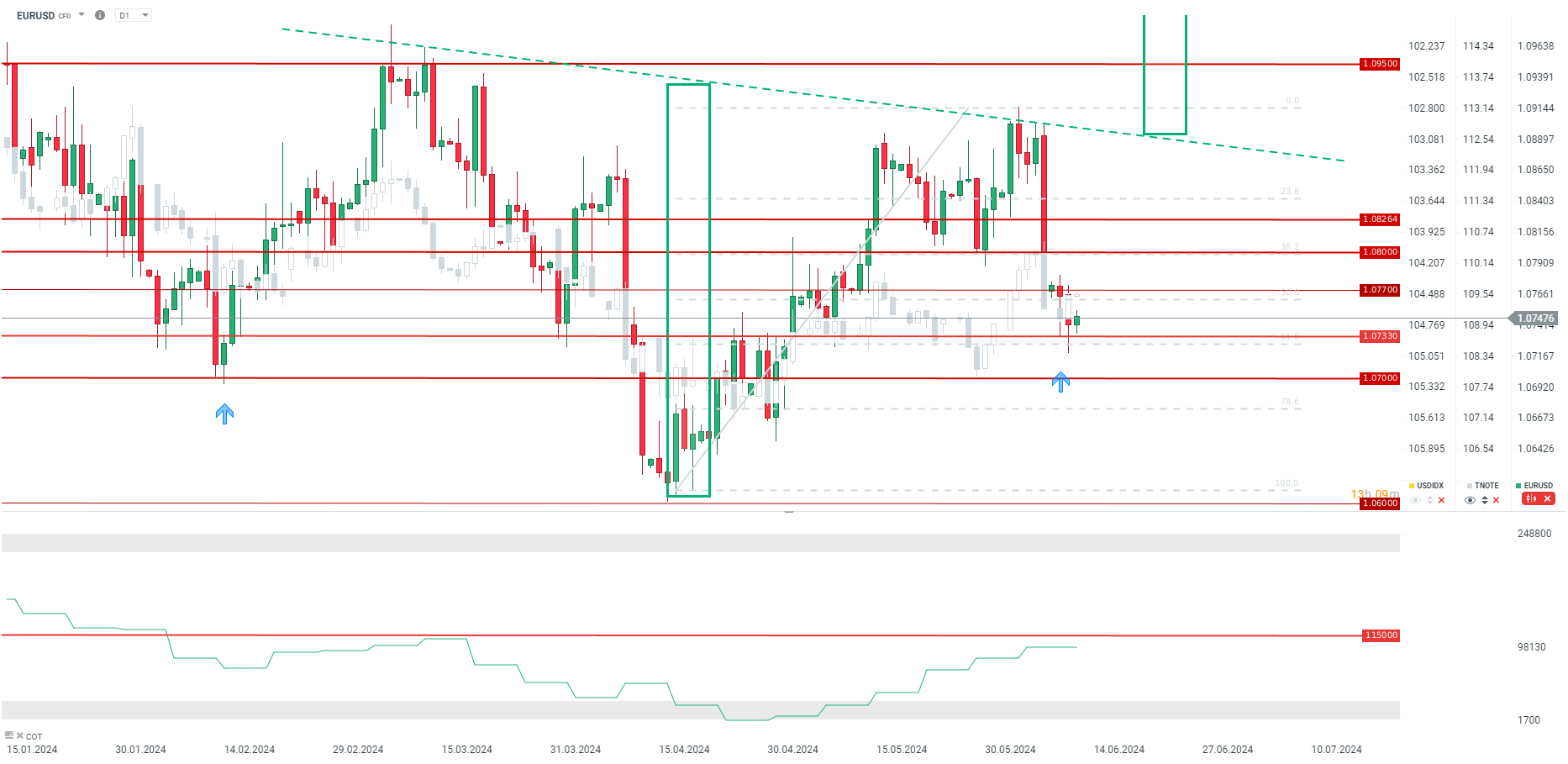

EURUSD has adjusted to higher yields, on the back of phenomenal labour market data and election turmoil in Europe. Nevertheless, there is a chance that EURUSD has reached a local low, at least for the next few hours. Without an upward surprise, EURUSD could check in above 1.0770, although, for example, the lack of a decline in core inflation could lead to another test of the 61.8 retracement of the last upward wave. Ahead of the Fed decision, a new game begins. Although the Fed should remain on a path of reductions, a stronger hawkish turn from expectations cannot be ruled out, which could lead to a test of 1.0700 tonight. It is worth noting, however, that we are forming a reversed head and shoulder formation, the line of which is located near the 1.0900 level, and in the event of actual communication of impending reductions by the Fed later this year, reaching this level and even realizing the formation are possible.

Source: xStation5

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%

Daily summary: Markets capitulate under the influence of the Persian Gulf

🚨 EURUSD deepens decline, falls to key support zone

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.