- Wall Street higher on Trump's re-aproach to China's tariffs

- Bessent, concerned with shutdown impact on the economy

- Rare earth metals surge on wave of export restrictions

- Wall Street higher on Trump's re-aproach to China's tariffs

- Bessent, concerned with shutdown impact on the economy

- Rare earth metals surge on wave of export restrictions

American indices are rebounding on Monday after a very negative end to last week. Following a series of declines and growing concerns about the economy's condition, investors are entering the new week with a slightly better mood, which translates into moderate gains for the main benchmarks - S&P 500, Dow Jones, and Nasdaq. There's an attempt to recover losses, although market sentiment remains fragile.

Some tensions on Wall Street have eased after President Donald Trump softened his rhetoric towards China, suggesting the possibility of resuming constructive trade dialogue. Market participants interpreted this as a signal of potential de-escalation of tensions between the world's two largest economies. However, comments from Treasury Secretary S. Bessent had the opposite effect, stating that the prolonged government shutdown is starting to have a real impact on economic activity. The lack of significant macroeconomic data from the USA means that the market is reacting more to political factors and investor sentiment today than to hard data.

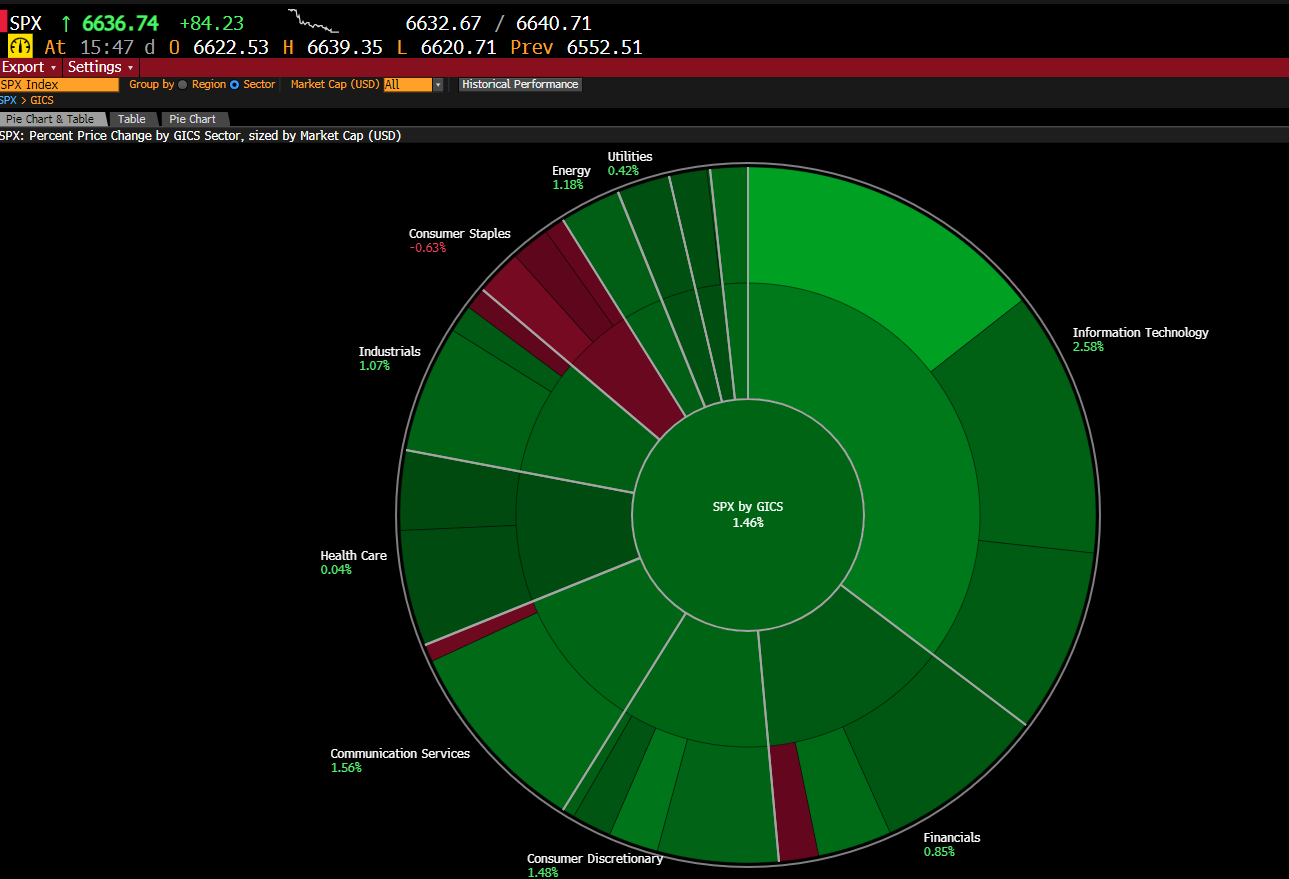

Source: Bloomberg Finance Lp

The main indices of the American stock exchange are rising across the board today, with IT remaining the leaders of growth. Behind them, industry and finance are performing very well, albeit slightly weaker.

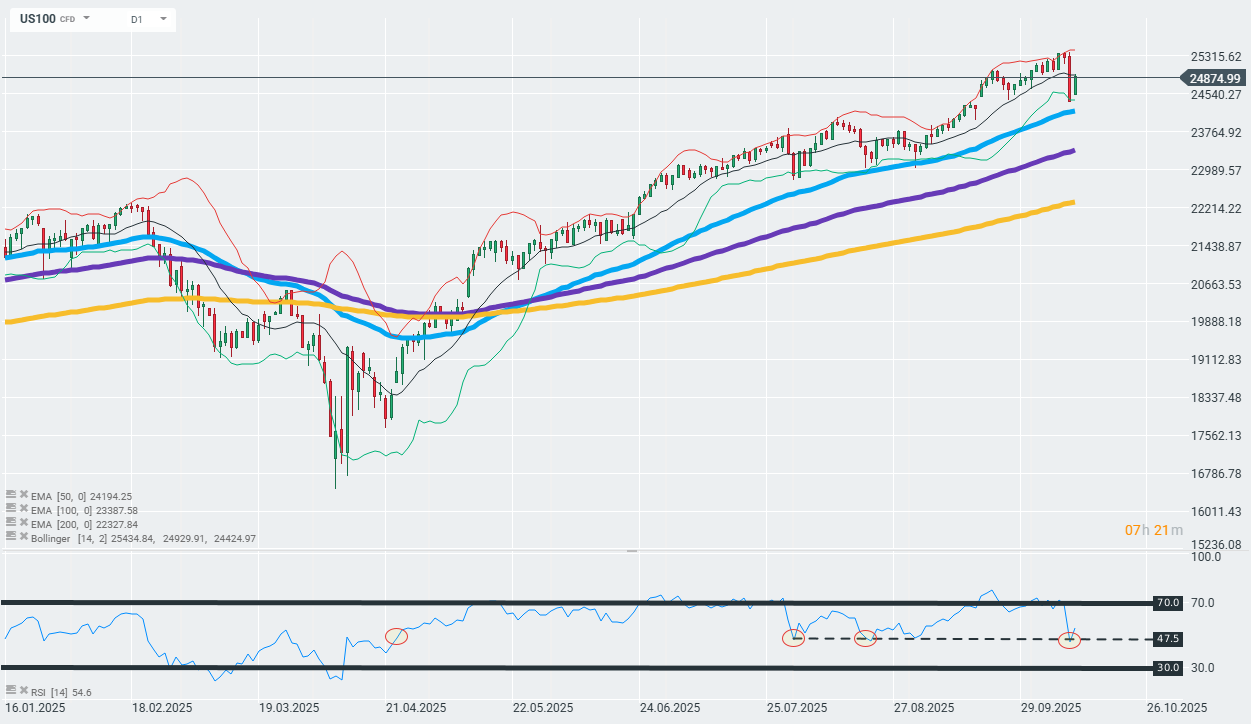

The US100 is rebounding after significant declines on Friday amid growing uncertainty between the US and China. From a technical perspective, the uptrend remains very strong. The 50-day exponential moving average, which hasn't been tested by the sell side since early September, could remain a significant support point. Source: xStation 5

Company News

The so-called "Magnificent 7" companies are rebounding after Friday's corrections. Nvidia (NVDA.US) is up over 2% at the opening, while other market leaders are up about 1%.

There are huge gains in companies related to rare earth metals following China's announcement of restrictions on the export and resale of rare earth metals and products containing them. Critical Metals is up 20%, and MP Materials (MP) is up 8%.

Estee Lauder — The beauty industry company is up over 4% following a positive recommendation from Goldman Sachs.

Warner Bros — The media giant is up 4% after rejecting a purchase offer from Paramount. Unconfirmed sources indicate that the offered amount was too low.

Rocket Lab — The space company is up over 6% after Morgan Stanley expressed optimism about the company's new product — the orbital carrier "Neutron."

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

India: New battleground of the trade war?

Another US Gov. Shutdown: What can it mean this time?

Mercosur: Farmers’ fears are exaggerated, industry triumphs - facts vs. myths

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.