- Wall Street opens higher

- Europe's PMI comes out slightly lower

- Activision Blizzard rises after new information regarding the acquisition

On the last day of the week, markets are slightly recovering from significant drops from the previous two days. At the opening of the session, US500 gains 0.30%, while US100 increases by 0.40%. The US dollar slows its strengthening, causing a reaction in the stock market. Over the past three days, starting from the conference after the Fed's decision, US500 lost almost 3.0% of its value. Investors are currently beginning to accept the prospect of maintaining higher interest rates for longer than previously priced in.

US companies categorized by sector and industry. Size indicates market capitalization. Meta (META.US), Nvidia (NVDA.US), and Amazon (AMZN.US) are among the biggest gainers today. Source: xStation5

The US500 is currently trading at 4390 points, showing a 0.30% gain today, which follows three consecutive days of record losses. The index experienced a decline from the resistance line at 4560 points, ultimately finding support at the recent local low of 4380 points. The upcoming week will be pivotal in determining whether selling pressure will continue to exert downward pressure on the index. Traders should keep a close eye on the 4300-point level, which aligns with multiple significant peaks and lows and could act as a critical support zone.

Company News:

Activision Blizzard (ATVI.US) shares are gaining 1,7% after the UK's Competition and Markets Authority (CMA) has provisionally approved its $69 billion acquisition by Microsoft after initially blocking it due to cloud gaming concerns. Microsoft (MSFT.US) amended the deal, transferring cloud gaming rights for Activision Blizzard games to Ubisoft, which alleviated the CMA's apprehensions. While this is a preliminary decision, the CMA has initiated a consultation period until October 6th to gather third-party feedback on Microsoft's proposed solutions. A final verdict is anticipated to be before October 18th. Microsoft's vice chair and president, Brad Smith, expressed optimism about the decision and the company's efforts to address the CMA's residual concerns.

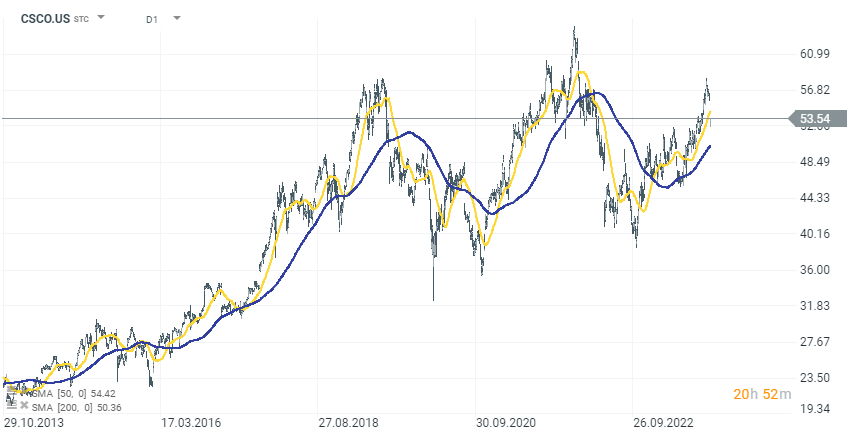

Cisco Systems (CSCO.US) announced yesterday its plans to acquire cybersecurity firm Splunk for $28 billion, marking Cisco's largest-ever acquisition to strengthen its software business and leverage artificial intelligence. The collaboration aims to shift from threat detection to predictive threat management, enhancing security analytics and ensuring observability across various cloud environments. This move is expected to boost Cisco's recurring revenue and improve gross margins and non-GAAP earnings within two years. The acquisition, set to close in the third quarter of 2024, underscores both companies' shared values of innovation and inclusion, positioning them as a top destination for software talent.

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.