- Wall Street Opens Higher Mid-Week

- The recent sell-off has resulted in significant oversold conditions

- Costco (COST.US) Declines Despite Surpassing Earnings Estimates

Wall Street began slightly higher, pausing the global sell-off seen in recent days. However, the dollar continues its upward trend, with the USD emerging as one of the strongest currencies among major economies today. This points to an ongoing trend as investors now anticipate that higher rates will persist for an extended period. The US500 is up by 0.30%, rebounding from a key support level, while the US100 sees a similar daily change. Meanwhile, US Treasury yields have pulled back from their recent peak.

Investor concerns are intensifying around the possibility that the Federal Reserve may maintain elevated interest rates amidst economic slowing. This apprehension has led US stocks towards their steepest monthly decline since last December. A notable shift is also evident among bond investors, who now anticipate more aggressive policy rates.

US Durable Goods

The US durable goods orders report for August was published today. Given its preliminary nature, the report garnered significant attention from market players. While the consensus hinted at a modest figure, the data surprisingly indicated a surge in headline orders. When excluding transportation, core orders exceeded expectations. Non-defense capital goods orders, excluding aircraft, rose by 0.9%, beating the anticipated 0.0%. However, there was a downward adjustment in the previous month's data. When transportation and defense are both excluded, there was a 0.7% decrease in orders, but shipments experienced a 0.7% increase. Even with the prior month's downward revision, core orders stand impressively above the consensus, hinting that the manufacturing slump might be on the verge of ending.

US, durable goods orders for August:

-

Headline: +0.2% MoM vs -0.5% MoM expected (-5.2% MoM previously)

-

Ex-transport: +0.4% MoM vs +0.1% MoM expected (+0.4% MoM previously)

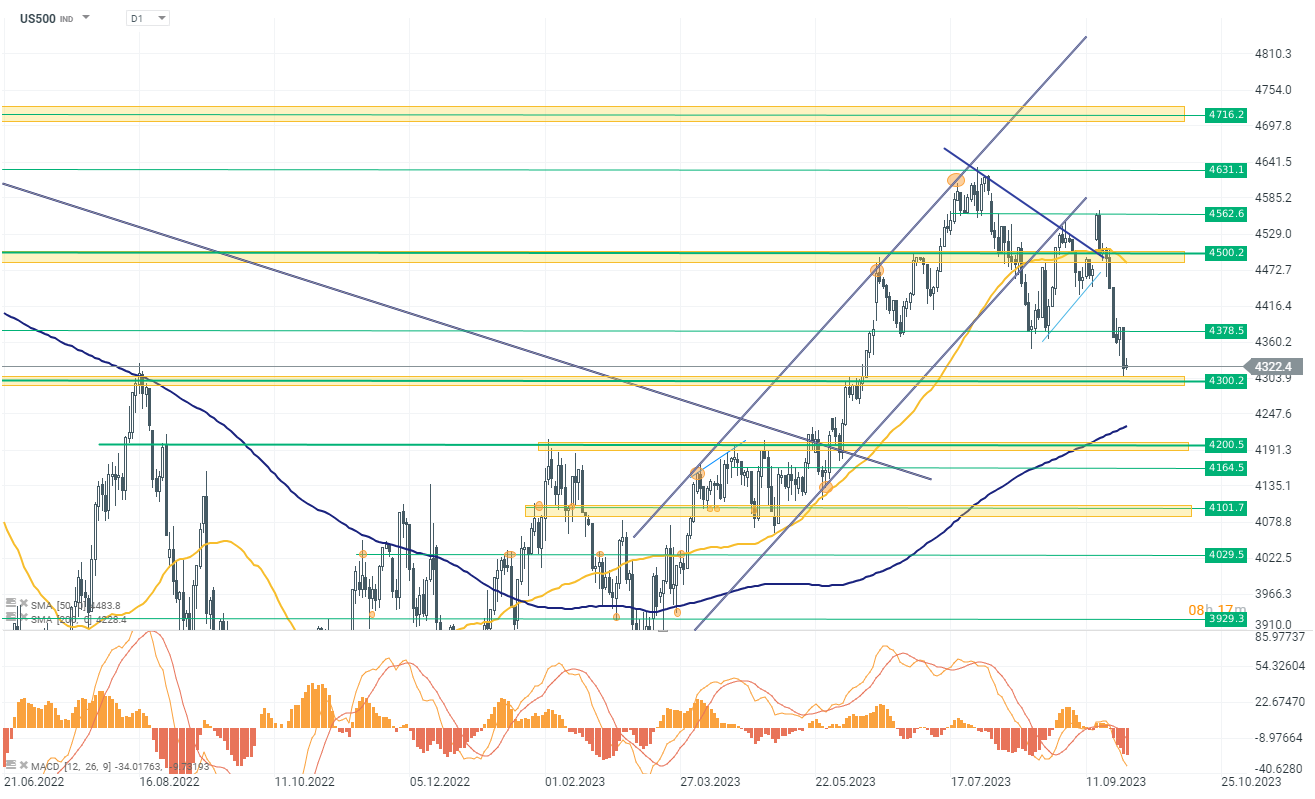

US 500

The US500 is currently trading at 4330 points, showing a 0.30% increase today, which comes after two weeks of substantial declines. The index experienced a drop from the resistance line around 4560 points, with the declines halting at a crucial support level near 4300 points. If this support zone is breached, and the index price falls below it, the next key level to monitor is around 4200 points, marking a significant area that could potentially come into play as the market seeks further direction.

Global news wrap

-

DOJ intensifies probe into Credit Suisse and UBS regarding suspected compliance failures related to Russian sanctions evasion. The investigation is in its early stages, and UBS is looking to grow in the US.

-

Evergrande Chairman Hui Ka Yan placed under Chinese police control for unspecified reasons, indicating the Evergrande situation may now involve the criminal justice system.

-

Futures and Treasuries rise, while a global equities measure drops below its 200-DMA, indicating potential oversold status. The Bloomberg dollar index remains near its 2023 peak, with oil prices rising and gold prices falling.

-

Italy aims to elevate Monte Paschi to the country's third-largest bank by merging it with a similarly sized peer. No formal merger discussions have been initiated.

Company News:

-

ChargePoint Holdings (CHPT.US) gains 4.3% after UBS starts coverage of the electric-vehicle charging company with a buy rating and $9 price target.

-

Costco (COST.US) falls 1.8% despite beating earnings estimates. The firm held back from commenting on the timing of its membership-fee increase, something Morgan Stanley sees as a slight disappointment.

-

Nutanix (NTNX.US) shares are up 2.2% with analysts positive on the infrastructure software company in the wake of an investor day event where it updated its financial targets.

-

Ginkgo Bioworks Holdings (DNA.US) jumps 16% after the health-care firm said it is collaborating with Pfizer to develop new RNA drugs. Endpoints News reported the news earlier.

Source: xStation 5

Source: xStation 5

Stock of the Week: Broadcom Driven by AI Sets Records

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.