Office prices in the US are anticipated to crash, with the commercial real estate market expected to face continued declines for at least another nine months, according to Bloomberg’s Markets Live Pulse survey. About two-thirds of the respondents believe that the US office market will only see a rebound after a significant downturn. This poses challenges for the $1.5 trillion of commercial real estate debt that is due by the end of 2025, especially with approximately 25% of this debt tied to office buildings. Additionally, the Federal Reserve’s tightening campaign has negatively impacted commercial property values by increasing financing expenses.

Factors such as higher interest rates and tenant behaviors are influencing the property sector. Increased interest rates can take years to impact commercial real estate owners, especially those with long-term fixed-rate financing and tenants under long-term leases. Furthermore, in the US, office workers are showing reluctance to return to their workspaces, more so than their counterparts in Europe or Asia. This hesitation is partly attributed to inadequate public transportation options. The survey revealed that 20% of respondents had moved further from their offices during the pandemic, resulting in longer commutes for many due to relocations or transit service cuts during the pandemic era.

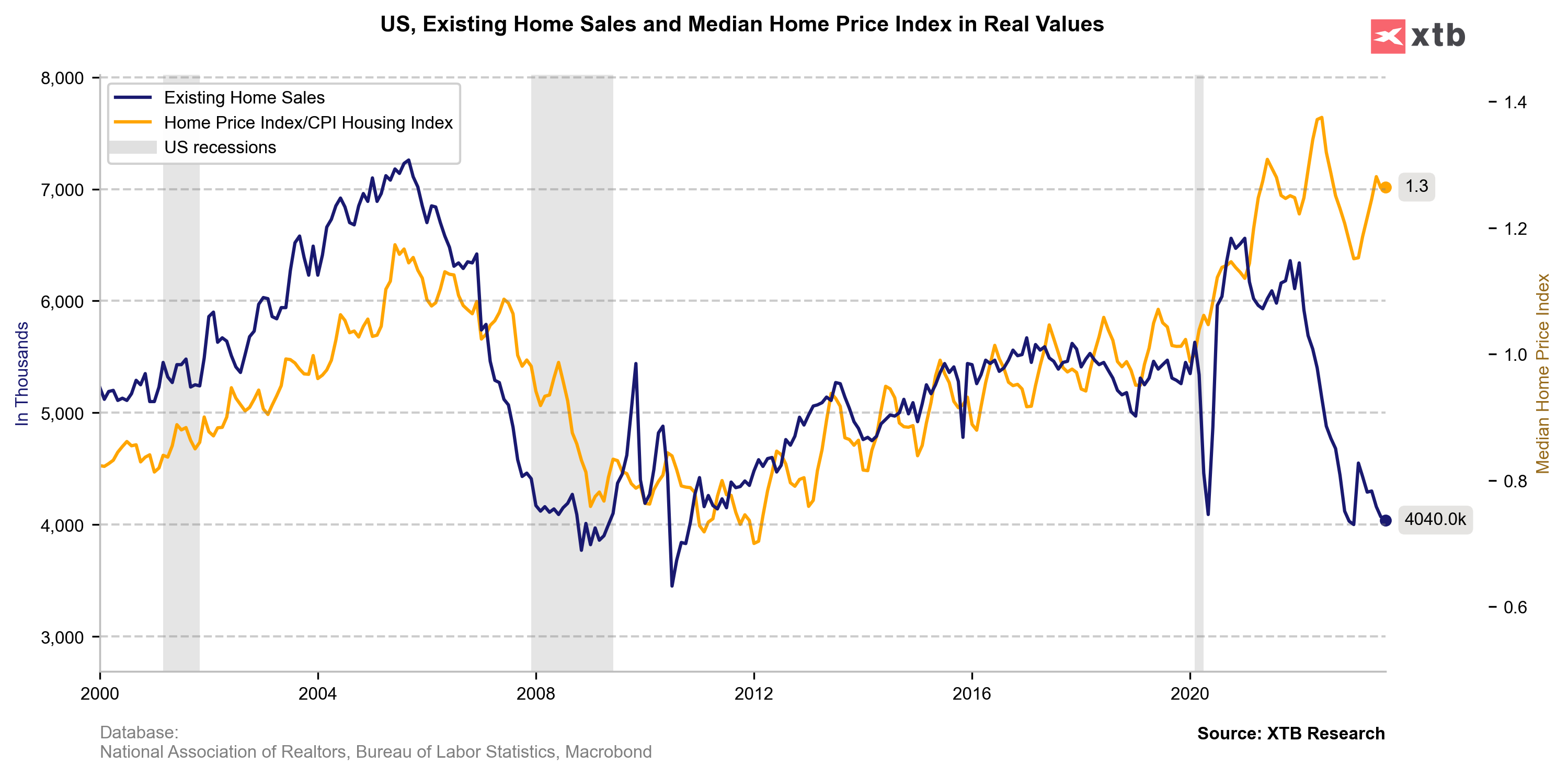

In real values for the entire real estate sector, we see that prices are currently relatively high. The inflation-adjusted housing price index is marked on the chart with a yellow line. At this moment, real estate prices are higher than at the peak before the 2008 crisis.

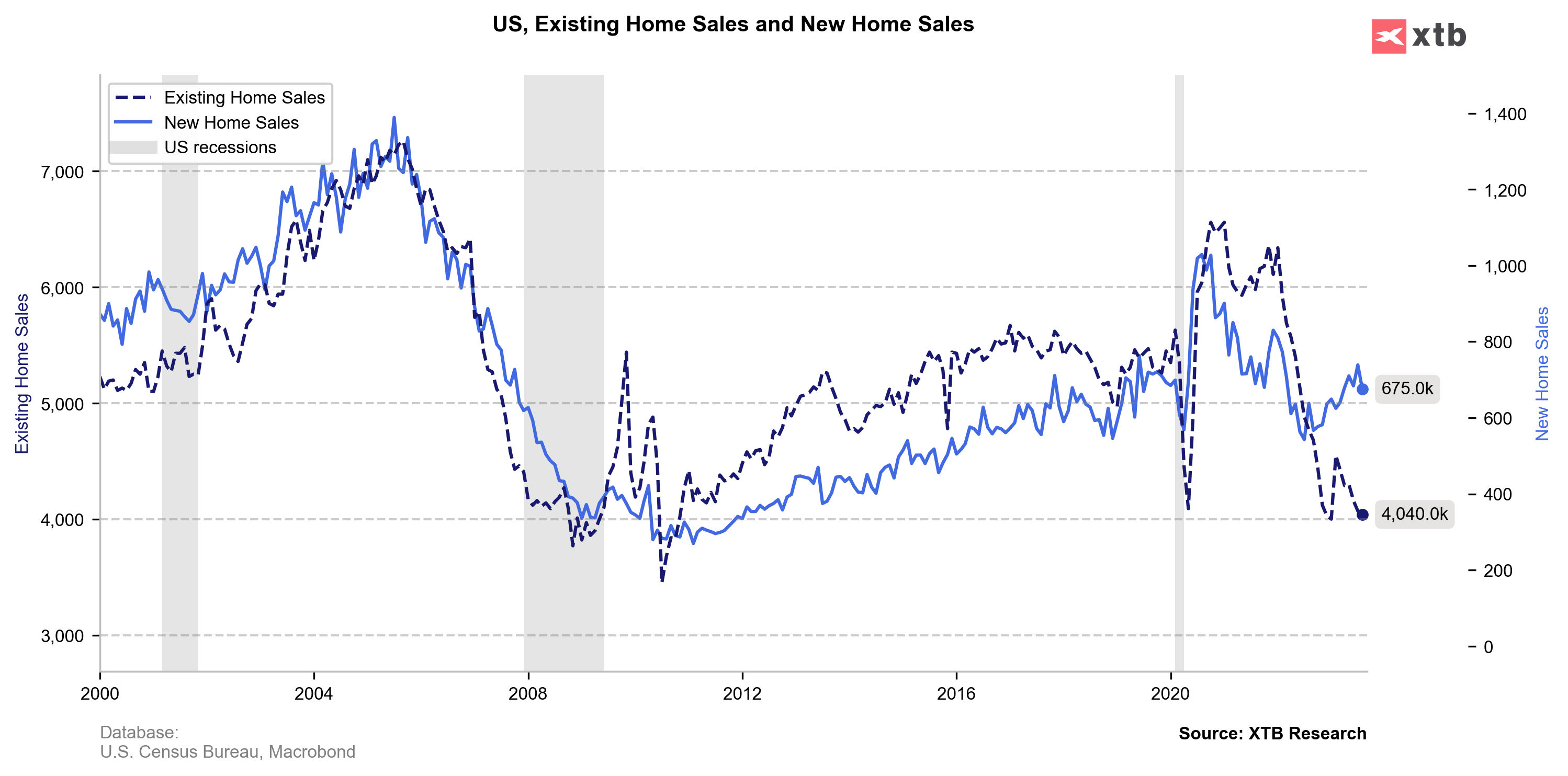

Sales of homes on the secondary market continue to be in a strong downward trend. High-interest rates and shrinking cash surpluses among consumers are putting pressure on the secondary market. On the other hand, the sale of new homes has remained high so far because it was profitable for developers to build due to the high real prices of real estate, and many investors decided to invest their capital in the primary market to protect their capital from inflation. However, recent data shows that this sector is also beginning to weaken.

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.